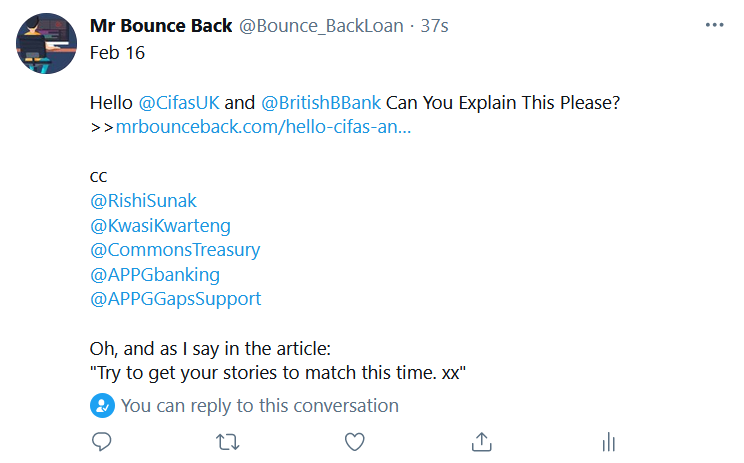

I post this Bounce Back Loan news update so that those working for Cifas and the British Business Bank can read and digest it, I did send a Tweet to them asking if they would let me know how these incidents/problems can happen and why they were allowed to happen and what, if they can be arsed, are they going to do to correct the incidents/problems:

Obviously, you dear website visitor can read it through too, for who knows, you may have been unfairly declined a Bounce Back Loan due to you being victim of these or similar problems.

I will once again invoke my whistleblower protection as afforded to me by a Government agency in making the following public.

Let me now grab my whistle and start blowing it loudly……………….

Background

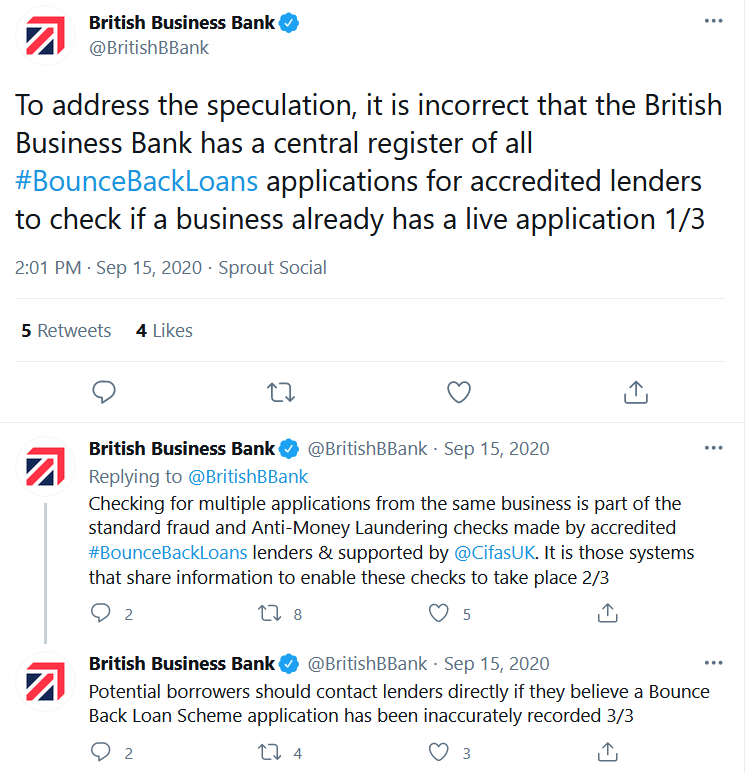

On the 15th of September 2020 the British Business Bank, stated the following:

