AIB Group (UK) Plc had a BBL drawdown value of £172.52m, and as such were the fourteenth largest Bounce Back Loan lender. That represents 0.38% of the total BBL’s issued.

Be aware, that as part of an acquisition by Allica of a £0.5bn SME lending portfolio from AIB, and with specific approval from BBB and HMG, Allica has acquired part of AIB’s BBLS and CBILS lending. The transfer of scheme loans between AIB and Allica took place within the Scheme portal in August 2022 and as such Allica Bank Limited acquired £35.68m of the original AIB Group (UK) PLC BBL loan book.

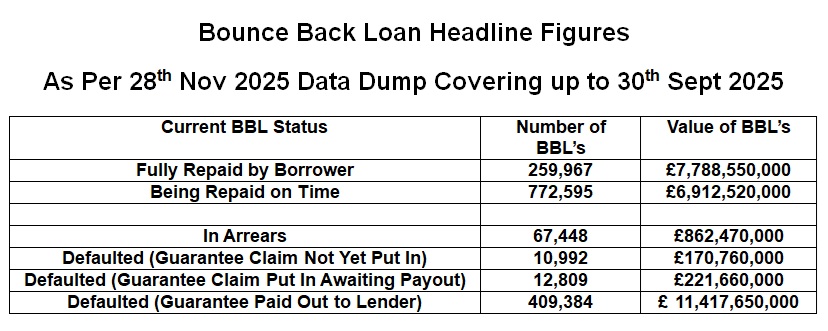

The following figures are as per the latest BBL data dump that occurred on the 28th of November 2025 and covers the actual state of play up until the 30th of September 2025. I update them every three months

Headline Figures All Lenders:

Before you Read On

If you are sat there in a dark place, worrying about Bounce Back Loan repayments that you cannot afford to make, or have defaulted on your BBL and are wondering why no one is chasing you, or your company strike off has been blocked and you are in limbo land, and/or just want someone to talk to before making a decision on how to proceed, feel free to give me a call.

You can contact me any day of the week, all in complete confidence and never forget, as the following figures will prove, you are not alone in your current circumstances, no matter what situation you find yourself in, and you have plenty of options.

I have personally taken over 22,000 calls to date via my Bounce Back Loan helpline and have chatted to even more via text message, WhatsApp, in person and online via my social media channels, if you feel it’s your turn for a chat, it will be my pleasure to talk to you, so give me a bell, the sooner you do, the sooner I can get you sorted.

The pandemic sadly took a lot of victims and left others with very deep mental and financial scars, but as far as a Bounce Back Loan goes, you have plenty of options available to you.

Pick up that phone and give me a call.

Suspected Fraudulent AIB Group/Allica Bank Bounce Back Loans

The suspected fraud figures for Bounce Back Loans issued by AIB Group is £2.26million which is 1.65% of their total BBL loan book. In respect of the value of Government BBL guarantee claims put in by this lender but with the reason for the claim being “fraud” that value is £1.95million read on for details of the additional Government Guarantee claims also put in and paid out.

The suspected fraud figures for Bounce Back Loans issued by Allica Bank Limited is £0.12million which is 0.34% of their total BBL loan book. In respect of the value of Government BBL guarantee claims put in by this lender but with the reason for the claim being “fraud” that value is £0.05million read on for details of the additional Government Guarantee claims also put in and paid out.

AIB Group/Allica Bank Bounce Back Loans Being Repaid on Schedule

The value of Bounce Back Loans from AIB Group that are being repaid as per the original agreement and therefore are on schedule is £27.85million.

The value of Bounce Back Loans from Allica Bank Limited that are being repaid as per the original agreement and therefore are on schedule is £7.43million.

AIB Group/Allica Bank Bounce Back Loans In Arrears

The value of Bounce Back Loans that AIB Group hold that are in arrears is £0.

The value of Bounce Back Loans that Allica Bank Limited hold that are in arrears is £0.90million.

- Loans with missed repayments are deemed to be in arrears.

- Loans are tracked in 30, 60 and 90 day cohorts by lenders to manage risk.

- Lenders report monthly arrears updates through the Scheme Portal on a “best endeavours” basis.

- Some lenders submit arrears via the automated (API) functionality in the Scheme portal, but it is not possible for smaller lenders to integrate with this functionality so arrears are entered manually.

- Loans in arrears that have moved to a later life-cycle stage (such as Defaulted) will be reported in the later life-cycle stage but may still carry arrears.

- At the time of this event occurring, this is an actual balance, and not estimated.

Value of AIB Group/Allica Bank Bounce Back Loans in Default

As per the latest most up to date set of figures, the Defaulted Outstanding balance of AIB Group Bounce Back Loans is £0.72million.

As per the latest most up to date set of figures, the Defaulted Outstanding balance of Allica Bank Limited Bounce Back Loans is £0.05million.

- Defaults are Loans where the lender has issued a formal demand to the borrower.

- At the time of this occurring, this is an actual balance, and not estimated.

Value of AIB Group/Allica Bank Bounce Back Loan Guarantee Claims Outstanding

As per the latest figures, AIB Group has £0.29million worth of Bounce Back Loans in a “claims outstanding” state.

As per the latest figures, Allica Bank Limited has £0.09million worth of Bounce Back Loans in a “claims outstanding” state.

- When AIB Group has submitted a claim under the guarantee, the loans sit in the claimed outstanding state whilst the British Business Bank awaits/processes the invoice for the claim and runs relevant checks.

- Under the terms of the guarantee the claim must be paid within 30 days of receipt of the claims invoice, however on average they get paid in 12 days.

- Guarantee claims can be submitted by Lenders each Quarter.

Bounce Back Loan Guarantee Claims Approved and Paid Out to AIB Group/Allica Bank

The current value of Bounce Back Loan Guarantee claims paid out to AIB Group and settled is £7.09million.

The current value of Bounce Back Loan Guarantee claims paid out to Allica Bank Limited and settled is £2.47million.

- Once a BBL guarantee claim is processed and payment is released to AIB Group, the facility is marked as settled on the Scheme portal.

- Some lenders may be more advanced than others in their claims and recoveries processes which could lead to figures being distorted.

- Lenders may submit guarantee claims Quarterly in line with the terms of the guarantee.

Value of AIB Group/Allica Bank Bounce Back Loans Repaid in Full by Borrowers

Some BBL Borrowers have of course repaid their loans in full, and currently the value of BBLs issued by AIB Group that have been fully repaid is £27.25million.

Some BBL Borrowers have of course repaid their loans in full, and currently the value of BBLs issued by Allica Bank Limited that have been fully repaid is £3.77million

Are They Jailing People for Bounce Back Loan Fraud?

They are indeed locking people up for BBL related fraud, and there is a section of the website dedicated to “BBL Jailbirds” listing exactly what some people did that led them to go before a Judge in Court, you will find it on the following link