We are now at the point in time when many business owners still trying to get a Bounce Back Loan are facing all manner of additional and unexpected problems trying to get one, and many are reaching out and asking their MP’s to assist with those problems.

Having seen plenty of replies to letters and emails sent in and shown to me from MP’s and those working for them who they delegate such tasks to, its fair and very true to say sadly that some MP’s and their employees are completely useless, but on the other hand, some do go above and beyond what is expected of them. To the latter – You get a big thumbs up from me, and thank you for doing so.

However, when faced with a problem sent in by one of their constituents, and be aware most MP’s will only help you if you are one of their constituents, Bounce Back Loans are just as alien to some of them as they may be to you.

The articles, guides and publications available in the House of Commons Library is where many MP’s and their staff involved in assisting with Bounce Back Loan related problems will turn for guidance.

I have stumbled on one article that has been compiled to help with those tasked with assisting with BBL related problems which titled “Coronavirus: Problems with Bounce Back Loans”.

Alas, it’s not overly informative, and once you see it you will get my point, and as such below you will find a copy of that article, however I have added my own notes in bold, so that any MP’s or their “problem solvers” “caseworkers” etc can get a much clearer and much more insightful overview of the problems and how to set about helping those who need help with a BBL.

Help and Guidance

If you are an MP or a caseworker for any MP, I do first and foremost accept that due to the current problems with Covid-19 and lock-downs etc, you are possibly overwhelmed with calls, emails and letters from constituents on a whole host of problems.

Therefore, if you are struggling to comprehend anything you have been asked from a constituent with a Bounce Back Loan related problem and you want more information and some clarification on such problems and some pointers as to how to get them rectified speedily, get in touch with me and I will happily phone you up and talk you through them.

Drop me an email to info@mrbounceback.com from your parliamentary email account so I can verify/due diligence you and I will be in touch.

Who runs the scheme and who offers loans?

The British Business Bank (BBB) oversees the scheme and accredits lenders. The government and the BBB have delegated all aspects of decision-making to individual lenders. This means that lenders make decisions about applications, as well as who they will accept applications from.

Good luck trying to get any sense out of the British Business Bank, they had major reservations about the scheme before its launch and to ensure they have their backs covered, have given lenders the power to do as they please with Bounce Back Loan applications.

Many lenders have “grasped that concept” and have stuck to fingers up to the Government, and despite the Government telling them they should open up their schemes to new customers, have flatly refused to do so for five months now, and continue to do so.

How large can the business be?

Although BBLS is advertised as being for smaller businesses, there is no upper limit on the size of businesses that can apply.

Be aware that some British Business Bank accredited lenders have their own rules and criteria bolted on top of the standard rules and criteria.

If you are contacted by a Sole Trader or someone who owns a LTD company it is also worth noting that some banks will prefer Sole Traders and not LTD’s and vice versa too.

Whilst turnover is meant to be self-certified and can be estimated as part of a business owners application for a Bounce Back Loan, some lenders are demanding Sole Traders applying for a BBL supply with them a 19/20 self-assessment, which forces those applying with such lenders to endure added delays even though those self-assessments need not be submitted until the end of the year.

If asked by a constituent, why a lender is asking for a 18/19 self-assessment that is all part of the Know Your Customer rules and allows a lender to verify they were in business and trading.

The turnover figures for the scheme for reference are for the calendar year 2019 and not the tax year, that often confuses some people, much more so when they have been asked to supply a 18/19 self-assessment, which as mentioned is purely to enable a lender to verify they were in business during that tax year, and is not used to verify any turnover.

Sadly, a small or even huge business that may apply with some lenders such as Metro Bank and Starling Bank can be declined for a Bounce Back Loan if the respective bank has no “appetite” for the market sector they operate in.

Do businesses have to apply to their existing bank?

No, they can apply to any accredited lender, but it may well be more efficient to apply to their existing bank first because the approval process involves some basic “know your customer” security checks. Businesses should only have one live application at a time.

The above is not true, in fact it is laughable. As of today, there are 28 accredited lenders, of which Tide have no more money to lend out and are not accepting BBL applications, Conister have also closed their application process, and will soon run out of their allocated funding.

An additional twenty-three of the accredited lenders are not accepting new customers, with HSBC slamming the door on such at 9:00 on September the 30th.

