When signing up to the Bounce Back Loan scheme, each lender entered into an agreement with HM Government, regarding how they would operate their scheme. However, here we are many months after the launch of that scheme, and many lenders are already failing to adhere to that agreement.

Let us look at some of those failings:

They all agreed to provide you with information you need in relation to your loan in a way which is clear, fair, and not misleading.

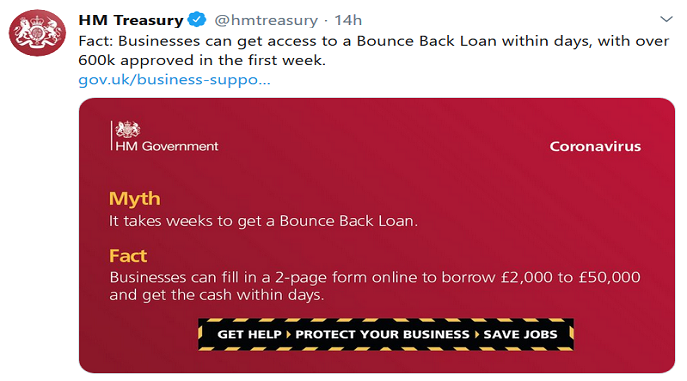

Look at the following “fact check” from HM Treasury, it does state very clearly that business can fill in a 2-page form and get the cash in days.

However, if you have attempted to get a Bounce Back Loan from several different lenders, you will notice they are now asking for a myriad of different documents over and above what the above states and are taking weeks and in some cases months to process your application and then, if you are lucky enough to be approved you could then face a long wait until you get paid.

Vulnerable Customers

Another agreement lenders signed up to was that if, after you have drawn down the loan, they identify or have reason to believe that you are vulnerable, they would consider (and where appropriate discuss further with you) what actions they can take to ensure your circumstances are accommodated.

Now, with the advent of top-ups and the fact many business owners are in the midst of lockdowns, along with not being able to trade and having their income levels decimated, many of those who want to get a top up are 100% vulnerable.

Their anxiety levels are through the roof right now, as many of them applied for a top-up three weeks ago today and have received nothing more than an initial email confirming their top up application had been submitted on the day they applied for a top-up.

I have yet to hear of one top-upper that has received a welfare phone call to put their minds at rest that their top up application is being processed and will soon be paid out. Lenders are simply ignoring them and when contacted the support staff simply fire out copy and paste answers and tell them to wait, with no regard of the added stress doing so has on that customer.

Piss Poor Leadership Will Lead to Many Business Failures

Sadly, many small business owners can see the writing on the wall. Many have taken out a Bounce Back Loan with the rightful aim of using the funds to help them bounce back, however with the continuous lockdowns and new “tiers” many business owners find themselves in a no-win situation.

Some have spent their loans on ensuring their businesses are fully “Covid-Secure”, only to discover that money has been wasted, for they are being told they must close their businesses down.

Some have been awarded Local Authority Grants, many have not been eligible, and even those who have received a grant know it will not cover their ongoing expenses.

A radical and urgent re-think of the Bounce Back Loan scheme is needed, if truth be known those loans need turning into tax free grants sooner rather than later to at least give small business owners some breathing space and allow them to concentrate on ways to save their businesses, rather than have the added worry of a six or ten year loan around their necks, that due to no fault of their own, and piss poor leadership by the Government and the negligence of many BBL lenders they are now unlikely to afford to repay.

Wake up and smell the coffee Boris and Rishi.