I think its fair, from the emails sent out by Starling Bank on Friday to say that they are sounding the early warning bell, that a number of their customers who are on their waiting list are never going to be invited to apply for a Bounce Back Loan.

In fact, that is something they do state on their website, “there is no guarantee that everybody on the list will be invited to apply”. It appears a couple of different versions of Friday nights email have been sent out to customers, and the emails are below.

Starling Email One

Starling Email Two

The thing to remember is that Starling Bank have their own criteria for approving Bounce Back Loans which they have tagged onto the basic and very light touch set of criteria that the British Business Bank have designed the loans around.

When Starling Bank initially started processing Bounce Back Loans they did of course mass decline around 3000 people late one Friday night, having first told both the British Business Bank and the Treasury that they were going to decline them, what is surprising now is that I haven’t heard of anyone declined recently that has been invited to apply for a Bounce Back Loan from Starling Bank.

Anne Boden the CEO of Starling Bank has said previously only those customers that fit the banks criteria will get a loan and they will be declining people that they deem not suitable for a BBL, you can read that in her own words HERE.

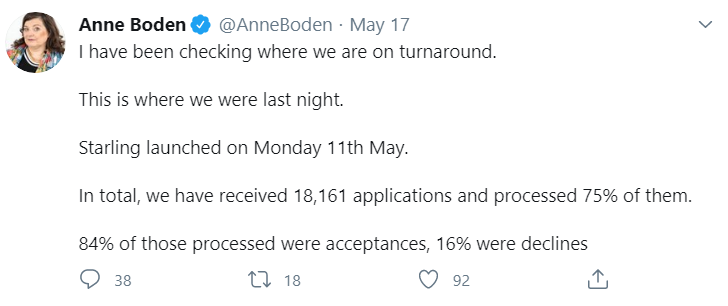

Also, regarding declines, here is a tweet from Anne herself way back in May:

Look at the decline figures and ask yourself why so many people were declined back then, but no one is coming forward now saying they have been declined. Are they “cherry picking” from the waiting list, read the emails again and form your own opinion.

If you are on their waiting list do as they suggest and have some other options active and available for getting a BBL, you could be on their list until the last day of the scheme, which currently is November the 4th, and may never get invited.

Tides Official Response to Their Problematic Waiting List

I have been banging on about the Tide waiting list for quite some time. In a nutshell if you are on that waiting list, and keep in mind they have no money to lend out, then you are likely to find that when you apply with another lender for a BBL you may initially get approved, but during the final checks, those being inter-bank checks some lenders will then decline you for being on that waiting list.

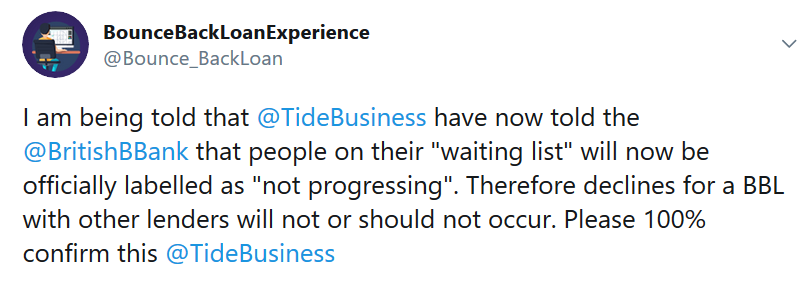

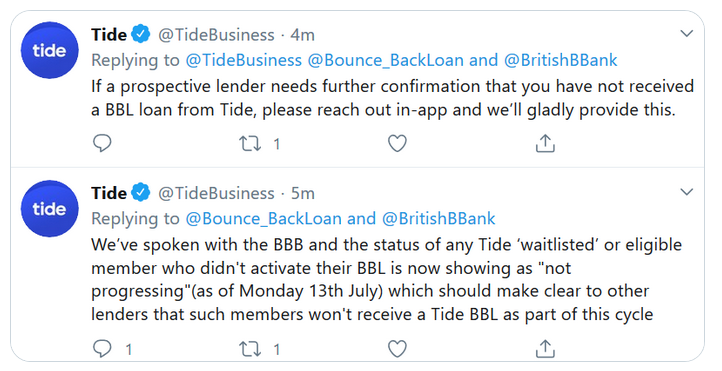

The reason for approval but then a decline is that other lenders see your name upon that waiting list as a BBL in progress, not simply being on a waiting list. Below is a tweet I sent to Tide and their official response about this situation:

Be aware though that despite what they are saying, people after July the 13th applying with other banks have still been declined for being on that waiting list.

