If you have been here for a long time, you will know that I have uncovered a whole slew of problems with the Bounce Back Loan scheme over the years.

This news update will explain how negligence and a series of errors by BBL Lenders stopped a huge number of genuine business owners getting BBLs, but even worse, and hideously, led to many of them being wrongly labelled as fraudsters by Rishi Sunak of all people.

So let me begin.

First, watch the following video of Rishi Sunak standing up in the Chamber of the House of Commons proudly proclaiming he had put safeguards in place that had stopped over £2billion of BBL fraud.

As you will hear and see in the video, initially Rishi is being handed his arse on a plate by Meg Hillier who is Chair of the Public Accounts Committee, and then you will see his response.

If what he said was true, that would be an amazing achievement, but by no stretch of even his warped imagination is it true. Let me explain.

The Imaginary Bounce Back Loan Scandal

In his response to Meg, Rishi clearly states some £2billion in BBLs had been blocked by the steps he said he put in place, one of which was a database built by CIFAS which BBL Lenders had to update with the details of businesses that they had approved and paid out a Bounce Back Loan to.

Lenders who were approving BBL applications also had to check that database, just to see if anyone was pulling a fast one by trying to get more than one BBL for a single business.

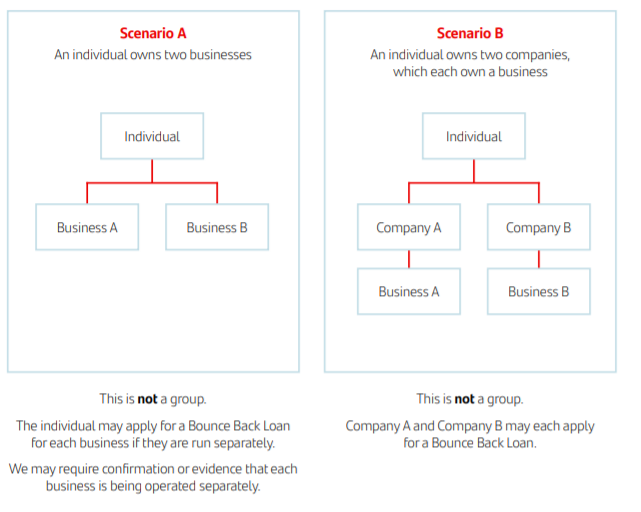

Keep in mind you could have as many BBLs as you had eligible businesses. But just one BBL to each business but only if those businesses were not part of a group of Companies which for example had a Holding Company at the top of the structure.

If that has baffled you here is a handy infographic that one BBL Lender has supplied.

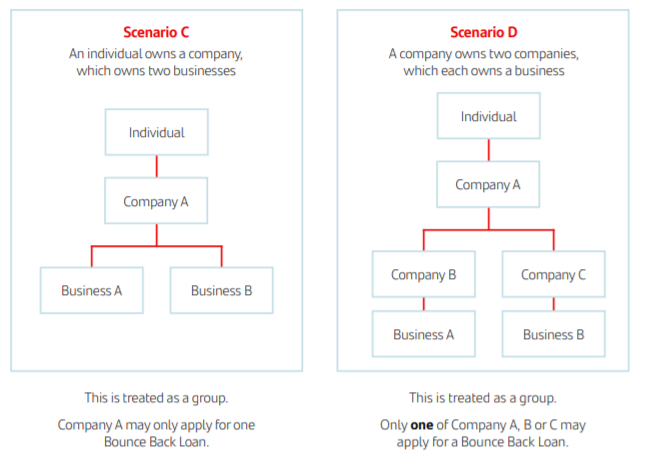

For reference, that numpty BBL Lender also had this in BIG on their website

When only certain applicants could estimate their turnover and they are now hounding those who did estimate but weren’t allowed to. But I digress.

That database went live several weeks after the launch of the BBL scheme, but it didn’t take long for all manner of mistakes and errors to start showing up.

You may recall some Lenders set up waiting lists for business owners to go on, in the hope they could get a BBL at a later date when they got to the top of that list, some BBL Lenders set up waiting lists when they didn’t even have enough money to lend out, so couldn’t even service customers on their waiting lists.

Some Lenders added the details of Borrowers who didn’t even draw down or get a Bounce Back Loan onto that dodgy database.

You may feel what is the big deal with such errors, well, those on that database who were obviously desperate to get a BBL to keep their businesses afloat, and many hadn’t been able to access Government grants during the pandemic and were unable to get a BBL, due to their details being on that database.

As all Lenders were told to check that database, and when they did they would see those customers as having a BBL from another Lender when they didn’t, or were showing on the database as having a BBL application in process, when all along some Lenders knew they didn’t have the funds to pay out to those customers on their waiting lists that they added onto that database.

