It will soon be Christmas, not sure where this year went as it all seems to be a blur, in fact I am still convinced what with all that the crazy stuff that has been happening over the last 9 or so months that I am in a coma and all this madness is weird hallucination.

Anyway, I digress, Sunday is a quiet day on planet Bounce Back Loan as always, so I will rattle through some of the feedback, complaints, and problems I have received this past week.

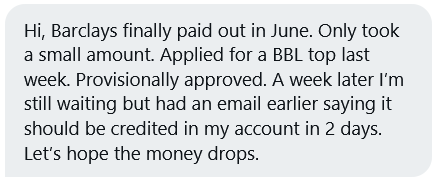

Barclays Top Up Delays

I have had plenty of people telling me Barclays are dragging their feet when it comes to paying out top-ups, this is a common complaint I receive:

Hopefully, it is simply a case that they are overwhelmed and will finally start paying those top-ups, as there are plenty of you out there hanging on waiting for them.

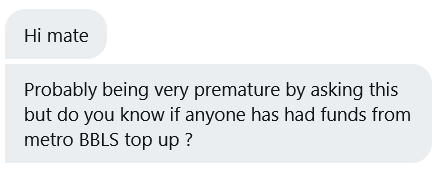

Metro Bank Top Up Payments

Glad that plenty of you finally had the chance to apply for a top up with Metro Bank last week, now of course is the wait for payments to start firing out:

As they started accepting top up application just before the weekend (now there’s a trick) I would expect you all to start getting paid from Monday onward. But pencil it a couple of extra days wait just to be on the safe side.

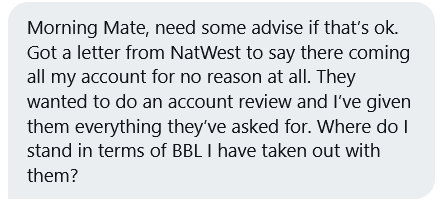

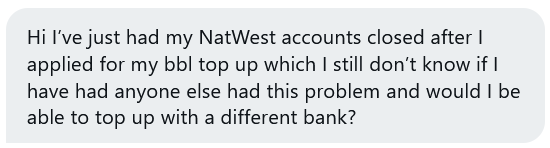

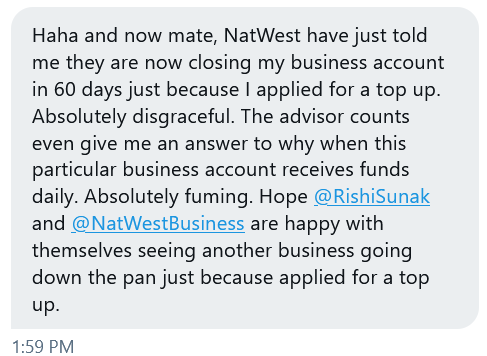

NatWest Continue to Close Accounts

I get, without fail at least one complaint a day about NatWest, sometimes many more than one, as that bank is now become infamous for closing peoples accounts with no reason given:

What is more puzzling, is that it is often those people who have been long time customers, applied for and have been given a Bounce Back Loan ages ago who suddenly find their custom is no longer welcome.

Even more puzzling is that NatWest tell them they have x number of days to withdraw their funds but make no attempt to ask them to set up a new direct debit mandate to pay back their Bounce Back Loans.

They have also been closing accounts when people apply for a top up on their original BBL. If you have your account closed by them before top ups become available, that also throws into the mix the problem of how you get your top up if you are eligible for one and need one, as the rules state you can only get a top-up from the original lender.

Obviously the rule maker that being the utterly useless British Business Bank haven’t thought of that scenario, in fact if they had paid attention to and made an effort to understand the myriad of problems people have faced with the BBL scheme they would have put something in place, but hey ho they haven’t, no surprise there.

Not a clue what NatWest are up to, however there is something very wrong with their system, much more so based on the fact many of those whose accounts have been closed have been customers for years, in some cases decades.

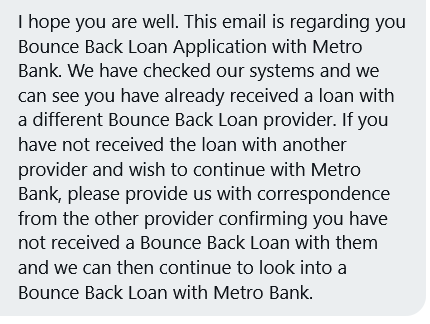

Imaginary Bounce Back Loan Still Causing Problems

This problem, if you excuse my French, boils my piss, the shared industry database that all lenders check to see if you have already been paid out a BBL still continues to cause problems. You may find yourself listed on that database if you are on a waiting list, have been on a waiting list for a BBL, have been paid out a BBL for a different business entity, or are even mistakenly listed upon it.