Many lenders also have a cut-off date, which is a date (often months before the scheme went live) before which anyone who did have an account with them (often only a business account) will be allowed to apply for a BBL.

There are currently five lenders that are accepting new customers, below is a quick overview of them:

Barclays – Barclays are accepting new customers for business bank accounts; however, they are taking weeks to open such accounts, and some of their staff appear completely untrained and make up non-existent rules when declining applicants.

Metro Bank – Metro Bank currently are only allowing LTD’s to open accounts online, Sole Traders must book and attend an in-branch appointment. Metro Bank also sadly have a bad track record for approving BBL applicants, paying them out their loans then locking their accounts and declining their Bounce Back Loans after initially approving them.

That is a disgrace and has led to some applicants…. Well I am not going there but you can imagine the dark place many business owners find themselves in when they have a long awaited BBL credited to their account then it is snatched back.

Getting a review/appeal of a decline with Metro Back can take weeks and support staff are telling such applicants to write in, thus leaving them in limbo for weeks, which could and possibly will due to the closing date of the scheme fast approaching, seeing some applicants missing out on getting a BBL altogether, which may only be by getting a successful review and overturning of a decline by Metro Bank or by applying with another lender.

Clydesdale and Yorkshire Banks – Both Clydesdale and Yorkshire Bank, just plod on opening accounts to new customers and allowing them to apply for a Bounce Back Loan once such an account is opened.

They are by no stretch of the imagination quick at doing so, but they do deserve some recognition for offering accounts and BBL’s to new customers. They will ask for proof if someone is listed on the “shared industry database” as having a BBL (when they do not) but they are 100% are aware of the problems with that database and will actively help with any problems arising from that database.

Starling Bank – Anyone who manages to open a business account with Starling Bank will have to then go onto their waiting list if they want to try and apply for a Bounce Back Loan.

Starling have their own criteria bolted on top of the standard BBL criteria/eligibility and as such they do not guarantee anyone chosen off their waiting list will get a BBL and they do not guarantee to select everyone on their waiting list to invite them to apply.

So, sadly business owners are taking a gamble if they chose to go with that bank, that they will be chosen/invited to apply and then another gamble that they will be approved for a Bounce Back Loan.

Being rejected by one lender should not prevent applications being considered by others (although it is important to know why the application was rejected).

Be aware that to reduce Bounce Back Loan fraud, a “shared industry database” was established. Sadly, that database is causing more problems than it was established to negate.

You may come across a BBL applicant who continually gets declined for a Bounce Back Loan with multiple lenders due to being listed on that database. They could be listed on it for simply being on a waiting list with another lender, having applied with a lender and having been turned down for a BBL or a whole host of other reasons, which have nothing to do with fraud, including database entry errors.

It is important that should you be contacted by someone that is declined the reason for that decline is established, ideally finding out if it is due to them being listed on that database (erroneously or when being on a waiting list).

If they are listed upon it for being on a waiting list, or the database appears to who they have a BBL from another lender when they do not, the applicant will need to get a letter or some other form of proof from the lender whose waiting list they were/are on, and present it to the lender that has declined them for a BBL, if that is the reason for their decline.

However, getting through to someone at some banks who can actually issue such a letter can be a nightmare for applicants, for reference Starling Bank and Tide are aware of the problem and can, albeit slowly in some instances issue such a letter/proof on demand.

Why is a lender taking so long to decide?

Reasons may vary, so businesses should contact the lender to find out why. Many lenders have been overwhelmed by the level of demand and so it has taken much longer than usual to consider applications – even if in theory that process is quick. It may be worth reviewing recent articles online about which lenders are taking more or less time to decide.

The quick and easy answer as to why some lenders are taking weeks/months to process new accounts and Bounce Back Loans is that there are only a handful of them offering accounts to new customers and as such they are overwhelmed and have a huge backlog of applications for both new accounts and BBL’s.

HSBC most certainly do have a huge backlog and as such no longer accept new customers to apply for a business or feeder account with them. Only those who applied before the 30th of September before 09:00 will still have a chance of getting a business account with them.

Why do some lenders only accept applications from existing customers?

This is most likely to result from attempts to manage levels of demand. Again, each lender is free to set its own criteria in this area. Some may only accept applications from existing customers with business accounts and have indeed rejected traders who use current accounts. In the latter case it would certainly be worth contacting the lender to discuss the matter.