Then to add insult to injury, Rishi minces into the House of Commons Chamber saying steps he had taken stopped 60,000 BBLs worth over £2billion going out of the banks doors to fraudsters, when I suspect and in fact know, much of it was not through fraud but through bank errors.

Read on to find out more.

Lets Look at Some of the Victims

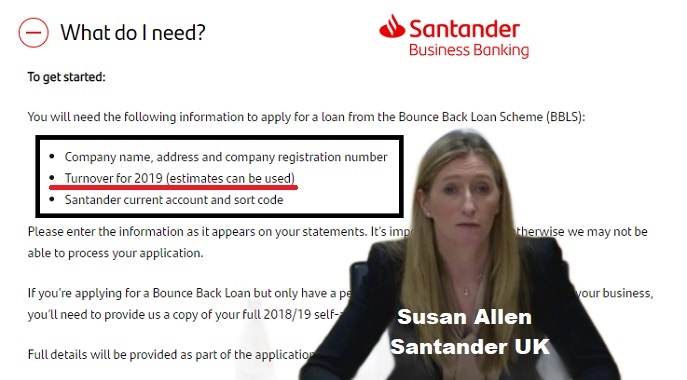

This is Starling Bank desperately trying to convince Barclays they had f*cked up, Barclays sadly were having none of it.

