You are probably now at the point in time when you feel like throwing your arms up in the air and giving up. Much more so if you are still after a Bounce Back Loan, a BBL top up or one of the quite illusive Discretionary Business Grants that local councils have been tasked with handing out.

It was once again like Groundhog Day for many people seeking any of the above yesterday and today will be the same too. I will let my Twitter followers do the talking today and give you an idea of what is happening out there right now regarding getting financial support for your business by either the banks or your local council.

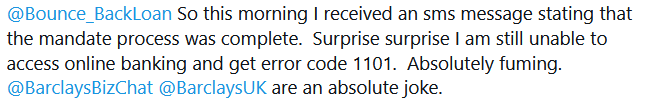

Barclays Still Taking the P*ss

This Follower simply wants to apply for a Bounce Back Loan with Barclays, however no matter how hard they try to do so, they meet with problem after problem, and Barclays keep on ignoring their pleas for help, and have been giving them when they do finally get to speak to someone, all manner of excuses for quite some time now:

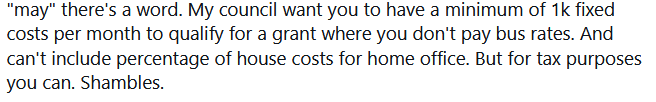

Councils Making Their Own Rules Up

Trying to apply for a Discretionary Business Grant from some councils is proving to be a nightmare, this Follower has discovered their local council has imposed their own unique criteria for those they are going to fire those grants out to:

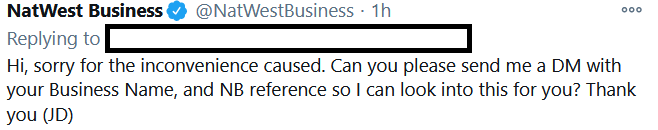

NatWest Luring People into a DM

Most banks want to lure you into a DM when you are chasing up a Bounce Back Loan or Top Up on Social Media but be aware when they do so they will simply tell you there is nothing they can do and tell you to contact the support team by phone, which will see you often being on hold for hours and then being fed even more bullsh*t and told to simply wait.

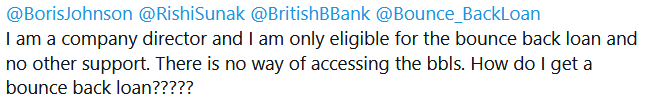

Plenty of Business Still After a BBL

There are still plenty of people who still have not been able to get a Bounce Back Loan, and if you do not have an account with any of the BBL lenders or want to take your chances going on a waiting list with Starling Bank, if they do let you get a business account with them, you cannot apply for one.

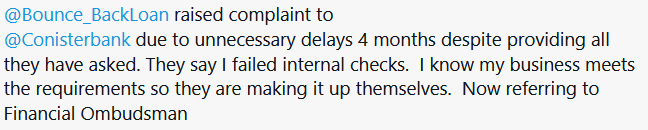

Jumping Through Hoops

This is a typical complaint I get these days about banks such as Conister, they have an extremely poor track record for the way they have been handling their customer support and many people who did apply for a BBL with them still have not got a clue whether their applications are going through or not or what is going on with their applications:

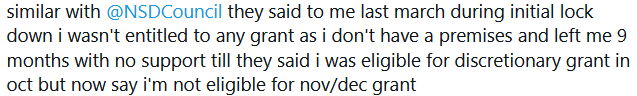

More Confusion for Those Seeking a Business Grant

As councils have been told they can make up their own rules as to who they can hand grants out to, that does of course mean they are going to chop and change their rules and leave many people without a grant:

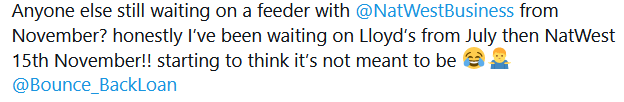

A Never Ending Wait

Plenty of people have been hanging on now for months to get a simple business account opened with different banks, and with no light at the end of the tunnel many of them are close to giving up.

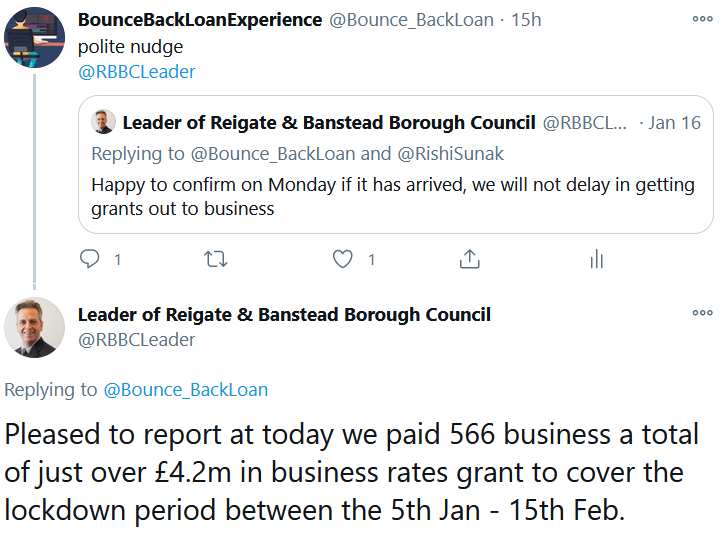

The Good Guys

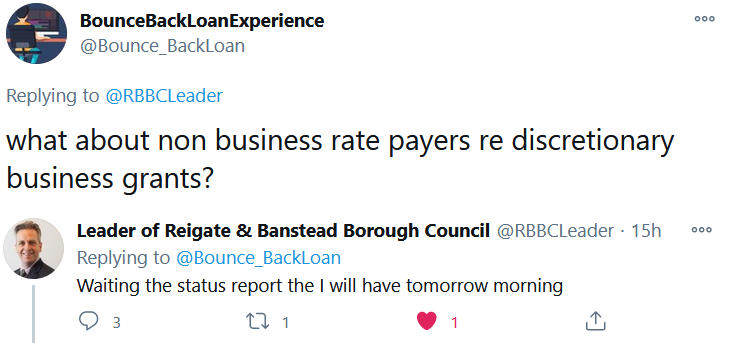

Whilst most councils have been hiding away or not responding to those asking about a Discretionary Business Grants, some have been prepared to offer help and support in every way they possibly can.

I am badgering plenty of councils on Twitter and via email about those grants and whilst many are proving impossible to contact or are claiming they are still waiting for guidance on how to distribute those grants, some have been very forthcoming and helpful:

Step forward Cllr Mark Brunt, Leader of Reigate and Banstead, who is a shining example of what those Public Servants should be like:

Keep Trying and Keep the Faith

With hundreds if not thousands of tweets coming my way each day the above are just a tiny example of those I get to see. If you are still waiting for a Discretionary Business Grant or simply an update from your council on one, do not give up, keep on at them, the same with those of you after a Bounce Back Loan or a Top Up, never give up. Get your local MP to assist you if you are about to give up.

You Couldn’t Make It Up

One final thing, remember Tide, the Bounce Back Loan accredited lender that let tens of thousands of people down with their BBL scheme due to them running out of money, then due to their “waiting list” and the BBL database that they listed those on their waiting list on, which by doing so then caused 1000’s of people to be declined a BBL with other lenders, well bash my bum with a biscuit tin lid they are now touting for votes. – You really couldn’t make it up.