I have finally managed to set aside enough time to link all four parts of my Tide Bounce Back Loan exposé videos together, and as such if you haven’t watched them yet, you can now do so below.

This is one of the most remarkable cases I have had to work on and involves Tide, a BBL Lender and their debt collectors trying to scam fees and charges from customers who had defaulted on their Bounce Back Loans,.

It also proves too, that those paid handsomely to ensure the BBL Lenders are not scamming the scheme, are asleep at the wheel,

I am pleased to announce that I have managed to shame the Conservative Government enough and they have finally taken action against Tide and their dodgy debt collectors.

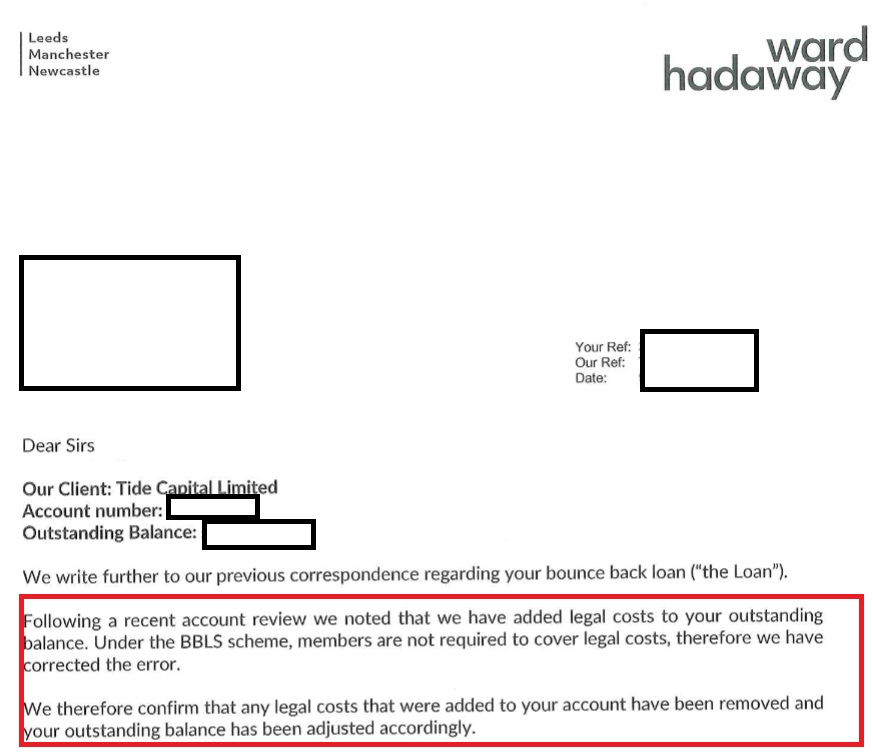

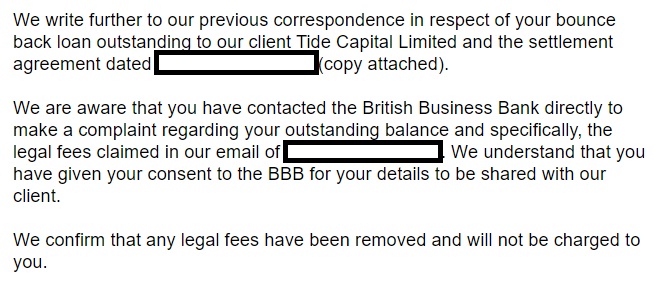

As a result, all of those affected by this scam have begun to receive letters from Lupton Fawcett and Ward Hadaway telling them those fees and charges are being removed, and if paid they will be refunded.

If you have been scammed by them but you haven’t had those fees or charges removed and/or refunded, and let’s face it as they were pulling a scam so they may still be doing so to some people, do feel free to get in touch and I will have a word with the powers that be and get you sorted.

Ward Hadaway

Luton Fawcett

Tune in Below

Metro Bank Scam

By looking around this website you will soon discover some other BBL Lenders have been pulling some right scams too.

So despite what little Rishi Sunak and his jolly, soon to be Ex-team of Ministers and MPs might say, it is not just SMEs who “played” the BBL Scheme, it is also some of the Lenders who by the way, a quick check of the Register of Members Interests will show, bung those MPs and Ministers gifts, cash and all manner of extras, in fact many also have major shareholdings in those BBL Lenders, as too do many Members of the House of Lords, I doubt that will shock you to learn though.

What are those scams I hear you ask, well here is one that came to light just a few days ago when I got access to the details. I do have a huge list of other BBL Lender scams, but I will save them for another day.

Back to that recent case, that being one in which the Insolvency Service slapped Andrew James Smith the Director of London Equine Services Limited with a 7 year ban.

If you are a subscriber you will find the full juicy details of that case here > https://mrbounceback.com/andrew-james-smith-the-director-of-london-equine-services-limited/

They gave him that ban for blagging a second Bounce Back Loan from Metro Bank after he had already got one for his Company from Barclays.

However, Metro Bank also gave him a £10,000 BBL Top Up in December of 2020, which means that bank did not, as they were obliged to do, check the “Shared Industry Database” when processing that top up as they were required to do.

That database had been set up to stop people blagging more than one Bounce Back Loan and was in place several weeks after the launch of the BBL Scheme, whilst it wouldn’t have prevented Smith blagging both initial BBLs, as the database wasn’t set up by then, if Metro Bank had done their job and spent a few seconds checking that database they would have seen he had two BBLs for his single company and could have stopped him blagging that top up.

Obviously they didn’t and gave him another £10,000 in cash, guaranteed by you and your taxes.

But fear not the bank will have no doubt have slapped a guarantee claim in for the full amount when he defaulted, even though it was their neglect that enabled that BBL Blagger to fill his boots with that top up.

What a time to be alive!

I asked the British Business Bank and the Insolvency Service for an official comment after I laid out to them that BBL Lender scam, this is what they sent me.

A Spokesman for the British Business Bank Said

“Thanks for forwarding – I’ll pass on to the team here as useful for awareness. As you’ll know, we don’t comment on individual cases (NB furthermore, as a government-owned arms-length body, we’re not permitted to issue comments more generally at present as we’re in the period of pre-election sensitivity).”

A Spokesman for the Insolvency Service Said

“Hi Mike, thanks for your email.

We wouldn’t have anything to add beyond the information you have flagged”

Metro Bank Comment

I also asked Metro Bank to return the money if they have claimed it via the Guarantee, so it can be use for a hospital, children’s hospice or some other worthy cause.

They haven’t replied.