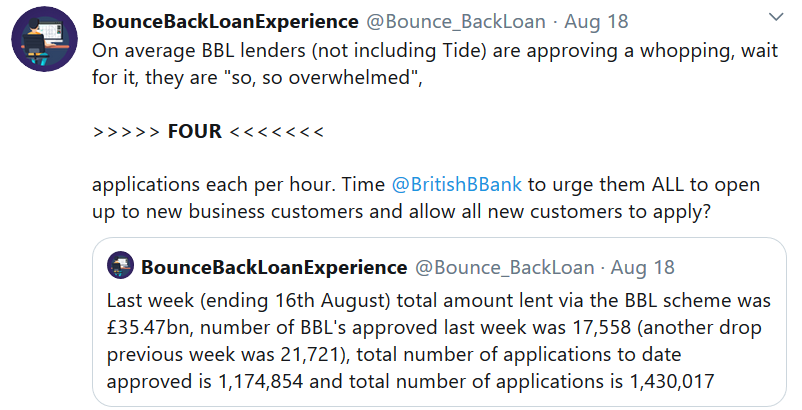

Claiming to be “overwhelmed”, having “unprecedented demand” and the many other excuses lenders make as to why they have not opened to new customers is simply not true. Based on the current figures, on average each lender is processing less than four BBL applications per hour.

It is however true to say that those lenders that do accept new customers will be overwhelmed and that is due to most of the other lenders in the scheme, not accepting new customers.

Obviously by not opening to new customers they do not get as much attention or complaints about delays, which those that do accept new customers are getting.

Not daft those bankers are they.

Why has a lender approved a loan and then closed the business account?

Banks are free to make these decisions

“Free to make these decisions”. NatWest, Lloyds and some reports about Starling do indicate many banks are just closing business accounts, often due to erroneous reasons and dumping customers, some of whom may have been with a bank for decades.

Metro Bank and NatWest, and some other banks have also snatched back BBL’s awarded to some applicants and will make them jump through hoops to get that decision overturned, if at all.

That in turn leads to many business owners who do get a BBL transferring their funds “to safety” once they have been credited with their loans, as they do not want to risk those funds being snatched back to due a bank error which could take weeks or even months to correct.

What can be done about it?

Customers are equally free to ask why. See the next question too.

Good luck with trying to get a Bounce Back Loan approval which turns into a decline, account closure or a snatch back of the BBL funds overturned, reviewed or appealed.

Such victims can spend hours on the phone trying to get sense of out untrained bank customer support staff and can also get a shrug of the shoulders from bank branch staff they approach too.

I have many time advised people to send in a good sob story to a banks CEO to get an account and/or BBL, that’s right business owners are having to practically beg to try and get a BBL due to the stubbornness of some banks to open up their schemes to new customers.

Not what Rishi envisaged I’m sure when he launched the scheme, but that is what has become of the scheme right now, sob stories and begging letters.

What can businesses do if they are not happy with their lender’s approach?

The first step is to talk to the lender directly to find out more or to seek more information. All customers can use the lender’s own complaints procedure. Many businesses and charities may also use the standard complaints procedure for financial services after they have exhausted the lender’s complaints procedure. Please note:

- This is unlikely to lead to a quick decision for businesses urgently seeking funds.

- The BBB does not deal with complaints about such decisions.

The “official” routes to get help and assistance with any standard complaints procedure set up by banks or those organisations tasked with looking into complaints and investigating them take far too long, much more so with Bounce Back Loan related problems and the fast approaching closing date of the scheme.

As an MP, you should pick up the phone and contact the CEO of any bank any of your constituents has contacted you about, letting the CEO know the problem and demanding they look into it within a few days.

Obviously you will much prefer to write letters and get a written response, but many of the problems are basic simple problems that can be sorted out in minutes, but only if someone “with a brain” at the bank does step in and sort them out.

Lest we forget that some bank staff, and I am seeing this more and more are simply making up rules that do not exists just to get rid of an applicant that is badgering them. I see that day, after day in fact hour after hour.

Let this rattle around your head, “what may appear to you as just another BBL problem can be, if not sorted out, a business destroying and livelihood destroying problem for many business owners.

When do applications close?

On 24 September, the Chancellor announced that the closing date for applications would be extended to 30 November.

I am sure every single Bounce Back Loan lender CEO will have that date circled on their calendars and will be having a party when the clock strikes midnight on the 31st of March 2021.