I hope you are finding my articles giving you an insight into the British Business Banks Top 10 Fraud Risks associated with the Bounce Back Loan Scheme of interest, if not eye opening.

You will find them all in this section of the website:

https://mrbounceback.com/category/bbl-wrongdoing/

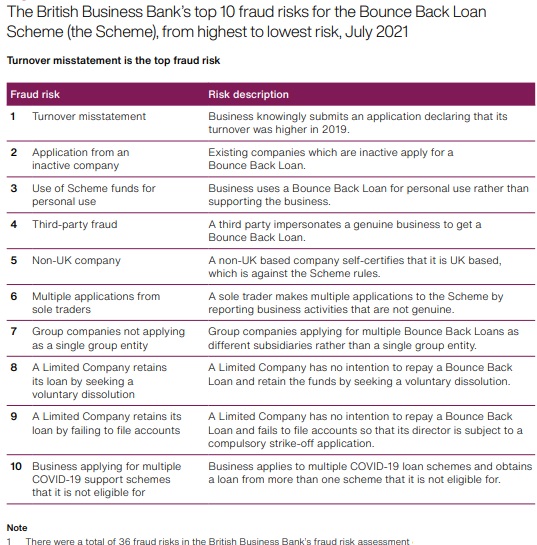

Whilst it is true to say that organisation, who were tasked with designing and launching the BBL scheme did get many of the fraud risks spot on, one that fortunately does not appear to have become a big a problem as they thought it would be relates to non UK Companies bagging Bounce Back Loans.

Having said that though, if there is a sudden flurry of cases coming to light moving forward, I will let you know. They did have that potential fraud risk highlighted as number 5 on their top 10 list of BBL fraud risks.

Non-UK Company BBL Fraud Risk

Definition: A non-UK based company self-certifies that it is UK based, which is against the Scheme rules.

Top 10 Bounce Back Loan Scheme Fraud Risks

My Fireside Chat With the British Business Bank

I did manage to sit down with the British Business Bank and a representative of 28 of the BBL Lenders, and asked them all manner of questions related to the BBL scheme, and that fireside chat is below, if you have not yet seen it.