I speak to many people involved in Bounce Back Loans, applicants, those who have received them, bank employees and bank bosses and even MP’s who have been inundated with complaints and pleas for help from those unable to get one and those experiencing ridiculous problems with their BBL applications and plenty of journalists too.

Currently, as you will be more than aware you can now apply for a Bounce Back Loan Top-Up, having badgered the powers that be for quite some time about allowing top-ups Rishi Sunak did see the logic in that idea and as such instructed accredited BBL lenders to offer that option.

Those lenders did of course then face what several of them told me was a nightmare scenario of making it possible, and fair play to those that did manage to update their systems rapidly to allow top-ups, but many are still trying to work out how they can do so.

However, as is always the case with anything to do with Bounce Baack Loans, allowing top-ups has caused a whole slew of problems, one that is stopping a lot of people from applying for one is that they are not able to change their originally entered turn-over figure.

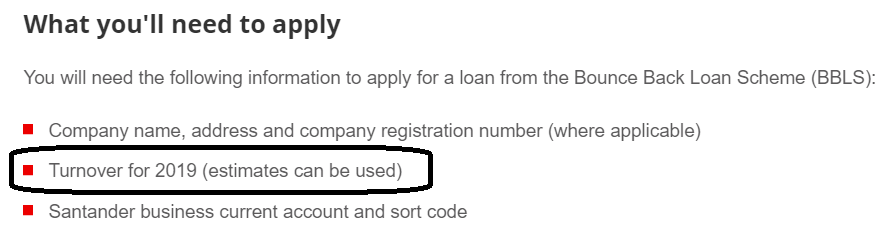

I have randomly picked out one bank to use as an example, that being Santander, look at the rules they have on their website for applying for a Bounce Back Loan:

As you can see in black and white, to initially apply for a Bounce Back Loan you can estimate your 2019 turnover, be aware that is for the calendar year not the tax year, so you would have to estimate your turnover from Jan 1st 2019 through to and including December 31st 2019 as per their rules.

However, as anyone with a brain will know an estimate can and often will change, take your car to a garage for a repair and the mechanic will often oo and arr suck on his or her teeth and then give you an estimate and often the final cost will be higher or even lower (rare for it to be the latter but hey ho) once the repair has been completed.

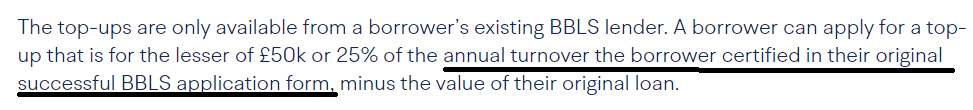

Now, the rules pertaining to a Bounce Back Loan Top-Up state the following:

As you can see you are obliged to go with the original turnover you entered when applying for a Bounce Back Loan, but no consideration is given whatsoever if that has changed.

Therefore, the British Business Bank who are the “rule-maker” for want of a better term are demanding that you go with what could now be an incorrect figure. That makes no sense whatsoever and needs changing and quickly.

All this talk of Bounce Back Loan fraud and how people are trying to cheat the system makes no sense when the rule-maker is telling you in no uncertain terms you have to stick to what could be an incorrect turn-over figure, they cannot seem to grasp the concept that an “estimate” could now be an “actual” turnover figure.

You try filing your self-assessment form as a sole trader for example with an estimated income figure and not an actual figure and see how you get on with HMRC.

Now the banks of course will be (and are) screaming that if you allow people to change their initial turnover figure people will just increase it to an amount over £200,000 and then try and blag the entire £50,000 they would then become entitled to for their BBL top up minus what they have already been paid out.

They do have a point of course, some would do that, but the rules could be changed and when applying of a top up you could for example be asked to enter your now actual 2019 turnover or how about just letting everyone eligible to a BBL just have access to the full £50,000 irrespective of their turnover, let’s face it, its helicopter money after all.

A recent poll I did run over on my Twitter account showed that over 50% of BBL applicants would not be able to take the top-up option as they had already claimed the full amount they were entitled to (based on their at the time entered turnover figure) at the time of them applying.

There have been constant calls for either the percentage of turnover to be increased above 25% or for an increase in the maximum limit of the BBL scheme, such as increasing it to £100,000. Whether that is a good or bad idea, well it would help possibly 100,000’s of small business owners to have cash on hand for the future.

Let’s face it back in May no one knew this pandemic would still be causing the problems it is causing.

However, Rishi has stated publicly that a new set of loan schemes will be rolled out in the New Year, but currently the one major problem that needs addressing is the turnover figure, but if he sees sense and does change it, another rule that will need changing too is the “only one top up allowed” rule, as those who have now applied for and been paid out a top-up if allowed to re-adjust their turnover figure will possibly be entitled to an increased amount and a second top-up.

That is of course going to have banks screaming again about additional work, but if that problem of estimated turnover had been properly addressed by the British Business Bank before top-ups went live it wouldn’t be an added problem for banks.

Do the decent thing Rishi, well I should say do the logical thing, that being allowing people to enter their now actual turnover. Everyone is watching.