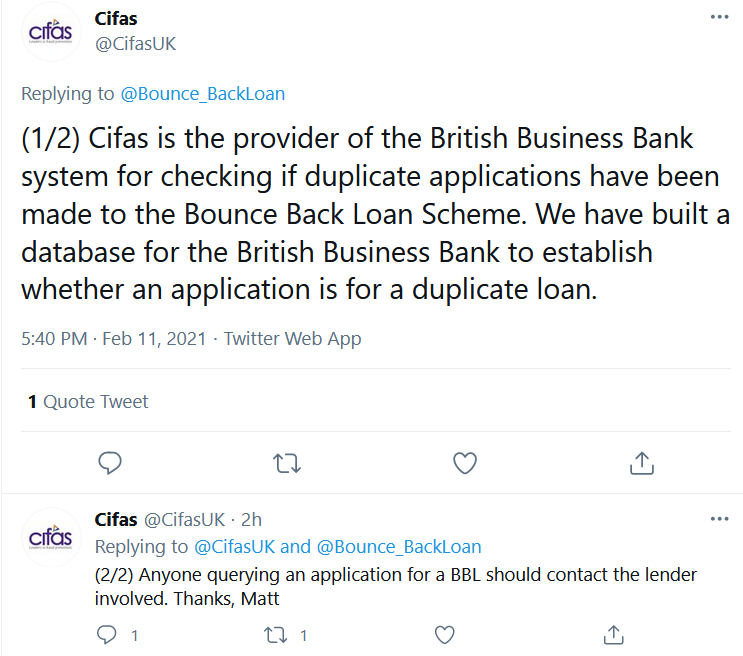

On the 11th of February 2021 Cifas stated the following

As such anyone who applies for a Bounce Back Loan and is declined has to attempt to contact the bank who declined them that loan to find out why.

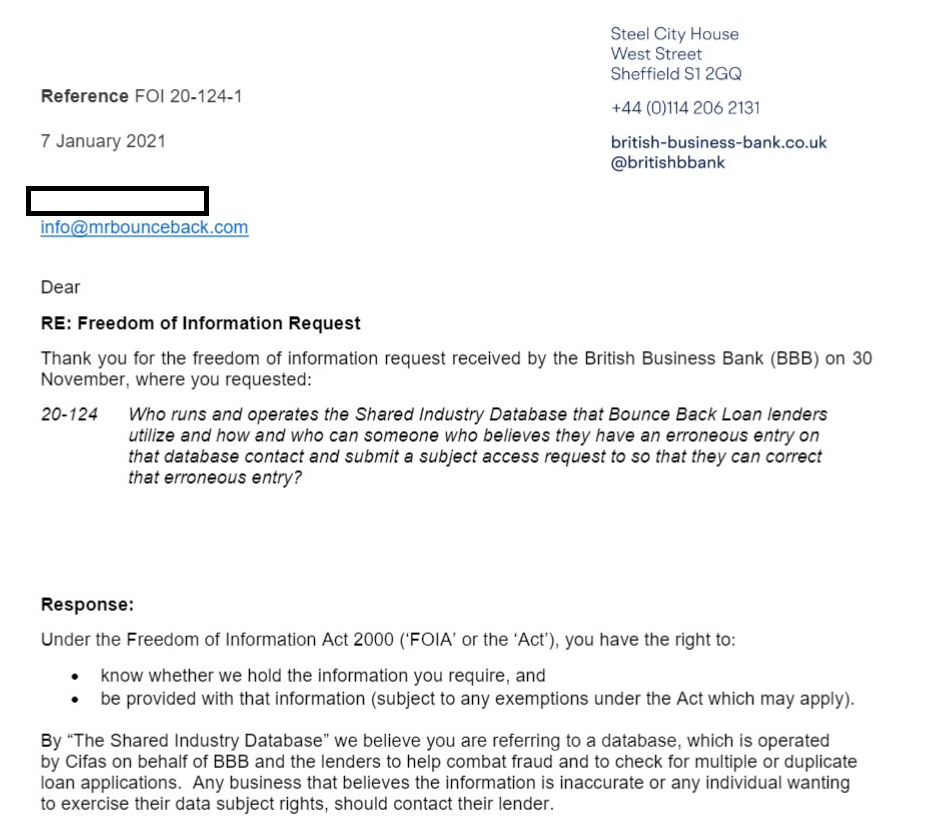

Below for additional clarification is a reply to a FOI Request I submitted to the British Business Bank on this subject:

Conister Bank

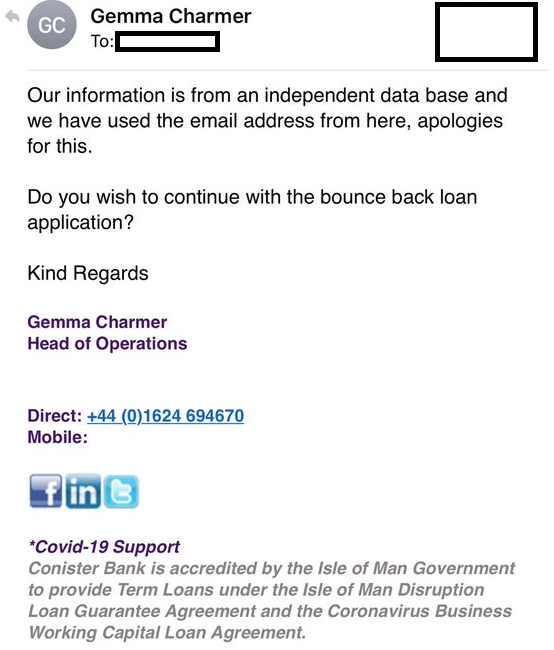

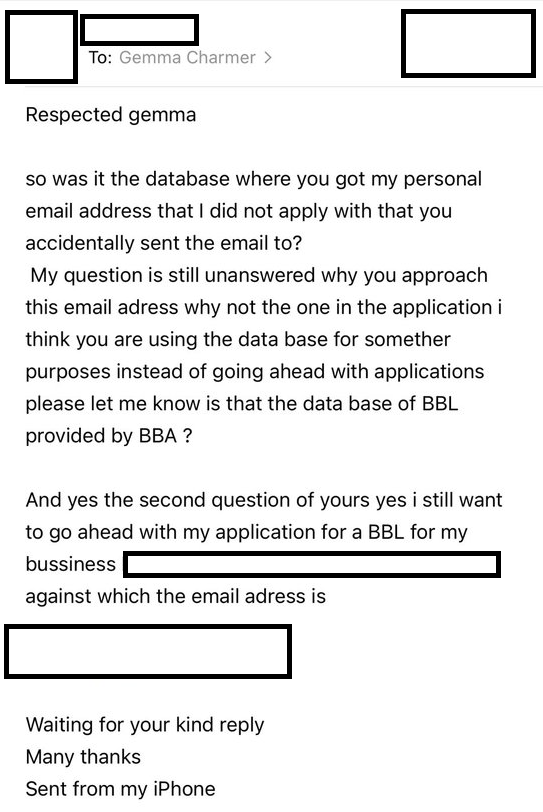

A small business owner recently applied for a Bounce Back Loan with Conister bank.

That person had applied previously for a Bounce Back Loan with Lloyds Bank, for a separate business entity and was approved for that loan and got paid it out.

On their application for their second separate business entity with Conister bank they supplied a different email address to the one they used on their Lloyds application.

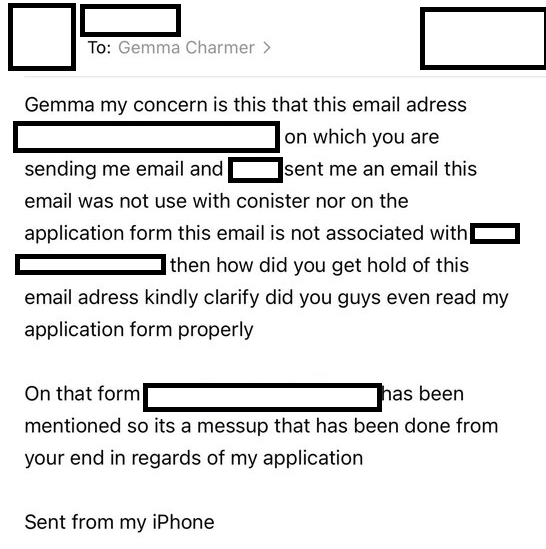

Conister Bank sent out to that applicant an email letting them know their application for a Bounce Back Loan was declined as they believed, incorrectly, the business entity they were applying for had got a loan for that business from Lloyds Bank.

