Below is a “fact sheet” on Bounce Back Loans as just issued by the Insolvency Service. In something of a pathetic and ill-thought fashion they dispersed into that fact sheet all manner of scare/horror stories of those found guilty by them of BBL wrongdoing, instead of offering well-thought out and practical guidance to those experiencing difficulties repaying.

I think we can all agree that they have been told to put out that “fact sheet” by the powers that be to put the fear of God into people with a Bounce Back Loan, when, if one single person in Government had an ounce of common sense, they would know many people are struggling to repay their BBL.

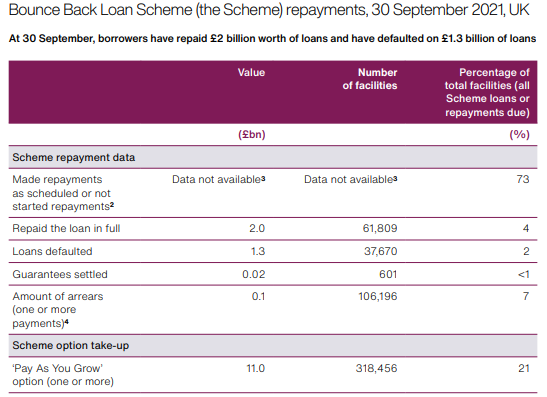

Their own figures indicate that:

Anyway, just so you know, I have now been given a firm date for the video I am filming with a major BBL lender and some others who have kindly agreed to take part in it, which IS going to guide you through everything you may currently have concerns about, if you are worried about or struggling to repay your BBL, including, but not limited to arrears and defaults, and I will be filming that next week.

I will not stand by watching people suffer whilst the Government does nothing, bar try and pathetically put the fear of God into people with their silly nonsense whilst offering no sound advice.

Here is the “Fact Sheet” as issued today by the Insolvency Service, I have removed their horror/scare stories, as people need helpful advice not to be frightened by some idiot at the Insolvency Service, whilst at the same time the papers are full of stories of how Rishi Sunak’s wife’s investments continue to turn sour and low and bloody behold take the Insolvency route leaving us the taxpayers to mop up her mess. You couldn’t make it up, even today they are still coming to light:

Insolvency Service “Fact Sheet”

Measures were introduced during 2020 to support businesses affected by COVID-19 such as loans, grants, and tax allowances. The Bounce Back loan scheme helped small and medium-sized businesses to borrow between £2,000 and £50,000, at a low interest rate, guaranteed by the Government.

The Bounce Back loans were made on the condition that they were not to be used for personal purposes, but could be used, for example, to purchase a company asset such as a vehicle, if it would provide an economic benefit to the business.

- Bounce Back loans must be repaid

The money lent to your company under the Bounce Back loan scheme must be paid back, over 6 or 10 years, with payments starting 12 months after your company receives the loan.

If the money your company borrowed is not repaid, your company may be investigated by the Insolvency Service, even if it has been dissolved.

- If we find misconduct

If we find there was misconduct in the use of the loan, action may be taken against you and your company.

- Types of misconduct can include:

- providing false information on loan application

- the loan being used for personal benefit

- dissolving your company to avoid repaying the loan

- What misconduct means to you and your company

As a result of the misconduct:

- your company could be wound up by the Court

- you could be disqualified as a director

- a Court Order may be made for you to pay compensation to your creditors

We may also look at whether other coronavirus (COVID-19) related assistance such as the Job Retention scheme (also known as furlough) and the Eat Out to Help Out scheme have been used correctly.

Fact Sheet Ends