In my never ending quest to ensure those genuine, hardworking business owners across the land who have experienced difficulties repaying a Bounce Back Loan are not hounded and pushed over the edge, I was delighted when the Labour Party got in touch with me about just that topic.

Having been told by a growing number of BBL recipients who have been struggling to repay their BBLs, they were fearful of just what the future holds for them, much more so having heard Rachel Reeves announcing, if Labour win the next General Election, a Covid Corruption Commissioner would be installed and stating, “We Want Our Money Back”.

It is one thing going after out and out Blaggers who scammed as much as they could out of the public purse by claiming business grants they were not eligible for, and those pulling all manner of scams to get a Government backed loan such as a BBL or CBIL, but it is another thing chasing business owners who did no wrong but cannot, through no fault of their own, repay such loans.

I was told the following

“Labour’s Covid Corruption Commissioner will go harder and smarter after the organised crime gangs, the fraudsters and chancers who wilfully and fraudulently exploited the holes in the schemes and ripped off the public.

Those who legitimately accessed business support have absolutely nothing to worry about. They have done nothing wrong and need to be treated sensitively and with respect especially in this difficult economic climate.

So far the Conservative government has lost an estimated £7.2 billion to Covid fraud and has blown £8.7 billion on failed PPE contracts from the pandemic. Our focus is clawing back what we can from this scandalous Covid corruption.

Ministers were warned at the time about the vulnerabilities and lack of basic checks in their schemes but they ignored them. We won’t make that mistake. That is why our Covid Corruption Commissioner will also help learn lessons for future schemes putting in stronger anti-fraud protections to protect all taxpayers.”

A Few of the Many Points I Have Made

To ensure that not a single genuine business owner with a Bounce Back Loan is hounded or harassed in any way, shape, or form, over and above the currently put in place rules regarding arrears, defaults, and recoveries, I have stressed the following points that their Covid Corruption Commissioner needs to take into account.

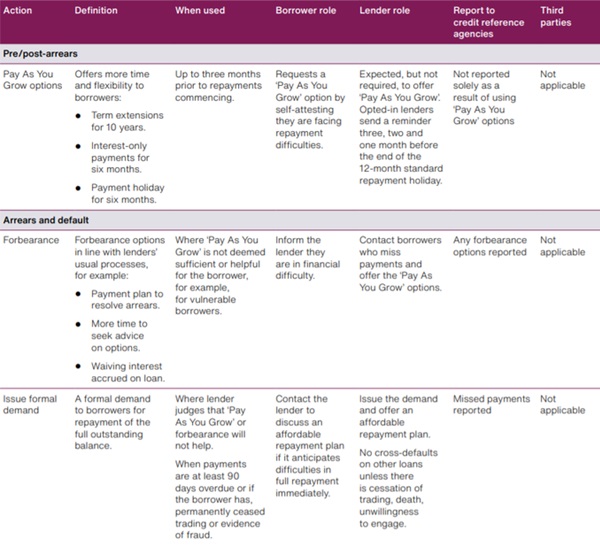

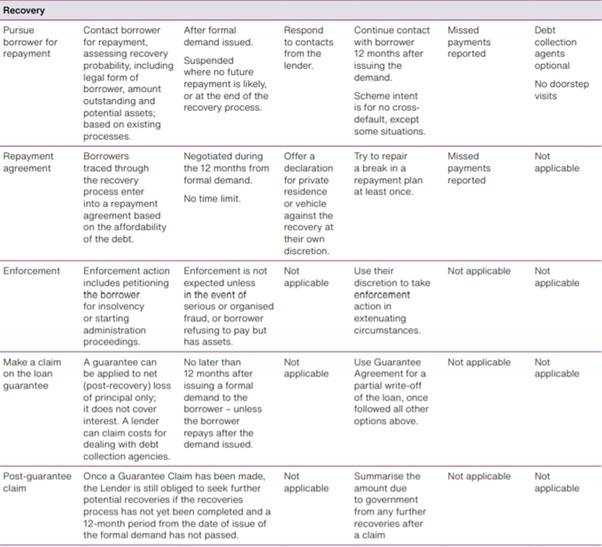

Current BBL Rules on Arrears, Defaults and Recoveries – Below you will find the current rules regarding Bounce Back Loan arrears, defaults, and recoveries, which is working and being followed by most BBL Lenders. I have stressed, that those rules, when followed by Lenders work, and they help ensure everyone who did nothing wrong does not suffer or get pushed over the edge, when at any stage of the process.