However, they did not use the email address on the application form they received, they replied to the email address listed on that applicant’s application with Lloyds Bank.

Proof:

The applicant contacted me to alert me to this rather unusual situation. I was also contacted by another applicant who experienced a similar thing.

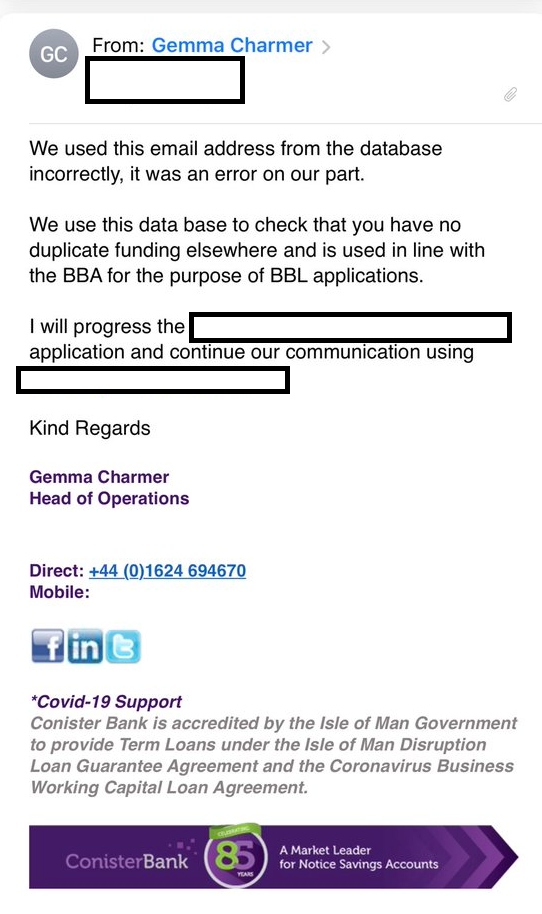

Knowing this not to be right, and aware that as part of the British Business Banks rules for accredited lenders that state bank staff processing Bounce Back Loan applications must be fully trained: I advised the applicant to keep asking Conister Bank why this had happened, and get them to admit it, to which they did:

Surely something has gone very wrong when Conister bank staff gain access to the database and then use contact information found on that database from another bank for a different business entity’s application with that other bank?

If the applicant had not contacted me for advice they would never had known, and their BBL would have not eventually been approved.

Why am I doing your job for you BBB and why did such a situation arise?

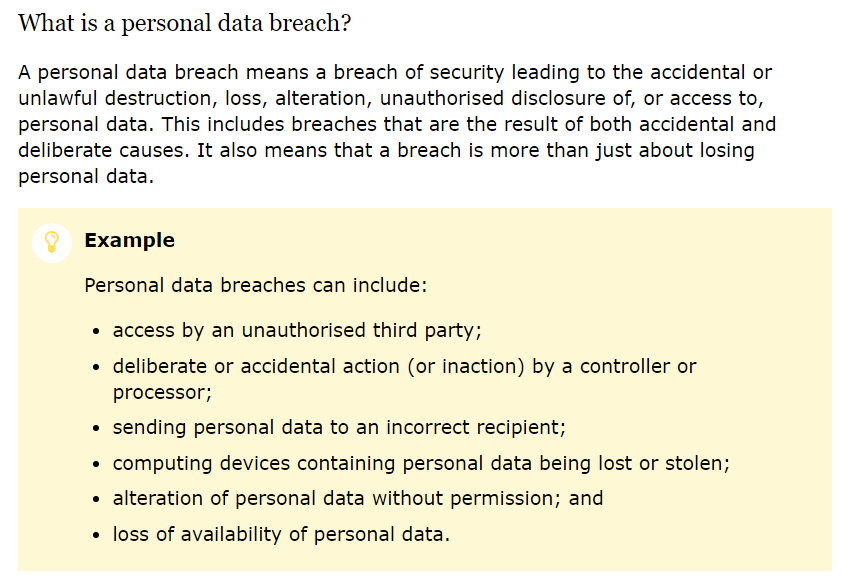

Data Breach?

