I continue to take a great number of phone calls to my BBL helpline, and one thing I have noticed is that a large percentage of those who have called were either vulnerable when they took out a Bounce Back Loan, and/or are vulnerable right now.

The Government and the Financial Conduct Authority have told all Bounce Back Loan Lenders that they must treat people with a Bounce Back Loan fairly when they get into difficulties repaying those loans, and much more so if the borrower is identified as being vulnerable.

I am pleased to let you know most of those Lenders are going above and beyond to help people with a BBL and can write off a BBL and stop chasing you for repayment if you are vulnerable.

Therefore if you have BBL arrears or your Lender has defaulted your BBL and sent it over to their nominated debt collector, it is important you alert them of anything that makes you a vulnerable borrower, as that will ensure you are treated sympathetically and could, very quickly result in the BBL being written off and all further recovery action stopped in its tracks there and then.

For reference I have also seen BBLs being written off along with any proposed punishment stopped in cases were someone broke the rules of the BBL scheme when applying for a BBL or once they received their BBL, once is becomes apparent they were vulnerable.

Vulnerable BBL Borrowers – Government Aware

In this section I want to look at what has been said with reference to vulnerable borrowers.

For as I have said repeatedly:

Never, ever forget, it was the Government who told you to close/suspend your business, then filled your heads with stories of how going outside could lead to your death due to the “pandemic” then as you sat there with your business devastated, and in most cases, in a very, very vulnerable state, dangled a huge £50k loan before your eyes, with no credit checks and no affordability checks.

Let me now reveal what has been said about vulnerable borrowers related to the BBL scheme by Government and relevant Departments:

British Business Bank

Before the BBL Scheme was launched the British Business Bank warned the Government of the following and said they wouldn’t launch the scheme unless ordered to do so by the Secretary of State, which is what happened:

Read Those Letters Here >https://mrbounceback.com/exchange-of-letters-between-the-british-business-bank-and-the-government/

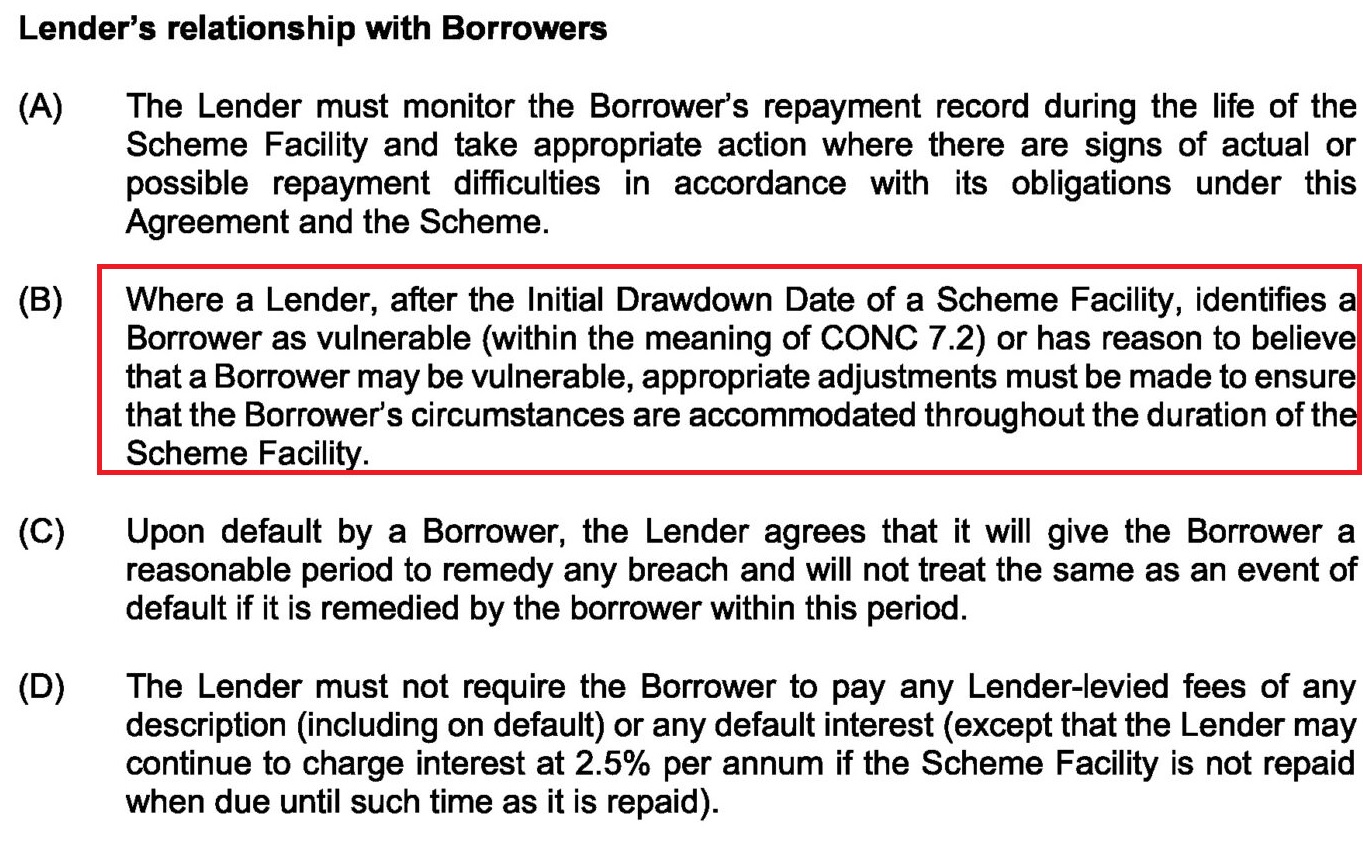

Lender and Government Agreement

View the Agreement > https://mrbounceback.com/view-a-copy-of-the-bounce-back-loan-guarantee-agreement/