If you find for example you get approved by, but then are declined by Clydesdale Bank, Yorkshire Bank or Metro Bank, the chances are during the inter-bank checks they have spotted your name on the Tide waiting list, you will need to ask Tide for proof you have not got a BBL from them and supply that proof the respective bank to get the decline overturned.

This is madness but sadly it is something you need to do, as for who is to blame, well the British Business Bank do have Tide listed as an accredited lender on their website, even though they have no money to lend out, Tide have, or state they have told the British Business Bank about the problem with their waiting list and the problem it causes for other lenders, but other lenders appear not to have been told hence them still declining people solely for people being on the Tide waiting list.

If you are on their list and are applying with other lenders for a BB, which you should be doing if you want one, I would urge you to get off that list pronto, imagine how you would feel for example if you finally manage to open an account with lets say Clydesdale Bank, go on to apply for a BBL, get the good news you have been approved then get another message from them saying, sorry we have had to decline you for being on Tide’s waiting list.

Been Declined a Bank Account or BBL?

Please read below for some reasons as to why you may be declined a bank account and/or a Bounce Back Loan with some lenders.

Many people who are declined tend to fear it is their credit rating/score that is the cause of a decline, and whilst that can and may play a part obviously, there can be a whole host of other reasons, some of which can be sorted out, and when the latter is the case you may find it much easier to open a bank account and/or obtain a Bounce Back Loan.

Some Lenders can and will and are in within their rights to decline anyone for an account and/or BBL based on their own criteria in additional to that laid down by the British Business Bank.

With that in mind, if you have checked all of the following and/or have been declined by one lender then you are also within your rights, and encouraged to apply to any other lender that is part of the Bounce Back Loan scheme.

Potential reasons not relating to credit score/rating

SIC Code – Not matching on companies house vs what you put in your application.

SIC Code – considered a reputational risk – you would be surprised how many business types fall into this category.

Directors/owners name(s) not matching companies house and/or

Voters roll e.g. Chris vs Christopher, as your middle name.

Business address not matching, has your accountant used their address to register? What is your correspondence address at companies house?

Business name not matching e.g. Ltd v limited

Recent changes of directorship and/or ownership – red flag at the moment due to BBL fraud

Markers registered against the company or director

Previous financial relationship with the bank or one its subsidiaries that did not end well

Compensation

Many Bounce Back Loan applicants that have been through hell and still are experiencing problems have been offered compensation from a bank ranging from £50 up to £2500 for the more complicated problems.

It is your choice as to whether you accept any offer of compensation and the amount you accept too.

Bank and Lender Updates

Be aware things can change in an instant at any bank and as such I will now give you an overview of how things are going with each bank, and let you know how and where to contact if you want to try and chase up your Bounce Back Loan application and find out where things stand with each bank.

Each bank will have their own criteria for opening accounts, and some lenders also have their own set of rules regarding who they will allow to open an account and/or apply for a Bounce Back Loan.

HSBC

The fastest way to get a business account with HSBC is to apply via their new HSBC Kinetic App

Link to the HSBC BBL section of their Website

Useful Email Addresses for Contacting HSBC:

New: bbls.complaints@hsbc.com

feeder.account.team@hsbc.com

Ian.Stuart@hsbc.com

Sally.A.Williams@hsbc.com

commercial.executive.complaints@hsbc.co.uk

amandamurphy@hsbc.com

marissa.k.adams@hsbc.com

julienapier@hsbc.com

feeder.account.team@hsbc.com

oliver.james.exley@hsbc.com

Lloyds

Lloyds continue to do what they do best, process, and pay out BBL applicants quickly and with no fuss or hassle.

Be aware that if you hold a Bank of Scotland or a Halifax or Lloyds personal bank account you can use the Onboarding Portal to get a Lloyds Business Account and then can apply for a Bounce Back Loan.

Be aware though the dates listed on the website, as you will have had to have a personal bank account in operation before those dates to be able to onboard with Lloyds, if you have opened an account after the dates you will not be able to use that onboarding system.

Halifax, Bank of Scotland, and Lloyds Onboarding Link

Lloyds CEO Email Address

vim.maru@lloydsbanking.com

Metro Bank

Metro Bank have now launched their Bounce Back Loan scheme, which is a sight to behold.

