One thing that was certainly a problem for a lot of Sole Traders when they wanted to apply for and get a Bounce Back Loan for their business, was finding a Lender that would allow them to apply.

That problem was due to the limited number of Lenders at the start of the scheme, and if you were not a customer of one of the big banks, then you faced having to hunt around and wait for newly approved Lenders to come onboard, then hope they allowed new customers to apply for an account then in turn apply for a BBL.

That meant a lot of Sole Traders opened up accounts with many BBL Lenders and would apply for a Bounce Back Loan as and when they succeeded in opening an account.

What made that problem even worse is that some Lenders would allow Sole Traders to open an account and apply for a Bounce Back Loan but would put them on a waiting list, meaning technically those applicants could not put in another application elsewhere as the rules, which confused no end of people stated you could only apply for one BBL at a time, and only when declined could you apply elsewhere.

A few completely gormless BBL Lenders would also list the details of Sole Traders who were on their waiting list on a database all Lenders had to check to see if an applicant had an application in with another lender to stop duplicates, and that also led to a great number of Sole Traders being refused a BBL as the Lender who wanted to approve them discovered they already had an application in, and were blissfully unaware that Sole Trader was simply on a waiting list with no guarantee that other lender would approve them.

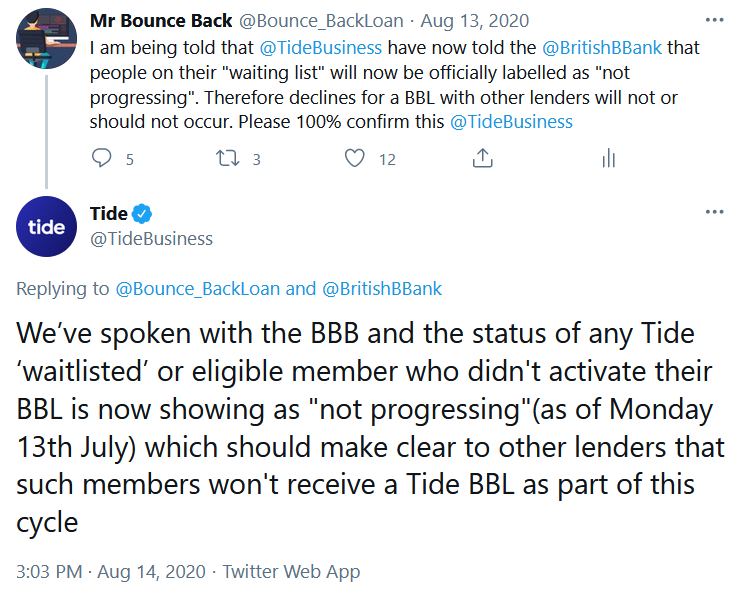

That was a shameful period of the BBL scheme and one the powers that be like to forget about and never mention. Tide and Starling Bank were two of the main instigators of that nonsense by the way, if you are wondering.

I did shame Tide for that situation who assured me they had put right that outrageous scandal >

Some Sole Traders managed to bag more than one BBL for their single business, which was not allowed, but some individuals simply made up businesses, chancing their arm that they would be able to blag a Bounce Back Loan.

Those that did and have not repaid their BBL and then take the Bankruptcy route are being found out and punished, and below are some recent examples of a whole slew of Sole Trader related cases along with cases involving individuals who said they had a business but didn’t.

You will find plenty of similar cases in this section of the website:

https://mrbounceback.com/category/the-disqualification-files/

If you want to know what a Bankruptcy Restrictions Order is, then I have a guide available on this section of the website >

If you need a chat about Bounce Back Loan related worries then please do give my helpline a call, it will be me that you are speaking to and it is all in complete confidence.

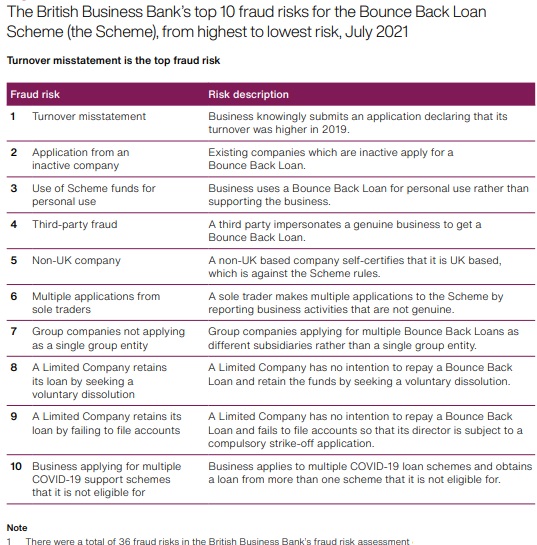

Multiple Applications from Sole Traders

Definition: A sole trader makes multiple applications to the Scheme by reporting business activities that are not genuine.