Speeding Up of the Defaults Process – A small number of BBL recipients who are clearly showing obvious signs of distress, both mental and financial, are being offered the option of having a BBL default speeded up by some Lenders, as those Lenders do know want to push them over the edge by making them endure 3 months of missed payments, waiting until their BBL defaults.

That option should become available from all BBL Lenders and not just those who truly care about their customers wellbeing.

Discretionary Breathing Space – I have been impressed by many BBL Lenders, who, when a BBL Borrower plucks up the courage to call them, and that phone call is extremely daunting for them by the way, and explain they are in a dark place wracked with BBL repayment worries, instantly give them a 30 day Breathing Space or even longer, in which they wont contact them or seek a monthly repayment in those 30 days, to allow them some time to work something out and seek help and advice.

That should be something that is offered by all BBL Lenders, not just the official 30 days Breathing Space, as there is no doubt in my mind, having been told so by many of my Helpline Callers, who have reached out to me in distress, it has saved lives.

BBL Defaulter Discounts – This scheme offered by one particular major BBL Lender should continue and possibly be extended to all BBL Lenders, for whilst some people will be screeching why should such discounts be offered, the one major Lender who does offer them has, based on the latest BBL performance figures, the lowest rate of “BBLs Gone Wrong”, and this allows business owners who haven’t Bounced Back or won’t do for years to continue trading but make a one off payment for a line to be drawn under their unaffordable BBL, given to them whilst ordered to close/suspend their business operations during the pandemic.

It also ensures something, rather than nothing, as is currently the case, is returned to Government coffers, as many BBL defaulters tell me they want to repay something back as they were grateful for a BBL but cannot, due to the pandemic and ongoing cost of living crisis, pay it back in full and would much prefer to pay something back rather than close their businesses down or just let the taxpayer pick up the entire tab of their BBL.

This will enable such business who do settle their BBL via a Defaulter Discount one off payment, to take as long as it takes to Bounce Back and the tax paid by them in the coming years will benefit the country as a whole.

Whether they adopt any of those suggestions is their decision to make.

Ongoing Discussions

I am of course having ongoing discussions with the team and have been alerting them to some of the ongoing scandals some BBL Lenders have been involved in, and some of the outrageous stunts they have been pulling, and the current Conservative Government have been refusing to address.

Ultimately I am also, probably ad nauseum, informing them of the following, which I tell callers of my helpline who are in a dark place with an unaffordable BBL.

“Never, ever forget, it was the Government who told you to close/suspend your business, then filled your heads with stories of how going outside could lead to your death due to the “pandemic” then as you sat there with your business devastated, and in most cases, in a very, very vulnerable state, dangled a huge £50k loan before your eyes, with no credit checks and no affordability checks.”

The Covid Corruption Commissioner needs to let that rattle around his head too.

Early indications with my discussions are, that if you did nothing wrong regarding your Bounce Back Loan or Loans, then you have nothing to fear from the Covid Corruption Commissioner whether in arrears or default.

But if you are a VIP Lane PPE Blagger, a Covid Business Grant Scammer or outrageously blagged a Bounce Back Loan with the sole aim of never paying it back, then you may soon have your collar felt.

As always, I will keep you fully updated with my ongoing discussions, and personally wish to thank the Labour Party for reaching out to me.

Need a Chat?

My Bounce Back Loan Helpline is open as always, every single day of the week, if you want a chat about anything associated with your BBL, including you being unable to repay it back or want to know what options are available.

It is me that you speak to and no one else, and its completely confidential. Having spoken to over 17,000 people so far, I have heard it all and I will be able to put your mind at rest on whatever it is that is worrying you.

Lets face it, talking about an unaffordable Bounce Back Loan is often something you cannot do with your friends or family, so please, do not let it eat away at you and push you over the edge, give me a call. I will get you sorted.

A big thank you as always to my website subscribers and those who have made a donation, thanks to you I am able to be there for the next person who calls me.

Subscribe to the Website Here > https://mrbounceback.com/membership-join/