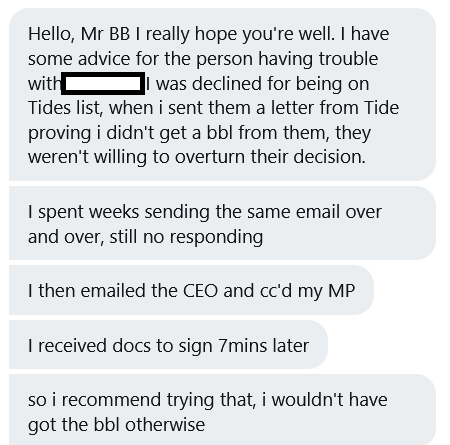

If you are you could find yourself unfairly declined a BBL, until you supply proof the database listing is wrong. The onus is then on you to jump through flaming hoops to get that listing corrected by the lender who added your details onto that database.

I am hoping this week to get a written explanation from the British Business Bank on that problem/nonsense.

To all MP’s reading this news update, I will show my arse on the Town Hall steps if you have not received complaints from your constituents about that ever recurring problem which needs addressing but hasn’t been for months and months and months.

In fact, the next time you meet up with your fellow MP’s (of any party) ask them about that problem and compare notes……

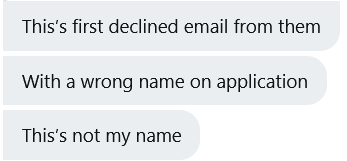

Dodgy Reasons for a Bounce Back Loan Decline

Each day I get a new complaint or one that I have seen a few times in the past, this one for example is a puzzler but not uncommon:

The DM’er sent me copies of letter/emails received from a bank letting them know their BBL application was declined, however it was addressed to someone else and not them.

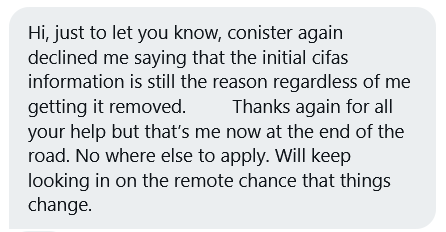

Incorrect Cifas Markers

If you have a Cifas marker listed again you then you will face all manner of problems getting a Bounce Back Loan, even if that maker is incorrect and you get it removed:

Seen no end of people having a false/incorrect marker and some have managed to go on to get a BBL when it has been removed but some have not been so lucky.

Unable to Open a Bank Account to Get a BBL

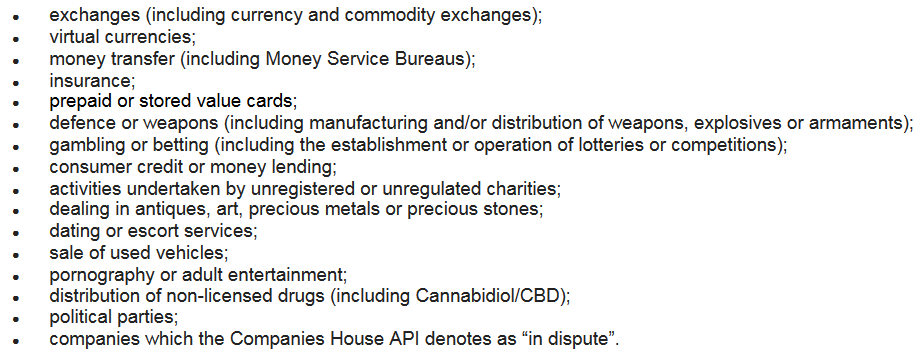

Finally, there is of course the ever-present problem of not being able to get an account with any accredited lender. As it currently stands, the last time I checked, on Starling Bank are accepting new customers. However, if you operate a business in any of the following marketplaces you cannot get an account with them.

Many lenders may also decline your Bounce Back Loan application if they do not “have an appetite” for the market sector you operate in, even if you already have an account with them.

You Get the Idea

The above are just a tiny sample of the complaints, feedback and problems I get sent daily, as always if you have met with a brick wall and are close to giving up, make sure you get in touch with your local MP, especially if you are being given the run around by a lender.

Whilst some MP’s are completely useless, a growing number of them are stepping up to the plate so to speak and are battling with bank CEO’s to get their constituents problems sorted out, and by getting them to jump in and help you it will save you a whole lot of heartaches and messing about trying to sort things out yourself.