A fair percentage of those who took out a Bounce Back Loan back in May, June and possibly beyond would have been pleased with Rishi Sunak announcing that he was amending the rules of the scheme to allow people to “top-up” their loans.

The reason for that change is obvious, it was due simply to the most prudent of business owners taking out a BBL for less than they could do, based on the fact they didn’t think the lockdown(s) and pandemic would be still rolling on many months later and now with no end in sight.

As it stands from Monday, those who took out less than 25% of their 2019 calendar year turnover out as a Bounce Back Loan can top up the difference, the maximum BBL being £50k based on a turnover of £200,000+

In layman’s terms, if your turnover for that year was £100,000 and you took out a BBL for £10,000 you can top it up by an additional £15,000 to round it up to £25,000 which is 25% of your £100,000 turnover.

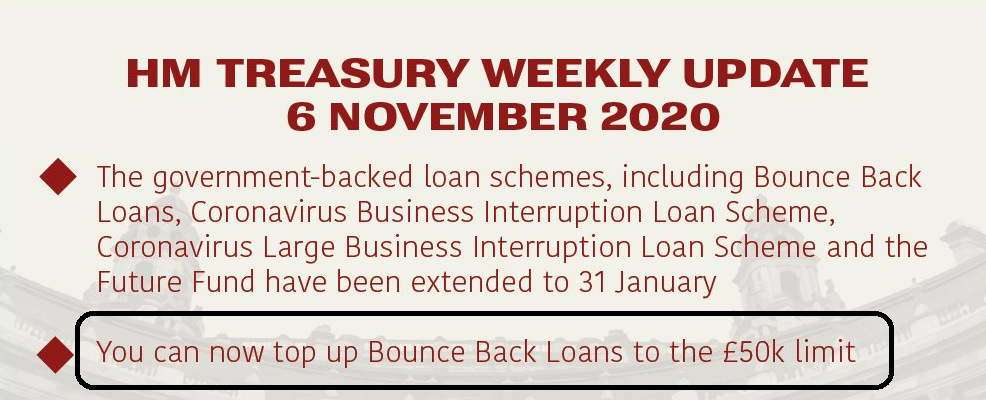

Confusion is however setting in when you have HM Treasury tweeting the following:

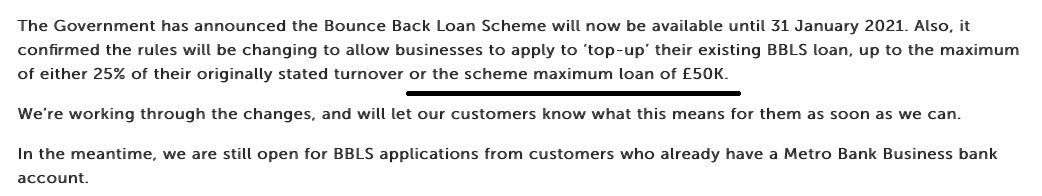

Then Metro Bank adding to that confusion tweeting the following:

However, other banks are stating you can only take out 25% of your 2019 turnover that you self-declared when you applied for your Bounce Back Loan up to a maximum of £50,000 as a loan , which seems to be how the top ups have been designed.

There will no doubt be many people now claiming they accidentally self-certified or estimated the wrong amount, with the aim of being able to get a higher top up, and there will also be those who now have an actual turnover figure that is higher than their estimate they self-certified some months ago.

How banks are going to handle that remains to be seen, and it should be Monday we will find out as next week is when top ups are being made available.

BUT, and this is a big but, keep in mind the lenders that are part of the scheme have fired out over 1.3 million Bounce Back Loans, and the chances of them all having a streamlined system set up and in place by Monday or some point next week are low and it is a big ask.

Therefore patience is going to be required, and until the British Business Bank make live the rules on their website and the top up systems are live no one will know how and when they will be able to get one, and there could and probably will be some delays with some lenders who haven’t been able to make a top up system live as quickly as other lenders.

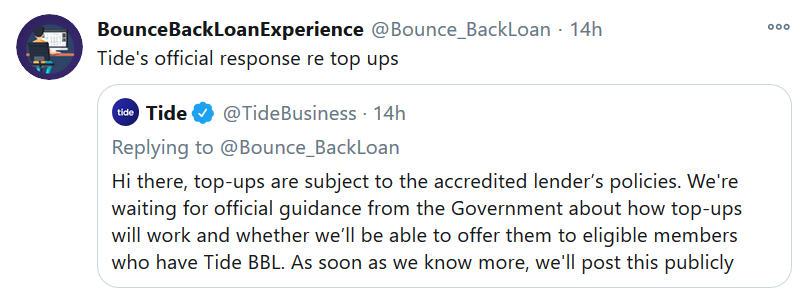

Tide and Conister who claim to have no more money to lend out could pose a problem, however Tide have assured me they are “working on it”.

As always though as with everything associated with the Bounce Back Loan scheme, top ups are an accident waiting to happen. My advice is hang on until next week and see how others are experiencing getting one.