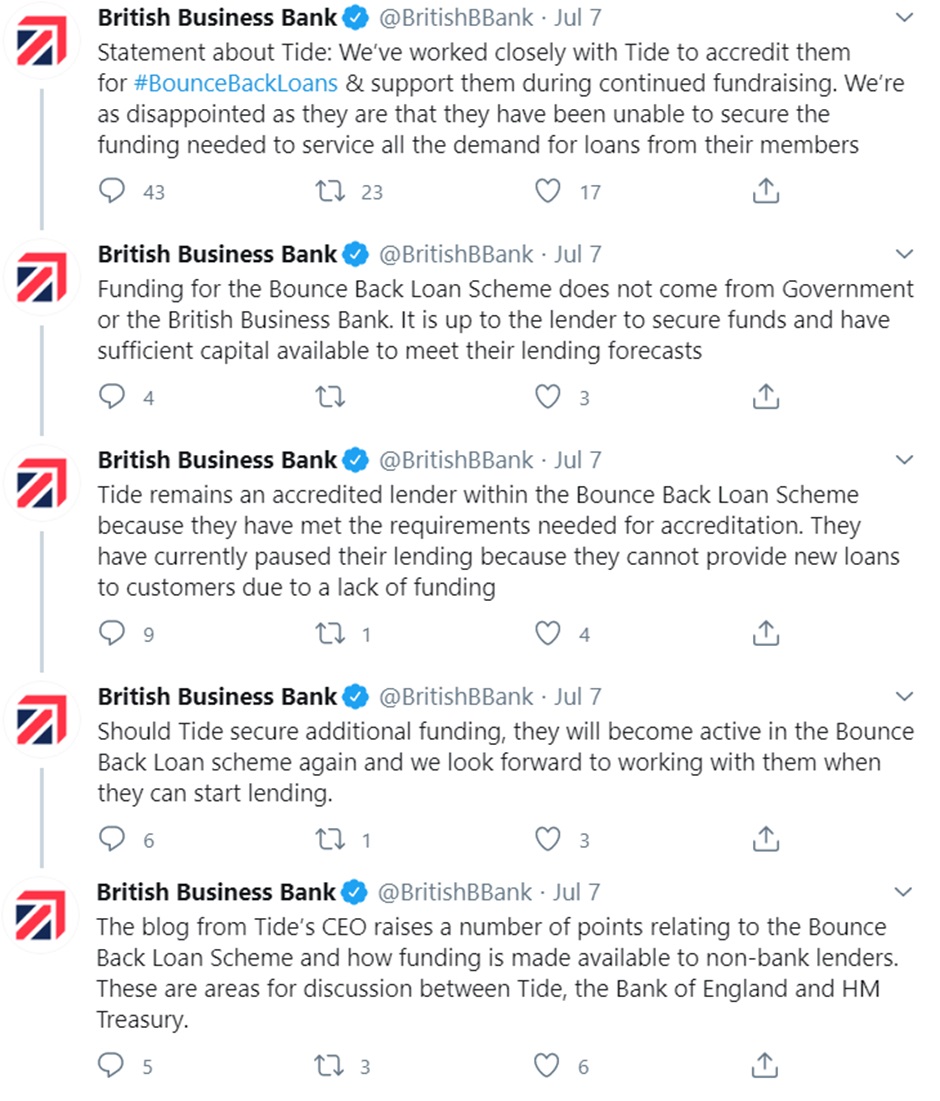

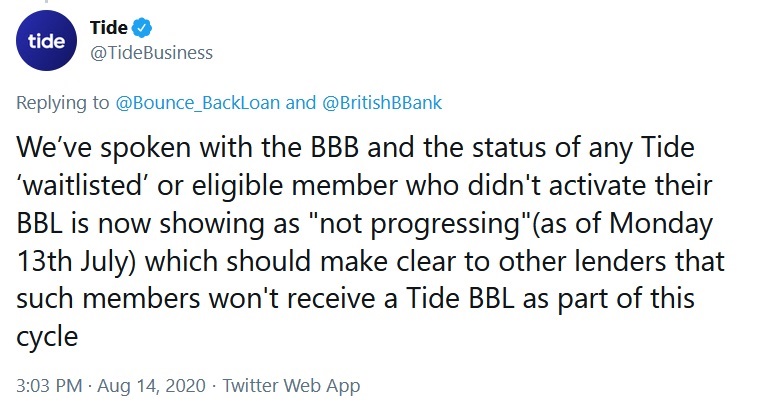

Lets move onto Tide, they added the names of those on their waiting list, who they must have known were never going to get a Bounce Back Loan as they had run out of money, onto the BBL database.

After kicking up a stink they promised to remove the details of those on their waiting list, which they didn’t do as quickly as they stated by the way.

How big was this problem, well if you look at what Tide were telling their customers, when they were on that waiting list and also on the database, the numbers were substantial.

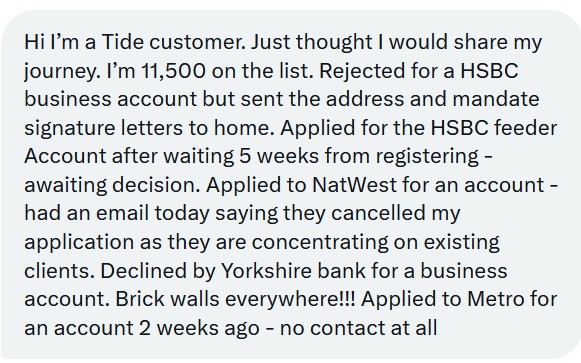

This business owner who told me their nightmare at tryng to get a BBL, was told they were 11,500th on the waiting list. I saw numbers much higher than that by the way.

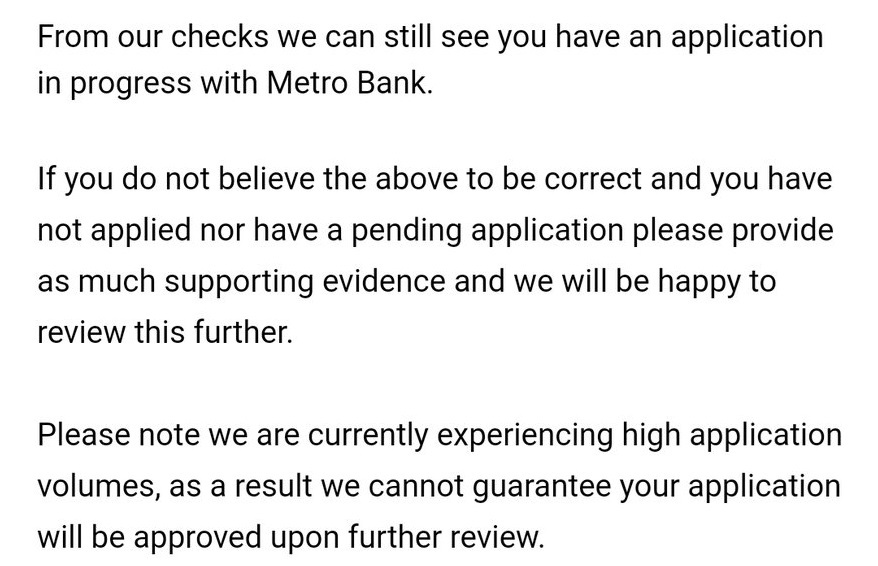

Here is another customer being told they has a BBL application in with Metro Bank, but that Metro wasn’t processing their application and due to errors it was trapped in a pending state for ages due to their system messing up and the bank werent responding.

Here is another one

No Help Available for Those Trapped

Those applying with any other BBL Lender for a Bounce Back Loan who had their details added erroneously/fraudulently onto that database by an unscrupulous BBL Lender, were then told they had to get a letter from that Lender some would accept an email, stating they did not get one and their application was not progressing.

Imagine phoning up a bank in the height of a global pandemic, and asking a call centre member of staff who could have been anywhere in the world, can they send you such a letter urgently. Most of the call centre staff at the time hadn’t a clue what those asking for wanted or how to go about getting it……

It Got Worse

This scandal was widespread and other Lenders were up to mischief which resulted in real, genuine business owners never getting a sniff of a Bounce Back Loan.

