Some Bounce Back Loan Lender Bosses are raging at HSBC, for leaving their banks vulnerable to BBL abuse and fraud.

Behind the scenes many of them are also suspicious as to why some Conservative MPs, Ministers and even Conservative Members of the House of Lords have been given outrageous amounts of cash for speaking engagements and even jobs by HSBC.

In fact, some of them are suggesting those cash payments and jobs are a corrupt and disgusting attempt by HSBC to ensure they are not going to be slapped or punished for openly ignoring the security systems built in to the BBL scheme.

However, it is slowly but surely coming to light, that many other BBL Lenders took liberties with a security feature built into the BBL processing system, which left taxpayers on the hook for a small fortune.

Not Utilizing the BBL Security System

The Shared Industry Database was a simple yet affective way to stop anyone trying to blag more than one Bounce Back Loan for their business.

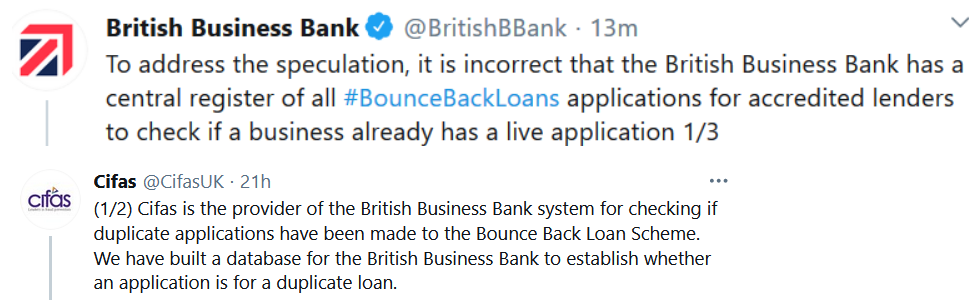

It was built by CIFAS for the British Business Bank, although at the time, and quite comically, the British Business Bank, bless them, denied any such thing, until I badgered both of them, and eventually CIFAS told me that despite the denials by the former, they had indeed built that database.

Anyway, that database was for BBL Lenders to enter the details of all businesses that had secured a BBL from them, and Lenders, just before paying out a BBL had to double check to see if the business about to get paid out their BBL had already got one from another Lender, and if they had then they were obviously not to pay out the BBL they were processing.

The BBL Scheme, as you know, launched on May the 4th 2020, and that database went live a few weeks later however, HSBC didn’t bother to make full use of that database until December, which was by the way, several weeks after they stopped accepting BBL applications.

Other Lenders started to make use of it rapidly, as you will hear in the video below, with Barclays beginning in mid-July, Lloyds the first week of August, Standander early-July, and NatWest using it within a couple of weeks of it going live.

So by not updating that database other Lenders wouldn’t know if HSBC had paid any company out a BBL, leaving them highly vulnerable to them paying one out to a Blagger trying to get a second BBL, and without checking it HSBC may have been firing out loads of BBLs to businesses that got a BBL from other Lenders.

It has now come to light many business owners did manage to blag second BBL due to that outrageous lack of security protocol by HSBC.

Here is Karl Reid from HSBC playing a perfect game of word soup regarding when his bank did or didn’t update the Shared Industry Database, even suggesting his bank did so in May, before that database had even been designed and launched!

Real Life Examples of Duplicate BBLs

As you will see below, some Lenders who were not at that meeting may have also been a bit slow implementing the checks, here are some recent related articles I have compiled on this topic.

HSBC Jobs and Cash Payments

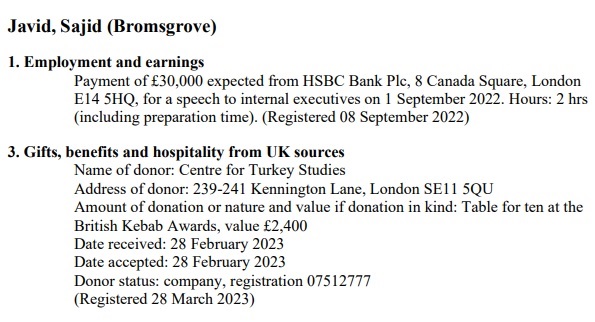

Here are some interesting cash payments made to Conservative MPs and Jobs other Conservatives have also bagged.

Lord Udny-Lister

You may remember Lord Udny-Lister, he said in his written statement to the Covid Inquiry, that he recalled the then-premier, who Udny-Lister had acted as Chief of Staff for, Boris Johnson, saying in September 2020 that he would rather “let the bodies pile high”.

Sajid Javid

*I am not saying there is any truth in the rumours about those payments being “bungs” to stop HSBC being slapped for wrongdoing. I am simply highlighting them, as I am sure those involved are more than happy for them to be…..

For reference, I was sat in that Committee Meeting, you may spot me in the video, so I know exactly what was being said behind the scenes both off and on camera, and by whom.