Due to the speed at which applicants are processed, and the rapid pay-outs too, many people wish they had an account with them, as their Bounce Back Loan journey would be an easy one for sure.

Metro Bank will let you register an interest in opening an account with them online and they will then make contact with you to arrange an appointment in one of their banks or ”stores” as they like to call them.

Applicants simply join an online queue and when it is their turn to apply for a Bounce Back Loan (which can be after a few hours), they then fill in the application form and once done they are then either approved on the spot, declined or told whether any additional information is required.

The feedback from many people is that Metro Bank are the game changer, as unlike most other banks people get to know at the end of their application their fate, without having to wait for days or weeks to discover what is going on with their application, as has been the case with other banks.

Visit the Metro Bank BBL Section of their Website

Email the CEO of Metro Bank Dan.frumkin@metrobank.plc.uk

Tide

Tide have run out of money to lend and are desperately scrambling around trying to raise more to increase the number of applications they can process, as such you can expect a huge delays before any application you have put in will be processed.

Visit the Tide BBL Section of their Website

Co-Op Bank

To be fair to the Co-Op not many people have been complaining about them, I have had a few here and there and some have been sorted out but every now and then I get someone appearing and asking for help.

Co-Op Bank CEO Email Address

chris.davis@co-operativebank.co.uk

Visit the Co-Op Bank BBL section of their Website

Yorkshire Bank and Clydesdale Bank

I get the odd complaint about both Yorkshire Bank and Clydesdale and it is always worth checking out their respective BBL sections of their websites for updates, seen reports of those banks taking applications for new bank accounts by the way, but check that out as it can change at any time.

Visit the Yorkshire Bank BBL section of their Website

Visit the Clydesdale Bank BBL section of their Website

Yorkshire Bank CEO Email Address

david.duffy@cybg.com

Clydesdale Bank CEO Email Address

david.duffy@cybg.com

Barclays

I am still getting all manner of weird and wonderful complaints about Barclays, it does appear though that many applicants now fly through their Bounce Back Loan system, but many are still experiencing problems with applying, getting paid and contacting the bank.

Visit the Barclays Bank BBL section of their Website

Barclays CEO Email Address

Jes.staley@barclays.com

NatWest and RBS

The usual complaints about NatWest and RBS, including poor communication, problems applying for a BBL and even people being declined. Once again you need to start haranguing the right people to have any chance of your problems being resolved.

They have been paying many applicants out obviously, so if you do manage to have a hassle free experience then you should get paid out fairly quickly, even if it is not in the time scale you had hoped for.

Be aware that you may apply, not hear anything and then out of the blue get an email saying they are so busy your application is being dumped and not looked at.

Visit the NatWest BBL section of their Website

Visit the RBS BBL section of their Website

NatWest / RBS CEO Email Address

Simon.Separghan@rbs.co.uk

Santander

Much like some of the above banks Santander have attracted plenty of complaints, but in all fairness many followers, and many long-time ones too have found emailing their CEO does get a response and their claims processed quickly. They too have also been dumping applicants via a mass cull type of email so be warned.

Visit the Santander BBL section of their Website

Santander CEO Email Address

nathan.bostock@santander.co.uk

Starling Bank

Starling Bank operate a waiting list type of system, however, be aware they have additional criteria of their own as to whom they will supply a Bounce Back Loan to. Therefore, there are no guarantees you will get a loan from them. They have declined many thousands of applicants.

Visit the Starling Bank BBL section of their Website

Skipton Building Society

Skipton Building operate a different business model than most mainstream lenders so you will need to check their website to find out more about what they have on offer to applicants.

Visit the Skipton Building Society BBL section of their Website

TSB

You will be asked to sign away your rights to be able to apply for a Bounce Back Loan if you try to open a new account with TSB. As such do not waste your time trying to get such an account with them if your intention is to apply for a TSB Bounce Back Loan.

Visit the TSB BBL section of their Website

TSB CEO Email Address

debbie.crosbie@tsb.co.uk

Other Bounce Back Loan Lenders

The following are other Bounce Back Loan Lenders, be aware I receive very few if any complaints about any of the following.

Visit the AIB BBL section of their Website

Visit the Bank of Ireland BBL section of their Website

Visit the Danske Bank BBL section of their Website

Visit the Ulster Bank BBL section of their Website