When you report an outrageous Bounce Back Loan related scam, designed to extort money out of highly vulnerable people, you would expect the organisation you report it to would show great interest, and vow to stop it immediately.

If that organisation is a Government Department, and you show them all the proof, they validate it, confirm what is going on is against the rules of the BBL scheme, and you then get a call you in the dead of night from them, to tell you it is against the BBL Lenders and Government Agreement, but there is nothing they are going to do, you would get worried.

Then you are told, in no uncertain terms “watch who you tell”, I am sure you would get somewhat worried, is that a threat, is that friendly advice, have you misunderstood the meaning of that phrase.

Well, that is exactly what has happened to me over the last few days, and below I will lay out everything, which has 100% been confirmed by the Government and their legal department, and you can try and make sense of what the hell is going on.

I must add, since putting out some of the rather cryptic tweets you are about to read, I have had contact with some, how shall I put this, friendly souls, many of you will know or be more than aware of, who will be helping me get this shocking situation addressed, as they are somewhat greatly more “powerful”, for want of a better word than I.

Let Me Begin

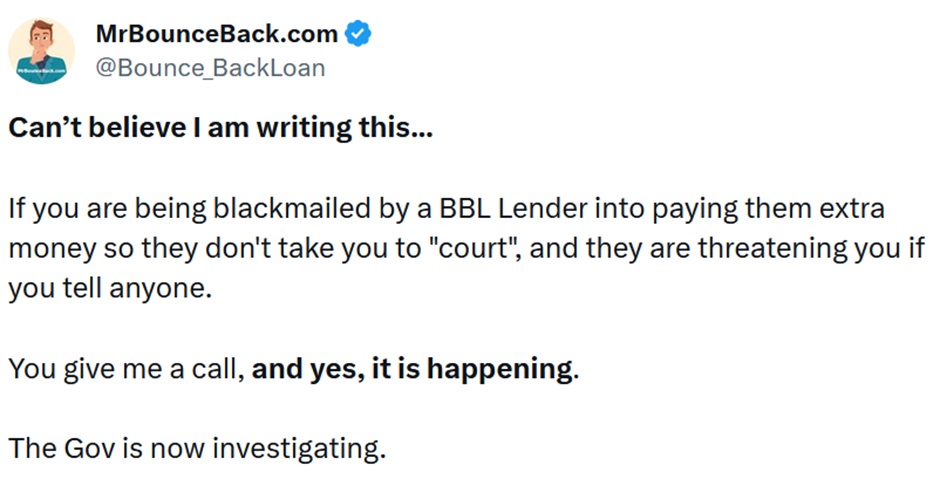

I put out the following Tweet, as I was confident it would garner responses, if this “scam” is as widespread as I believe it may be

Sure enough, after tweeting it, my helpline lit up with callers, who all told me that is what they had experienced with one BBL Lender, they all named the same one, and they all sent me proof via documents, letters, and emails they had been sent, threatening to take them to court if they do not pay fees and charges when either they have defaulted on a BBL or even worse, when they were simply, as 100% permitted by the rules of the scheme, and actively encouraged, trying to set up a repayment plan.

I know that Lenders are forbidden to charge fees or hit people with charges when in default or when setting up a repayment plan, so I asked a few of the people who had contacted me would they be happy for me to send their letters and emails to a Government Department as proof.

I also asked them if they would be prepared to speak to that people from that department and explain their plight. By doing so I would be confident the Government would not dismiss me as some kind of nutjob.

They agreed to do so, in fact the common reply when I asked them was “happy to, I have done nothing wrong” or words to that effect.

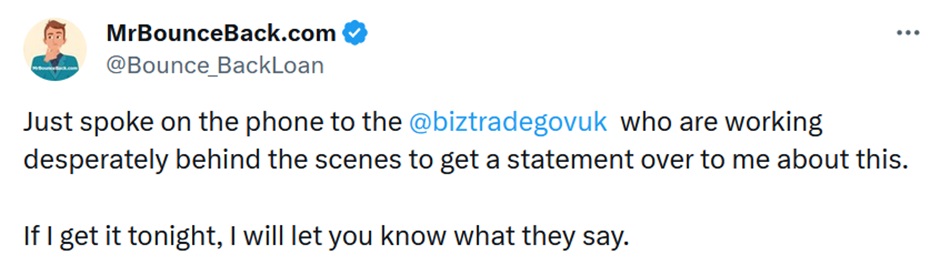

I collated that information, and contacted the relevant Government Department, and expected a very quick response I then contacted the Department of Trade, asking for a statement.

