As word is now getting out that there is a legal route to take to challenge Bounce Back Loans, that has sparked a lot of debate on that very topic.

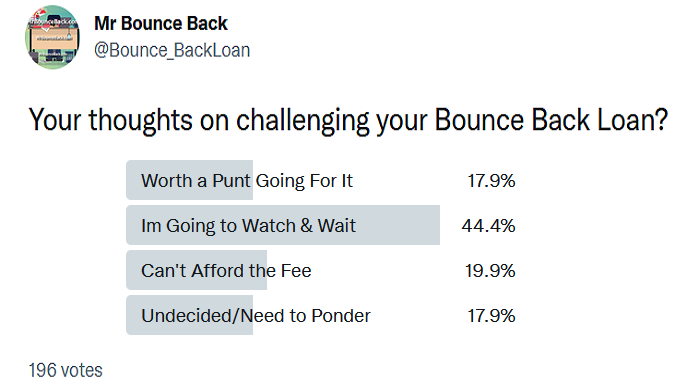

Knowing what others are considering doing is important, and therefore I am happy to enlighten you on that. I started a poll on Twitter on Sunday the 31st of October, and whilst my ramblings often mean such polls get buried on my timeline, and many people do not see them, I have so far gained a good response.

As you can see below, at the time of me putting together this update, the results are interesting, be aware the poll is still live so the results for each option can and may change, having discussed the poll with others before making it live, and knowing some who voted may not even have a BBL or may just want to give an incorrect outcome, the results do fall in line with opinions of others and what they expected to see, you may probably be of the same mind too:

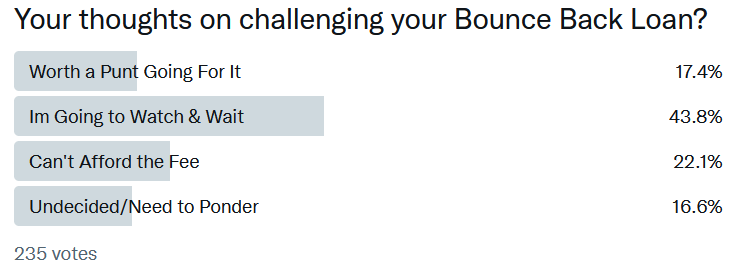

Update:

Worth a Punt Going for It – Those with multiple BBLs for different businesses appear to be the most likely to take a punt with one of their loans using the Back British Business service, that is what they are telling me. However, feedback from Sole Traders does appear to indicate a fair number of them are happy to take that route too.

I have also had word from some SMEs they are going ahead with the service as they have been messed about with their BBL, and the tailored/personal service offered will help them address some of the additional problems they have endured as it will give them peace of mind those problems or any worries they have about taking out their BBL will be addressed so they know that they have done no wrong.

I’m Going to Wait and See – Got to say the results on this option are more or less what I expected to see at this stage. £550+VAT is a lot of money for many people, much more so taking into account the way businesses have taken a financial hit since the pandemic began. I am with you on that type of approach, much more so if funds are tight.

If others start reporting good outcomes, then you will be more inclined to give it a whirl, I will report on things as feedback comes in. Good, Bad or Ugly.

Can’t Afford the Fee – The fact that many people simply cannot afford to pay the fee associated with the Back British Business service, indicates as clear and night follows day the BBL scheme has failed them.

If everyone had “Bounced Back” using their loans:

- most wouldn’t be considering legally challenging them as they would be bringing in the cash, their turnover and possibly profits would have been increased and they would be grateful they had got a loan and singing Rishi’s praises, instead of having to use that loan to survive for way longer than expected.

- even those who by their personal nature were always going to be “won’t payers” and had wanted to challenge their loan either way, they would be able to afford to do so if the BBL scheme had served its purpose/aims/goals.

Keep in mind all estimates by banks, Government and even the National Audit Office indicate a huge number of people, even after those organisations had reviewed their original estimates, are going to default. Anyone with common-sense in charge of the BBL scheme would have addressed that point long ago without pretending to help with PAYG options that land borrowers with even more interest to pay.

Undecided/Need to Ponder – The results of this option on the poll are revealing, but let’s face it, throwing £550+VAT at an untested legal route means those considering doing so need to be 100% confident it is a risk worth taking.

No matter which group you fall into I will be there on your journey, for there are challenging times ahead for everyone, trying to run a business knowing, through no fault of your own you have had to take out a BBL just to survive from mid-2020 is stressful.

It is worth noting that NatWest revealed just the other day some 7% of those who took out a BBL have repaid their loans in full. I know many people took those loans out as a safety net, just in case, but some people repaid their loans as they had been worried about stories of the police kicking in front doors, and they repaid due to them being confused about the rules and fearing they may had fallen foul of them.

Oh, and NatWest did snatch back a lot of BBLs too, like many other banks have done, so I am unsure if they have included the ones that they did manage to snatch back in that 7%.

Let us see how it progresses, interesting times ahead. Keep your feedback and experiences coming in, so I can continue to put it all out there, that way you will be helping others who may be on the fence regarding challenging their BBLs, if you have chosen to take that route.