Time for a quick update, as many people have been contacting me with updates as to what has happened to them when they have reached the end of the process of defaulting on a Bounce Back Loan.

If you are not familiar with the process lenders have to have follow to get their money back when a borrower doesn’t pay them back their respective Bounce Back Loan, further down this page I have once again published that procedure, as many people have not stumbled upon it yet.

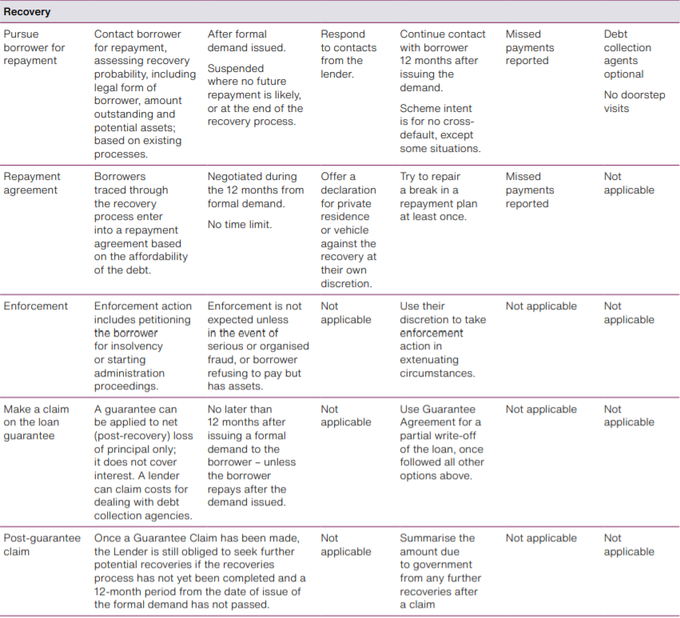

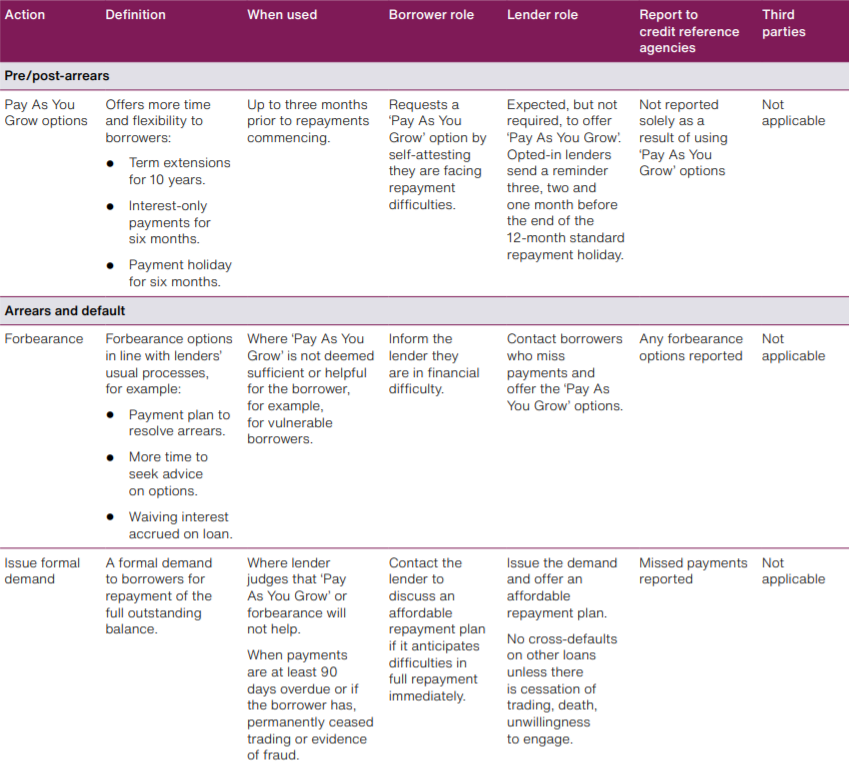

In most cases, but not all, once anyone with a Bounce Back Loan misses three repayments the lender will send them a default letter and a demand for full repayment, and if the BBL is still not repaid after they send out those letters, they tend to send it over to their nominated debt collector.

Be aware some lenders may do the legwork themselves, but most of them will pass it over to a debt collector. Lenders love it when they do as its less work for their inhouse team.

This is important, those debt collectors cannot and will not come rattling at your door, as they are not allowed to as part of the rules of the BBL scheme, their sole purpose is to try and get you to agree to a repayment plan but, and once again this is important, only if one is affordable.