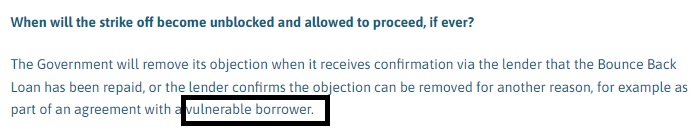

Department of Trade

This is what the Department of Trade said when I asked about the limbo land people find themselves stuck in when trying to legally dissolve a Company with a BBL owing:

Read More > https://mrbounceback.com/the-government-have-just-been-in-touch-with-me/

Insolvency Service / Minister of State

This was an outcome of someone who was found to have committed some wrongdoing with a Bounce Back Loan by the Insolvency Service and was getting a long disqualification for such, but had the BBL written off and the disqualification quashed by the Minister of State once their vulnerability came to light on appeal:

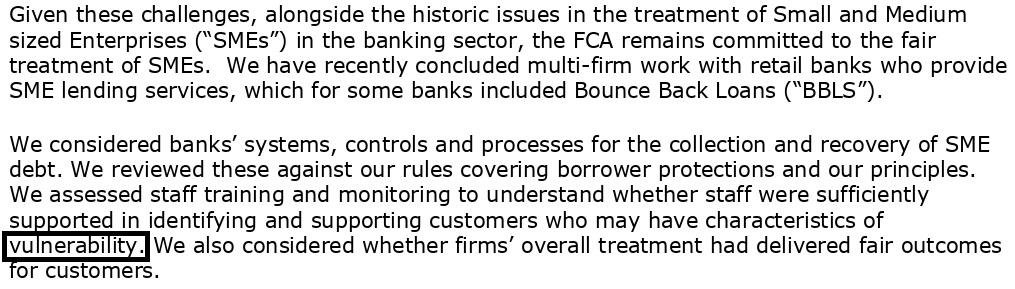

Financial Conduct Authority

I am in constant communication with the FCA, and anything I get wind of with regards to BBL Lenders treating BBL’ers unfairly I tell them about.

If you want me to, I can also pass your details over to the FCA if you give me your permission to, and they will be in touch and listen to what has happened and act accordingly. For reference I have done that many, many times and each time the FCA have responded and contacted the BBL Borrower. Give my helpline and ring and let’s chat if you have been treated badly.

The FCA obviously launched an investigation into the skulduggery and appalling treatment that some BBL borrowers have had to endure brought on by the shocking actions of BBL Lenders, and found they had been up to some very disturbing things, they have written to those lenders and told them to buck their ideas up or they will be in trouble:

Read More About Their Investigation and See the Letters Sent to BBL Lenders > https://mrbounceback.com/category/vulnerable-bblers/

Vulnerable BBL Borrowers

When someone is vulnerable due to financial or business worries, they may exhibit a range of symptoms. Here are some common signs or symptoms that may be observed, be aware this list is in no way exhaustive:

- Persistent stress and anxiety: Constantly feeling overwhelmed and worried about financial issues or the state of their business.

- Sleep disturbances: Difficulty falling asleep, staying asleep, or experiencing restless sleep due to financial or business concerns.

- Mood swings: Frequent shifts in mood, ranging from frustration and irritability to sadness or hopelessness.

- Difficulty concentrating: Finding it challenging to focus on tasks or make decisions due to preoccupation with financial or business worries.

- Withdrawal or social isolation: Avoiding social interactions and isolating oneself due to embarrassment or shame about financial difficulties.

- Physical health issues: Experiencing stress-related physical symptoms such as headaches, digestive problems, muscle tension, or fatigue.

- Decreased productivity: Finding it difficult to maintain productivity at work or in business due to distractions and worries.

- Increased conflict or tension in relationships: Financial stress can strain relationships, leading to arguments, tension, or breakdowns in communication.

- Impaired self-esteem: Feeling a sense of failure or worthlessness due to financial or business struggles, which can negatively impact self-confidence.

- Health neglect: Cutting back on healthcare or self-care expenses due to financial constraints, potentially leading to neglect of personal well-being.

- Loss of interest in activities: Losing enjoyment or interest in hobbies, socializing, or other activities due to financial concerns taking precedence.

- Excessive worry about the future: Constantly fretting about what lies ahead, fear of bankruptcy, job loss, or the survival of the business.

- Unhealthy coping mechanisms: Engaging in excessive alcohol or drug use, overspending, or other detrimental behaviours as a way to cope with stress.

- Increased debt or financial risk-taking: Making impulsive financial decisions, taking on more debt, or engaging in risky financial ventures in an attempt to alleviate the situation.

- Feelings of hopelessness or despair: Experiencing a sense of helplessness, loss of hope, or a belief that the financial situation will never improve.

If you or someone you know is facing financial or business-related vulnerabilities, it’s important to seek appropriate support and guidance. Call me on my BBL Helpline if you want a chat, and do make sure you tell your BBL Lender and/or their nominated debt collector.

Can You Help Me Help Others?

As Mr Bounce Back is funded by subscribers, please if you can afford to do so consider subscribing to the website or making a donation via the links below:

Subscribe on a One Off Basis or on a Recurring Basis:

Or Make a Donation

Click Here to Donate >>https://fundrazr.com/d2Psr2

Thank You for your ongoing support. I can only do what I do with your support.

From Today’s Treasury Committee Meeting with The FCA

“Some customers will say mind your own business”.

“One of the things we have observed is that there is sometimes a sense of shame in talking to a human about the problems you are facing”

“To engage anonymously about their circumstances can actually signpost them to support which they might not have secured by picking up the phone they are doing it online”

I am here if you need me.