At the time of the above I did alert the British Business Bank of this, what I would define “data breach”, as per the definition laid out on the ICO website:

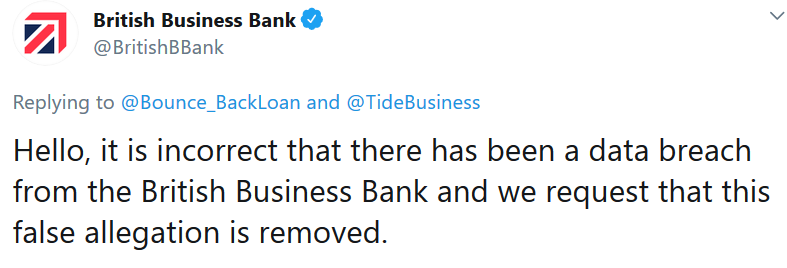

The British Business Bank being what they are, ended up having what some called a massive hissy fit and breakdown on Twitter and they spent the best part of a day chasing around anyone who dared utter any reference of this problem with the following tweet:

I will refer to the British Business Bank and Cifas Tweets again at this point, as the BBB say they do not have a central register/database yet Cifas clearly say oh yes you bloody well do we built it for you……

Failure of the Database

Looking at the above it is clear there are problems with that “database” that Cifas say they designed for the British Business Bank and the British Business Bank appear to claim they do not have.

For the record I have seen multiple reports from others applying for a Bounce Back Loan with Conister who are told their application has been denied as they have a “Cifas Marker”, when contacting Cifas they are told they do not have a marker.

It would appear Cifas staff members are telling people they have no marker but then fail to tell them about the database, thus many people then are at a loss to understand why a bank tells them they have a marker when Cifas staff then tell them they do not.

I have also been told by those contacting Cifas about a possible marker and whether they have a marker of any type on the Bounce Back Loan database Cifas say they do not have such a register/database. Which adds to the confusion.

In the Cifas Tweet above they and the British Business Bank state that anyone who believes they are on that database should contact their bank. Try asking most bank staff about a Bounce Back Loan register or database and see how you get on……

The problem being most bank staff processing Bounce Back Loans cannot be contacted via phone or even at all by applicants, and only via bank support staff, who have to act as middle men/women for those contacting a bank pleading for help, which then adds to the delays and confusion, Cifas and the British Business Bank should know that, but I doubt they do.

Starling Bank

I have also seen proof, which I will supply below that Starling Bank have put on the Cifas or British Business Bank database (whichever one one them has the balls to claim responsibility for that database) people who have not received a Bounce Back Loan as having got one with their bank.