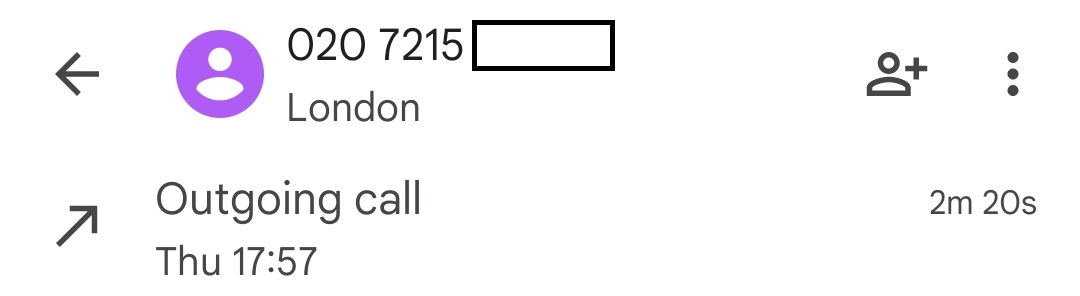

Sods Law did come into effect as there was an Emergency Cabinet Meeting called due to what has been happening over Yemen way, however I was assured in a phone call I made to them at 17.57 Thursday the 11th of January 2024 they were doing their utmost best to get a statement to me.

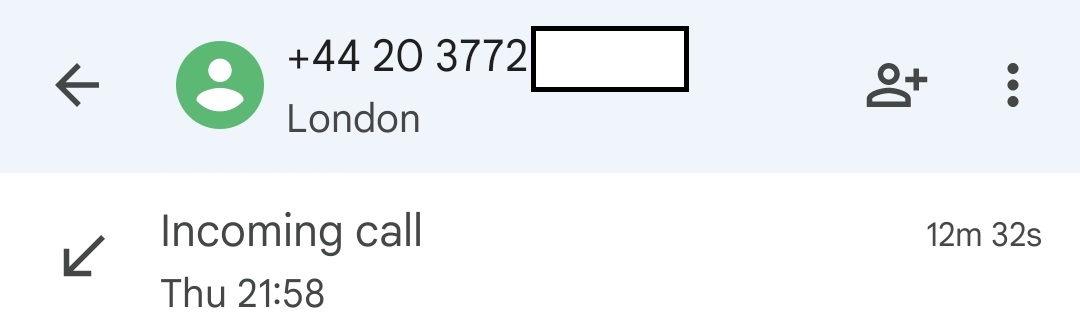

Later that night at 21.58pm on Thursday the 11th of January 2024 my phone rings. Hurrah, the statement is coming, or so I thought.

I was told the Legal Department had confirmed Lenders are forbidden, by the rules of the BBL scheme, to charge any additional fees when someone defaults and certainly never when someone is setting up a repayment plan.

That call was from the Government Department who handle BBL matters, they and their Legal Team, having reviewed the rules of the BBL Scheme, confirmed that no such charges can be applied.

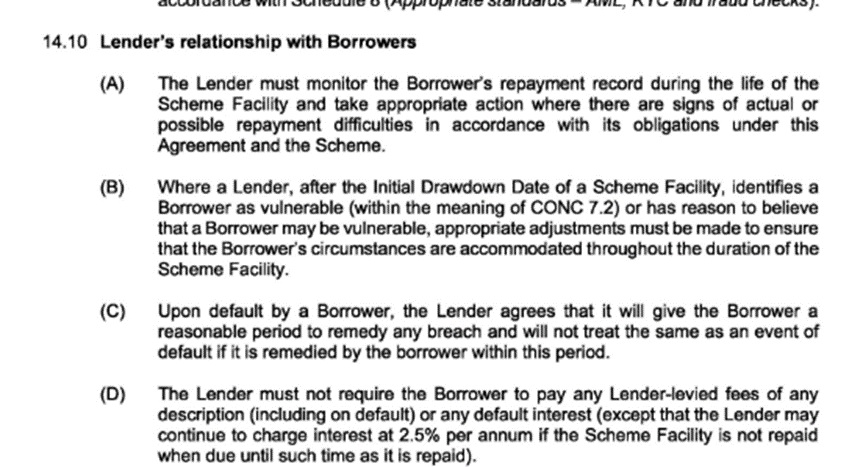

In fact it clearly says so on the Government – Lender BBL agreement page 25 section 14.10D

>https://mrbounceback.com/view-a-copy-of-the-bounce-back-loan-guarantee-agreement/page-25/

There is one exception of course and that is when fees or charges are ordered by a court. The cases I got wind of from callers were never taken to court, it would be a bloody interesting court case to watch, and no one to date or to my knowledge has been taken to court for simply not being able to afford to repay a BBL or due to them wanting to set up a repayment plan, but I digress….

