Many of you out there will now be of the mindset that you fully intend to challenge your Bounce Back Loan and either get its value massively reduced or even written off, and I do not blame you for that based on everything that has gone on since the scheme started, and things that continue to happen with the aftereffects of the pandemic.

However, if you have been keeping track of my news updates, one thing that has become apparent is that many people did “over-egg” their turnover to secure a Bounce Back Loan, but there was a lot of confusion over the way that aspect of applying for a Bounce Back Loan was presented to you.

Those that did scandalously exaggerate their turnover knowing what they were doing was wrong are not who I want to concentrate on, many of them that did and for want of a better phrase “took the piss” have already declared bankruptcy or have gone through Insolvency and have been hit with a BRO or long disqualification.

There is an ever growing list of such people listed on this section of the website:

https://mrbounceback.com/category/the-disqualification-files/

The “rules” of the scheme were confusing to say the least. and even the banks misinterpreted them at times, you will find more than enough cold hard proof of that by looking around this website.

For reference. I want to present to you the following as an insight into the crazy way that “turnover” was presented to applicants:

“Turnover”

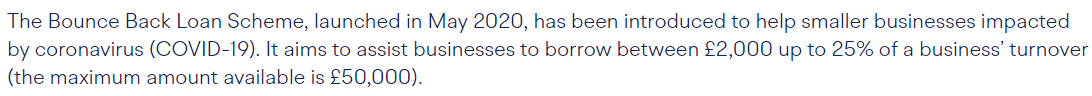

The rules stated that a business could apply for 25% of its 2019 turnover as the maximum amount it could secure a BBL for, however that caused confusion with many SMEs believing it was the 2019 tax year and not as intended the 2019 calendar year.

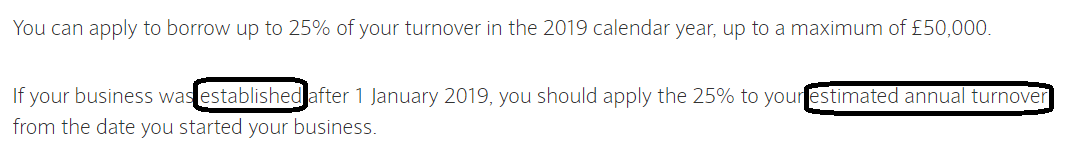

However, to add to the confusion, the wording indicated that “If your business was established after 1 January 2019, you should apply the 25% to your estimated annual turnover from the date you started your business.”

Definition of the word “Established”

“Having existed or done something for a long time and therefore recognized and generally accepted.”

Therefore, it would be fair to say that many people will have estimated their turnover no matter how long their business had been established, as that is what the wording seemed to permit, whether the powers that be believe that to be how they wanted that aspect of the scheme to be designed, or not.

Barclays

Barclay’s stated this for example

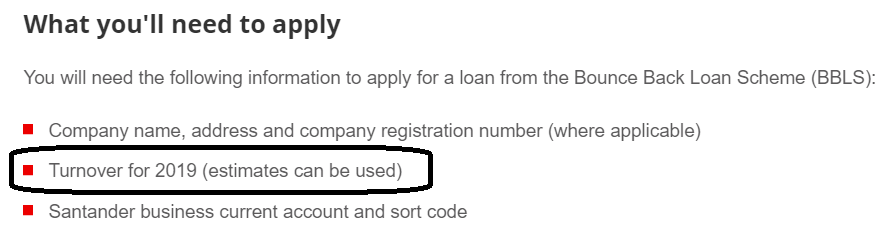

Santander

Santander simply stated this on their website:

British Business Bank

The British Business Bank stated this:

You get the idea, keep in mind that Back British Business offer a personalised service, so do feel free to contact them if you want to make use of their service, or want any additional information before taking them up on that service.

Is it worth the £550 plus VAT (£660.00 in total) fee? Only you can decide. However, it will be worth using the £50 discount code offered by the EUA Campaign:

You Have to Decide for Yourself Whether to Challenge Your BBL

It is going to be your decision whether you do make use of the service offered by Back British Business, and as such please do think about your options moving forward.

I am not offering any type of advice, legal or other, but am committed to ensuring you are aware of all of the options available to you, and I am carefully watching the progress made by the Back British Business team in getting BBL’s either written off or reduced in value and will continue to report on that aspect and all other aspects of the BBL scheme moving forward.

Having seen the stunts pulled by banks and those in charge of the rules of the scheme and their flat out refusal to acknowledge the problems the BBL scheme have caused and the devastation to many businesses moving forward, the time has certainly come to challenge those loans.