If the lender has not claimed on the guarantee, anything the debt collectors raise goes back to the lender but if they have claimed on the guarantee (and they rarely tell you as it undermines the role of the debt collectors), any repayment plan and funds collected will ultimately be repaid to the Government to reduce the guarantee liability.

The nominated debt collectors will snatch your hand off when you do agree to a repayment plan, and for the record I have seen plenty of people now repaying their £50k BBL’s at £5 per week.

Keep in mind that interest can be knocked off a BBL as you will see below, so that is often what will happen and explains why such a nominal amount will be accepted, besides it allows the powers that be to massage the repayment figures to make it look like people are repaying, but they don’t say how much they are repaying!

However, be aware that if you do answer the phone to the debt collector when they call, they will ultimately get you to fill in an income and outcome form to work out if you can afford to repay anything, and ultimately it is what is on that form and what the figures you disclose reveal as to whether they will agree to a repayment plan.

They only have 12 months to try and see if there is any chance of a repayment plan, if not and the 12 months expires, they are obliged, once again by the rules of the scheme, to give up trying to contact you.

If you do agree to a repayment plan and end up missing repayments sometime in the future the 12 months the debt collectors can try and contact you is then reset or is in most instances so they will be in touch, but no doorstep visits.

As it is the income outcome type of form, which could be a physical one or one you fill in online or simply one you do over the phone, if the figures you disclose on that form proves you have no spare funds to commit to a repayment plan the debt collector then tends to say, OK, you cannot afford to repay at the moment we will be in touch in a few months’ time.

What they are doing there is simply running down the clock to the 12 month point in time. So just be aware of that as they will contact you again in a few months to see if your circumstances have changed, but ultimately they will stop trying when they reach the 12 months point in time if you cannot afford to repay your BBL.

I often get asked if the lender will try to make them bankrupt, the rules clearly state that the lender will only do so if you are suspected of being part of a criminal gang or have hidden away your assets and stick two fingers up at them (I am paraphrasing the latter, see the rules below for confirmation of the only times they will enforce the debt).

To be fair to the lenders, the number of wayward BBLs they are enforcing is tiny, in fact as they can claim on the guarantee every 3 months and get paid back rapidly, they have no reason to enforce a defaulted BBL. But they can do as per the extenuating circumstances listed on the procedure listed further down this page.

So, what happens when you have defaulted on your BBL, received the letters, had a debt collector trying to contact you for 12 months and they have given up?

Well, having spoken to 1000s’ of people who have reached that stage they all tell me nothing then happens, it all goes quiet. The bank have had their money back so they are happy, the debt collectors have done their job and 12 months have expired so they get paid are they happy and give up trying to contact people.

If the bank suspects you scammed them in one way or another, when they put their guarantee claim in, which they do every 3 months in huge batches, they mark such BBLs as “suspected fraud”, suspected but not proven, remember that.

They do report BBLs to credit reference agencies, however in most cases sole traders have them logged on their T/A file not their personal ones, so their personal credit ratings are not affected as no one can see their BBL, whether being repaid or not, that is possibly why you can’t see yours on your personal credit file (some have spotted them but negligible numbers of people).

As for what will happen in the long term, well as it stands, and this could change at any time in the future, the Government is embarrassed about the BBL scheme and have no plans to come chasing you, unless you are part of a criminal gang or hand yourself in. I will let you know if that changes.

Hand themselves on a plate to the powers that be is what those 1000+ people I have listed on this website (https://mrbounceback.com/category/the-disqualification-files/) did when taking the insolvency route and have been given disqualifications or Bankruptcy Restrictions Order (BRO).

If you take the Insolvency/Bankruptcy route with a BBL owing every aspect of the application and how the funds were used will be investigated forensically and any shenanigans will lead to a Disqualification or BRO.

If anything above doesn’t make sense then give me a bell and let’s chat.

You will find my number here >

BBL Helpline: 15,198 Calls – £278,961,733.33 in Callers BBLs Not Pursued – Lovely

I cannot and will not tell you how to “blag the system”, but I can chat you through anything that doesn’t make sense, as I am aware many of you out there are in a dark place worrying about your BBL repayments and I refuse to sit and watch anybody suffer in silence, which is sadly what some lenders and the Government have been doing, to their shame.

Here is the procedure, I try and post this as often as I can as its important and the lenders are sticking to it, fair play to them:

As always, if anything changes, and let’s face it, the Leadership of the country is constantly changing, I will let you know.