The Bounce Back Loan scheme will come to a close on March the 31st 2021, and as such that will be the day when the curtain finally comes down on that Government Guaranteed Loan Scheme.

However, it is blatantly obvious that many SME’s are going to struggle to pay back those loans, having been forced to suspend their business operation time and time again due to repeated lockdowns.

Even with the Pay As Your Grow options available, many will still face all manner of problems being able to repay those loans when they are due, much more so those who took out a loan back in May of last year as repayments are due in the next few months.

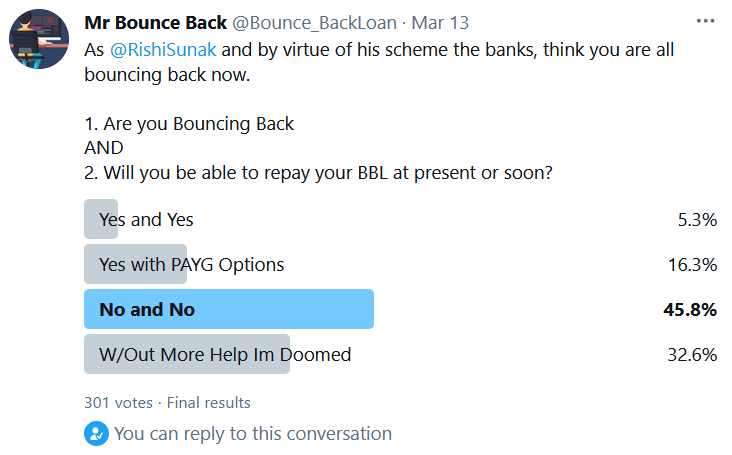

A recent quick poll I ran on Twitter shows just what percentage of people with a Bounce Back Loan are faced with the options given in that poll, which does make for grim reading:

He has made no effort to ensure those who still have not got a Bounce Back Loan and qualify can get one, he has just left us to rot.

Agreed went to metro today and failed a credit check so cannot get a business account. Pathetic seeing as bbls is not credit checked.

To roll out a scheme of this scale in such a short space of time was always going to cause headaches; the balancing act between making the scheme accessible whilst preventing mass fraud has left many legitimate businesses unable to obtain finance. As the scheme matured, banks have been more demanding on determining eligibility. Is this fair to those who have missed out through no fault of their own, absolutely not. Does it help protect tax payers money end up in the wrong hands, yes. Depending on your personal outcome/agenda, it is very easy to bash Rishi and the banks after all the latter relied on said tax payers money to survive during the last financial crisis. I haven’t heard many coherent alternatives.

Common sense and in my current position also in order to service a loan with interest profits need to be higher. How can this be with the government follow up of imposing lockdown for most the year. It is impossible for most businesses to even begin to pay this loan back.

What if you can’t make payments? Want to your best but not in situation to be able to make any payments. Clear guidance and support is needed.

I have a business account with Clydesdale or virgin money as they’re now called. Refused to process my BBL application citing lack of proof My Ltd company was trading, they’ve asked me me to provide bank statements and invoices even thought we are an event managent company one the worst sector affected by Covid-19. I forwarded a VAT certificate clearly showing we were trading prior to 1 March 2020, to no avail, terrible. What happened to self certification under the BBL rules?

Think the government need to turn these loans into grants, for businesses that did get 1, they were designed for short term relief however a year later businesses have suffered more . Shouldn’t be offered debt but the same financial support in the form of grants

As a sole trader banking with Barclays since summer 2019, i was told 100% i was eligible by Barclays themselves. Issue… despite being with them they refuse to open a business account, and claim the skeleton is exactly the same. They can’t pay any business account outside barclays, nor can they pay personal due to british business bank rules. We are financially ruined with no hope of recovery, almost homeless and still zero help in any way shape or form.

Hi all!

I`m a migrant self employed over 10 years ago. From 1 side i understand why so many person can`t get the loan (fraud). Other side don`t understand why government let them run with that money and refuse or make impossible to get for business who pay tax, really run the business. Like me my bank refuse, because they say need business bank account with them, but they not offer to no1. Where i have my business bank account that bank don`t offer bbl at all. I don`t see the way out from this situation, lose my rent soon, difficult to buy food and the bills….