When it comes to the Bounce Back Loan scheme, some people working for certain lenders are famed for never being able to shut up and can often spout all manner of nonsense when being quizzed by others about the scheme.

I often refer to for example those running the British Business Bank as a gift that keeps on giving, but not in a nice way, for the way the ignore people pleading for help on Social Media, and refuse to give out any meaningful help, support and/or information to those who contact them, you can always rely on that supposed Bounce Back Loan rule maker to show just how inept they really are.

The same can also be said of some bank bosses too, and in my new series of videos I have been letting you know what some of those people in charge of certain banks or the business banking lending divisions of accredited Bounce Back Loan lenders have been saying when questioned by MP’s

Today I am going to be showing you what Susan Allen, CEO of Retail and Business Banking, Santander UK; Anne Boden, CEO, Starling Bank and David Oldfield, Chief Executive, Lloyds Commercial Banking has to say about a rather serious subject that being Bounce Back Loan fraud.

As you will see via the video below there are saying that exaggerating your turnover when you applied for a Bounce Back Loan is fraud.

Below is today’s video in which you will see and hear Susan Allen, Anne Boden and David Oldfield saying exaggerating your turnover when applying for a Bounce Back Loan is fraud.

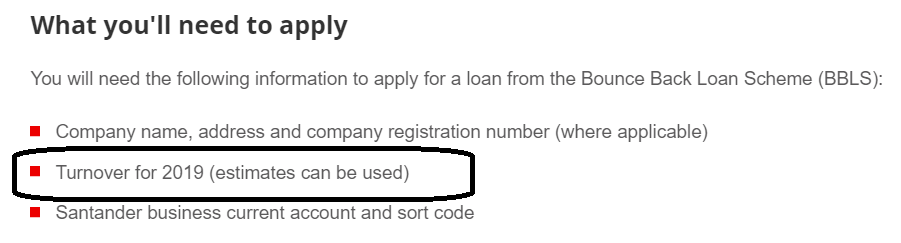

Now keep in mind many people, dependent when they set up their business were able to self-certify an estimated turnover when they applied for a Bounce Back Loan, that was and still is in the rules, and as anyone with half a brain knows an estimate is just that, it can by no stretch of even a warped mind be classed as an actual. Here is a screenshot of the eligibility requirements on Santander’s website as of today:

What makes their claim worse however, is that when Top Ups were announced I did question those in power as to whether people could alter their turnover to what may, for many people, now be an “actual turnover” if they now have that actual figure rather than the estimate they were told to use on their original application.

The response was NO, whatever turnover figure you put on the original application was the one to be used when applying for a top up.

Therefore, if your now “actual turnover” for example was less than your “estimated turnover” then to apply for any top up you were still entitled to apply for, you had to, by the rules set up by the British Business Bank, lie, and therefore by that weird and wonderful rule they forced you to commit, in the bank bosses’ terms, fraud.

They were obviously worried that people would increase their turnover to try and bag a bigger loan so imposed that rule, which by the way did stop many people who did end up with a higher actual turnover than an estimated one from getting a top up.

You couldn’t make it up.

Oh, and Anne is chatting to Rishi later today on one of his Plan for Jobs video chats things, so wonder what she is going to come out with today.

Here is the video: