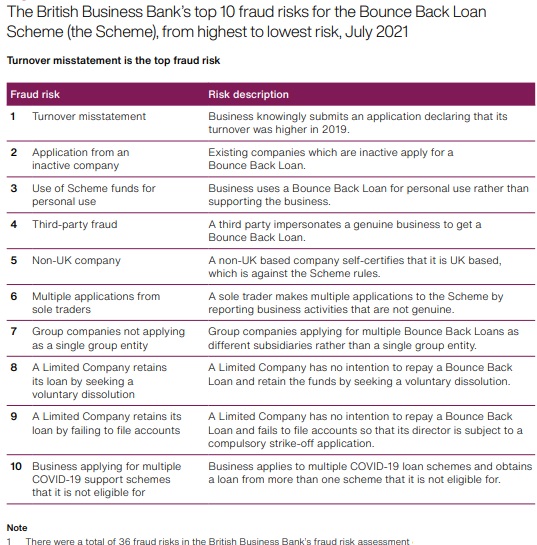

The British Business Bank, having expressed their concern of the fraud risks associated with launching the Bounce Back Loan scheme in their Reservation Notice to Ministers days before the scheme went live, were of course ultimately ordered by way of a Ministerial Directive to make the scheme live back on May the 4th 2020.

They identified 36 potential fraud risks with the BBL scheme, and as you are about to discover they were correct in their predications.

In the coming days, I will be looking at the top 10 fraud risks to the BBL scheme that the British Business Bank predicated, and I will be giving you details of just a few of the many Company Directors, Sole Traders and Individuals who have been found to have committed wrongdoing in each of those fraud risk categories and giving you an insight into the punishments bestowed upon them for their actions.

In this article I will be looking at the subject of “Turnover Misstatement” or in layman’s terms, the over-egging of turnover to get a Bounce Back Loan.

Turnover Misstatement

A Business knowingly submits an application declaring that its turnover was higher in 2019. The Insolvency Service love such cases, as they are very easy to prove and once they have the data it is wrongdoing that is impossible to deny.

Having said that, if you are thinking about taking the Liquidation route, I have seen cases whereby those who did make a mistake with their turnover figures or who were not in the right frame of mind when applying being forgiven, and, in certain circumstances, a proposed Director Disqualification can be cancelled.

Feel free to give me a call if this is something that may be worrying you.

Recent Cases Involving Turnover Misstatement

Here are some very recent cases related to Turnover Misstatement uncovered, and the punishments handed out to the named Company Directors.

| Director/Sole Trader Name | Punishment | Details of Case |

| Patience Yakwange Kaya – Joepar Ltd | 11 Year Disqualification | CLICK HERE |

| Adrian Vasile Faur – Ady Fast Electrical Ltd | 11 Year Disqualification | CLICK HERE |

| Ruben Corneliu Pascal – New Era Pi Limited | 10 Year Disqualification | CLICK HERE |

| Lukasz Wasilewski – Mat Trans Limited | 11 Year Disqualification | CLICK HERE |

| Rachel Harris – My Business Space Ltd | 10 Year Disqualification | CLICK HERE |

| James Alexander – Ebstree Solutions Ltd | 10 Year Disqualification | CLICK HERE |

| James Junior Hamilton – Hamilton Apartments Ltd | 11 Year Disqualification | CLICK HERE |

Featured Turnover Misstatement Article

You will find 1500+ wayward Bounce Back Loans and the punishments handed out to Company Directors, Sole Traders, and Individuals in my Bounce Back Loan Abuser Tracker section of the website.

An Insolvency Service Spokesperson Said:

Being the pain in the arse I am, I asked the Insolvency Service about proposed Director Disqualifications related to BBL wrongdoing, and if they could be mitigated against, are they motivated on ethnicity and a whole host of other topics, here is their reply:

“In tackling financial wrongdoing, the Insolvency Service considers each case on it individual merits. Sanctions such as director disqualification or bankruptcy restriction orders are based solely upon the available evidence and consideration of public interest. Factors such as nationality and ethnicity, categorically have no bearing on operational decision making.”

Based on that comment they gave directly to myself, you really should put up a spirited defence of any wrongdoing they are proposing you are punished for. Give me a bell if you want a chat, for there are some utterly useless Solicitors out there and some extremely good ones who can deal with such matters, and it is the latter you should be aware of and speaking to.