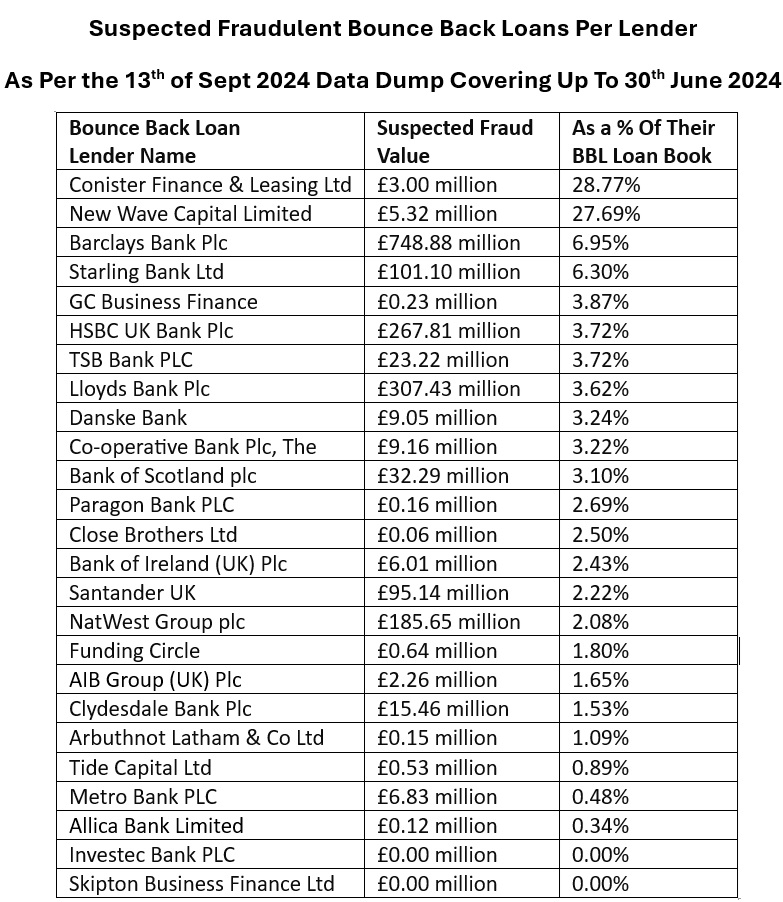

If you are wondering the value of Bounce Back Loans that each Lender suspects in their respective BBL loan book are dodgy, then look no further.

Below you will discover the respective amount that each Lender has logged as being suspected fraudulent BBLs.

Government Response/Comment

The figures presented are indicative levels of suspected fraud identified as at 30 June 2024.

These data points are reliant on lenders’ fraud tolerance thresholds.

A loan facility is marked as suspected fraud where a lender has determined that there are sufficient grounds to suspect that fraud may have occurred, and further investigation is warranted.

Lenders are continually adapting their processes for identifying and combatting fraud to counter new methods employed by bad actors.

As such, figures for suspected fraud will vary from quarter to quarter, both for individual lenders and the overall schemes.

It is important to note that ‘suspected fraud’ will not necessarily equate to actual fraud in the scheme and the marking of a loan as ‘suspected fraud’ within the Scheme Portal does not necessarily mean that there has been any proven wrongdoing on the part of the borrower.

Lenders are not law enforcement agencies or investigatory organisations.

Ultimately it is for law enforcement and the courts to determine if fraud has been committed.