My reply to being told that and remember I had laid everything out to them including documents, letters and emails proving that one BBL Lender was hitting people with fees and charges they have no right charging, and I had spoken to multiple real life people caught up in it, willing to talk to them too, was, “excellent”, and I asked them would an investigation be launched straight away and would they act quickly to stop what was going on.

I wasn’t ready for what then happened.

I was told, no, there is nothing they are willing to do. Obviously that sent me on something of a wild rant, why would they not act, and if they won’t, who the hell can I tell to ensure it is stopped, I admittedly may have ever so slightly raised my voice when asking that to the person I won’t name on the other end of the line.

I was told there was nothing they will do. Also, that person told me “watch who you tell”.

Yes, you read that correctly. There is always to possibility I misunderstood the last part, was is a threat, friendly advice or me not hearing it correctly. But the first part was heard and repeated to me.

How the Scam Works

Here is how that scam works, before I explain be aware that looking at the Government figures, if that BBL Lender has pulled it on all of their customers in default, currently a tad over 800 of them, and those customers paid, then based on Government figures the Lender has bagged, if those vulnerable borrowers paid those fees and charges which is usually around 10% of the money owed, over £2.4million.

Keep in mind that Lender has received over £24million from their defaulted BBLs and have been paid out that amount in full, from the Government by them claiming on the Government Guarantee.

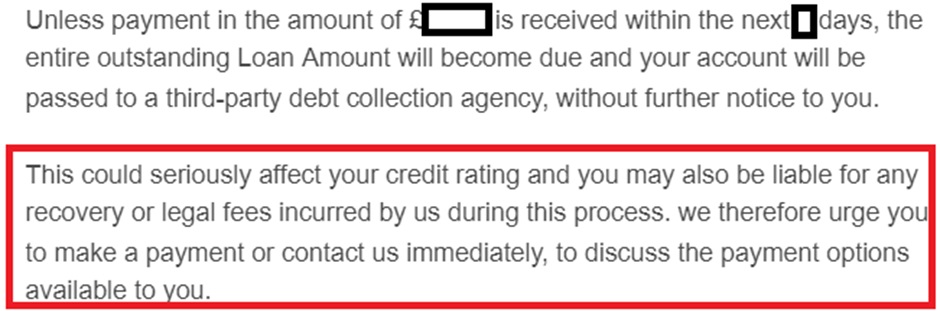

Here are some of the threats and demands from official documents sent to that Lenders BBL Borrowers, most of whom are clearly vulnerable, which I reiterate has all been fully verified by the Government Department and their Legal Team.

This BBL recipient was trying to set up a repayment plan

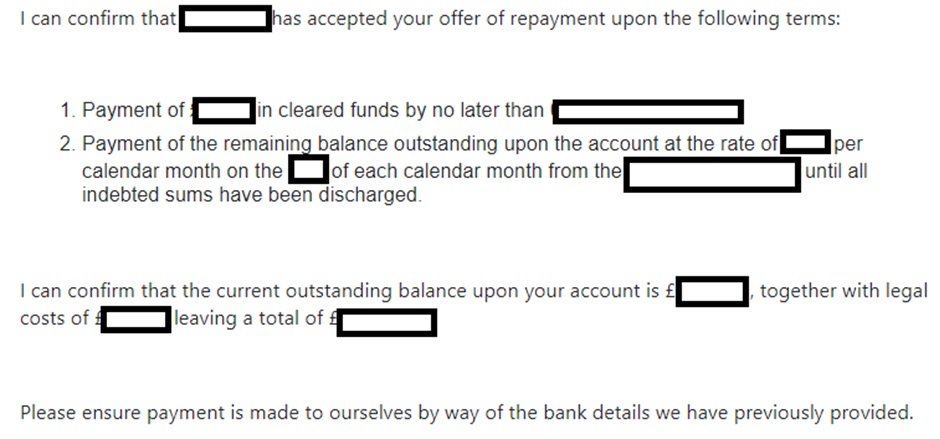

The Government have confirmed they cannot add fees onto a BBL that is in default. That Borrower also got the following

The “legal costs” were approximately 10% of the amount owed. They are not allowed to charge any such fees, its there, in big in the Lender and Government Agreement and as such it is a breach of said agreement, and hopefully when someone finally is prepared to do something, which won’t be this current Government seemingly, they should have the guarantees yanked on everyone with a BBL who has been scammed this way, and who knows, those BBLs should also be written off by the Lender too.