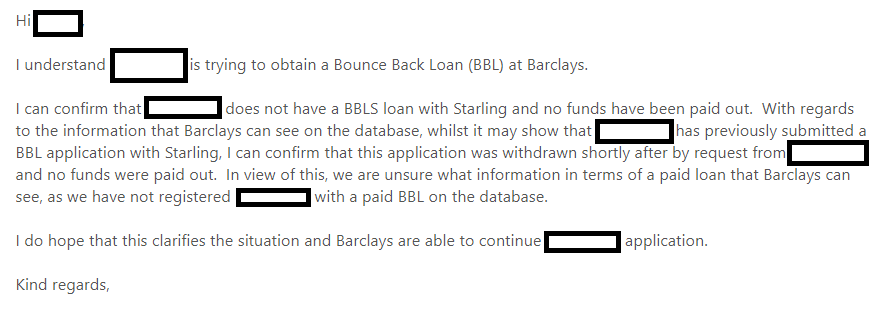

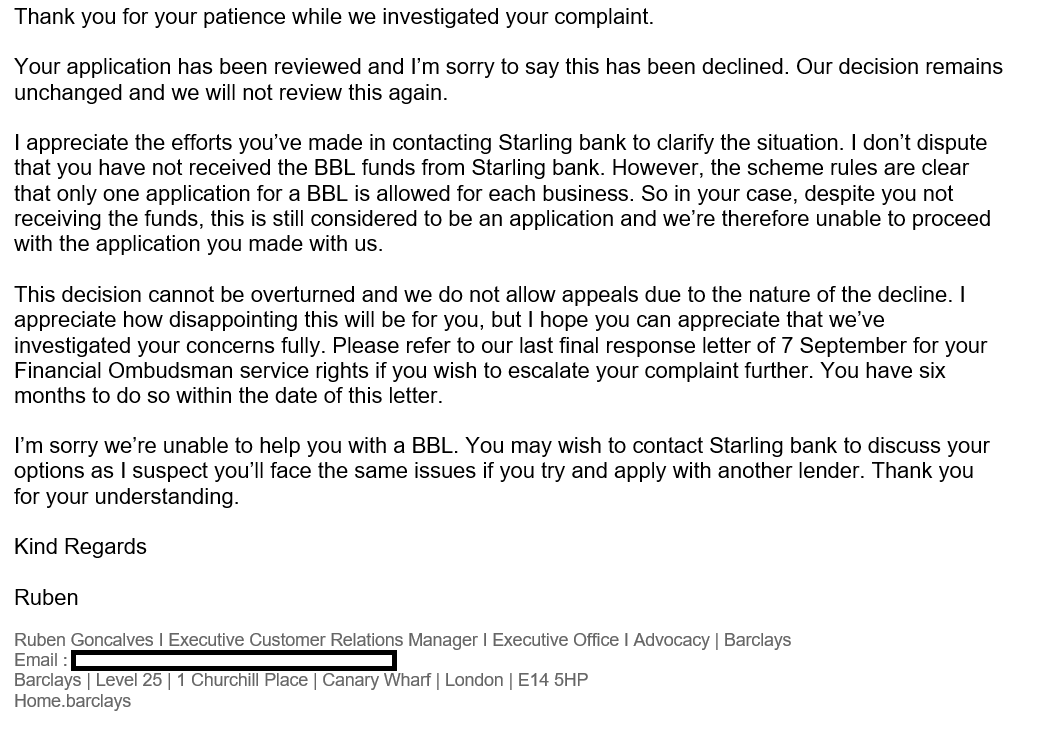

This is a reply sent by Starling to Barclays regarding an applicant who was declined a Bounce Back Loan with Barclays as Barclays said they could clearly see Starling had them listed as having been paid out a BBL on that register/database.

That in turn led to an applicant being declined a Bounce Back Loan when they applied with Barclays:

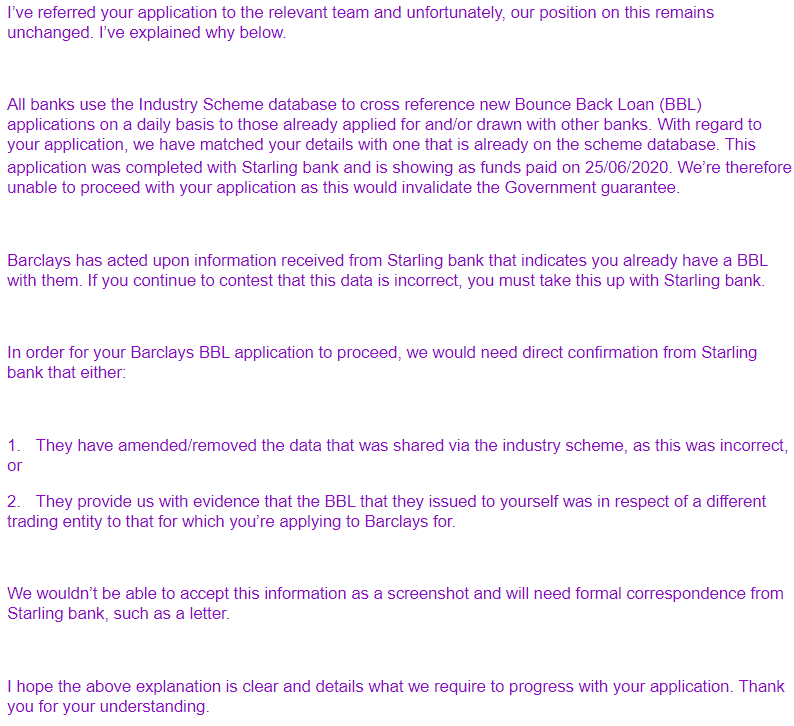

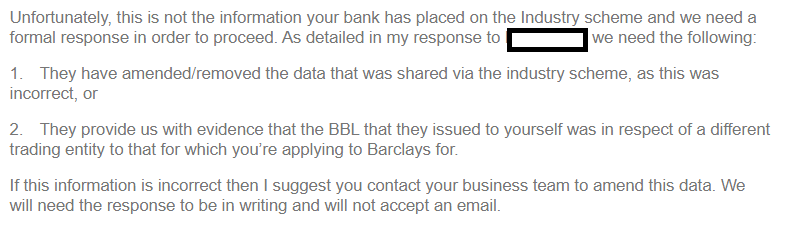

The applicant continued to protest that they had not been paid out a BBL by Starling, but Barclays stuck to their guns and replied with this:

It was finally sorted out when an Executive from Starling Bank stepped in and decided to let the applicant re-apply with them for a Bounce Back Loan as Barclays were not for giving in.

Barclays Bank Making Up Rules

Low and behold Barclays Bank decided that they would invent a rule of their own, to make the above problem go away.

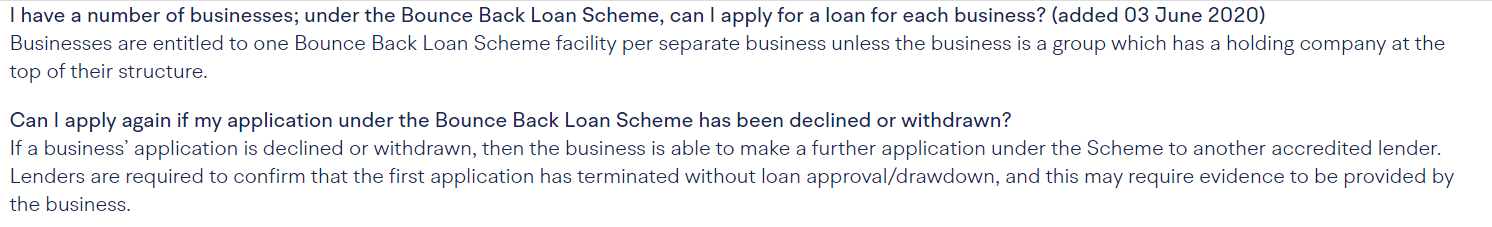

Here are the rules from the British Business Bank website for applying for more than one business entity and re-applying for a declined BBL:

Barclays decided they would mix those two rules into their magic mixing pot and came out with the following:

You could not make this up!