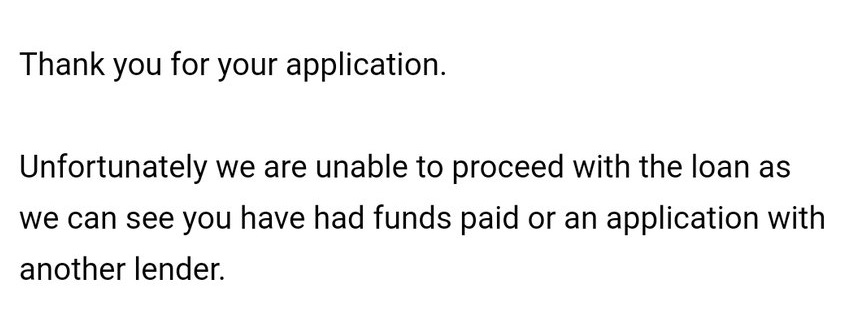

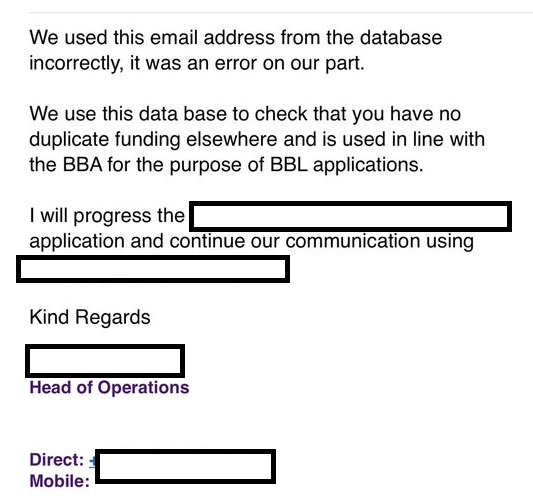

In fact, here is one Lender admitting they accessed the dodgy database and took the email address of a different company banking with Lloyds Bank, and erroneously used the other companies contact details they scraped off the database to contact the Director of that other Company turning down his application instead of the right one.

The list of these errors goes on and on and on, the above are just a few examples.

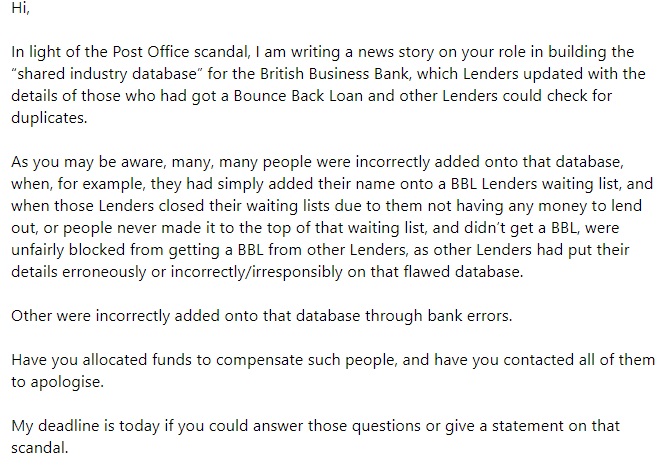

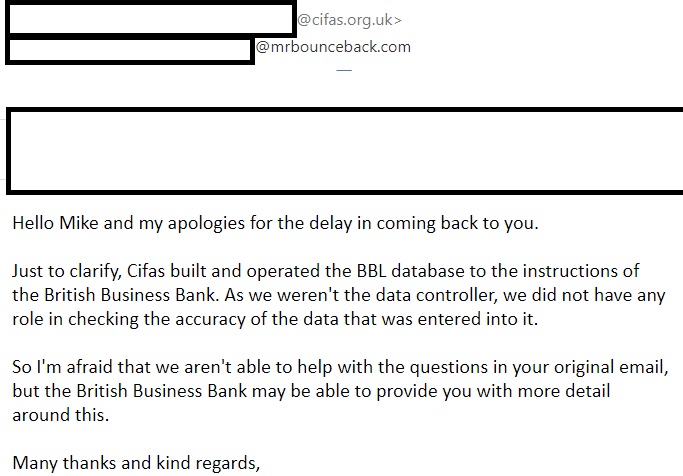

I asked CIFAS, if they would be offering compensation or even a simple heartfelt apology to those affected by this scandal, here is my email and their rely.

No One Will Take Responsibility

Let’s just hope you don’t get your collar felt for having an imaginary Bounce Back Loan in the future, if you were someone affected by this scandal!

It turned into a Post Office Horizon V.2. type scandal a long time ago.