Tide

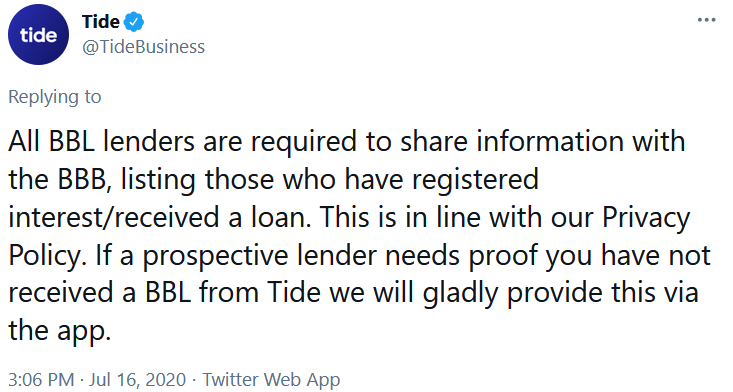

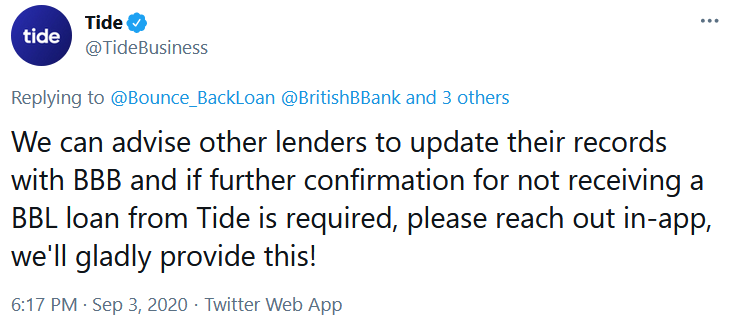

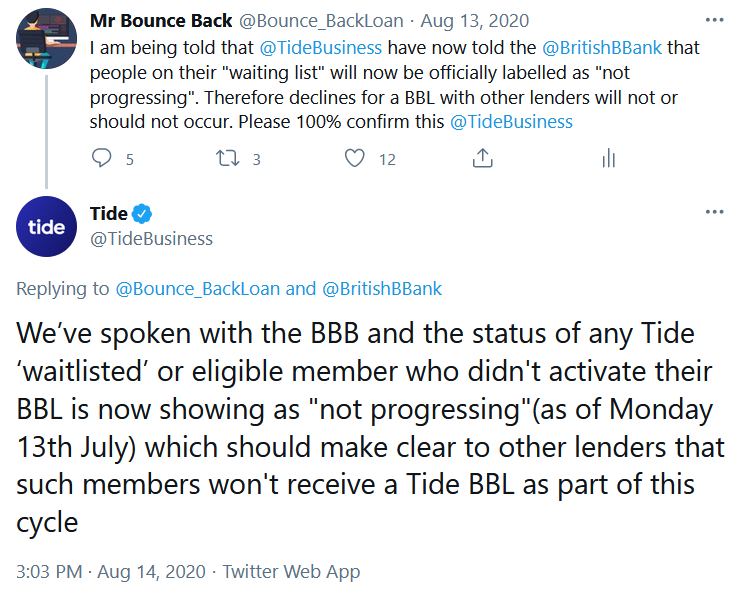

Low and behold, I have seen hundreds if not thousands of people declined a Bounce Back Loan simply for adding their name onto the Tide waiting list.

To refresh your memory Tide ran out of money to lend via that scheme and therefore had to let a lot of people down. However, when those who were on that waiting list applied with other lenders that are part of the scheme, they were declined as those other lenders believed that they had been given a BBL from Tide.

Tide have constantly said they told the British Business Bank that this problem existed, and it would not be a problem after the 13th of July 2020, however I have seen no end of people still declined due to being on the now defunct Tide waiting list.

In fact, Tide even alerted other lenders to update their records as seen in the Tweet below, and have admitted this problem exists:

People for reference were still being declined due to this problem weeks and months after Tide admitted it existed and had been “fixed”, proving someone had failed in their duty regarding updating that database and alerting other banks of the problem.

Failure of the Database

Obviously, the database was set up among other things to stop duplicate Bounce Back Loan applications being processed and paid out.

However, the problem it was set up to fix has caused additional problems, a few of which are clearly laid out above.

My question is will either Cifas or the British Business Bank put their big boy pants on admit the problems the database has caused, admit they have done nothing to correct those problems, admit they could have been much more pro-active in alerting BBL applicants of those problems, and obviously do the decent thing and offer substantial compensation to those that have faced either a delay in getting a Bounce Back Loan or have been declined their right to get one due to those problems.

I do so look forward to your reply. But alas, based on your “form” I doubt you will reply and will bury your heads in the sand.

Duping the Queen?

I note Jonathan Britton, a Non-Executive Director at the British Business Bank has recently been awarded OBE, could I ask he returns that award to Her Majesty in light of the problems above, as I feel it is wrong for him to hold onto it whilst the above problems exist, and so many hard working decent folk have been caught up in this mess through no fault of their own.

I am confident if he looks deep into his heart, he will realise that is the decent, ethical, and honest thing to do.

Waiting for your reply Cifas or the British Business Bank……………

Oh and try to get your stories to match this time. xx