Also, to ensure that customers doesn’t blab about it to anyone, this was also added onto the communication

A Government Minister also told Baroness Bowles of Berkhamsted, whilst at committee. “Lenders must not require Borrowers to pay any Lender levied fees of ANY description including on default, or any default interest”

This was once again confirmed to me by the Government Department and their Legal Team late last night.

One person reporting to me they were a victim of this scam, told me the BBL Lender had confirmed they were vulnerable

That emailer does of course mean Borrower not Lender, for anyone nit-picking.

They then were so distressed about the demands for extra fees, several thousand pounds in fact, they instructed a Solicitor to act on their behalf, who instructed the Lender, in no uncertain terms, to contact them and not contact the Borrower in future on this matter, due to their highly vulnerable state.

The Lender ignored the instruction and would you believe, continued to hound the Borrower, the Solicitor is of course now addressing that utterly appalling situation legally.

Sadly, as it stands, even though I have handed all of the proof, which the Government has seen and verified, that this Lender is disgracefully hounding, no let me rephrase that, EXTORTING money they have no right to claim from Bounce Back Loan Borrowers, and even worse often very vulnerable Borrowers, then telling them as you can see above, not to tell anyone, no one in power seems to give a damn.

You can understand why the victims of for example the Post Office Scandal were chasing their tails and getting nowhere for years, and this outrage, is, in my opinion, on a par with that P.O Horizon Scandal.

I just hope and pray those victims that haven’t come forward yet, victims of this extortion, blackmail, threatening action, call it what you will, have not been pushed over the edge. Some of those who contacted me who are currently victims of this scam have told me they have experienced very dark thoughts.

Shame on the Government.

I have of course alerted other interested parties who you may hear from soon, discussing this issue.

But if this current Conservative Government won’t act, and disgustingly bat me off with a shrug of the shoulders after handing them the information on a plate, others will.

Maybe people like the following with links to that Lender, are the reason why no action is being taken against them.

- Earl of Lindsay – Conservative

Who knows….

If you have been victim to what I shall now class as a Government Backed Extortion, Blackmail Threatening Scam, give me a call on the helpline.

I do of course wish to keep the door open for anyone with an ounce of morality and fair play in any Political Party who wants to step in and help stop this scam, to get in touch.

I am happy for any Government Committee to call me as a witness, and I will lay everything out, for the world to see.

Peoples mental health and dare I say in some extreme cases, their life could depend on you stepping in and sorting this out.

Oh, and that BBL Lender, flatly refused to offer PAYG options to their BBL customers, wonder if that was so lots of them would struggle to repay their BBLs, and end up defaulting, the Lender then gets the full amount of the BBL owing back off the Government plus a juicy 10% on top by extorting and threatening those businesses at disadvantage of not being able to take the forbearance options built into the scheme.

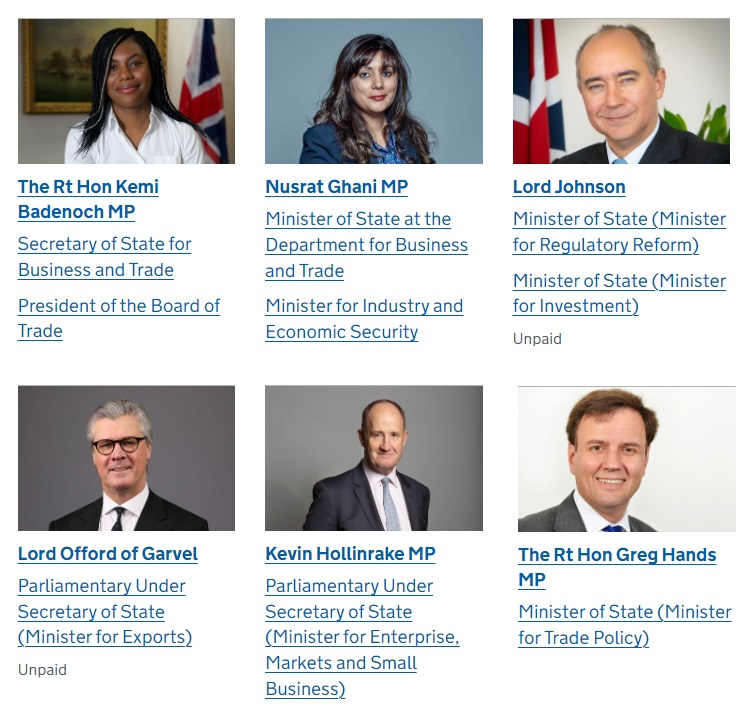

FYI this is the Department for Business and Trade Wall of Shame/Numpties

All of the above is going on right under the noses of the following, I am surprised the UK has any trade or business with these utter buffoons running the show. But who knows, they may simply be compromised, or some might say get an envelope stuffed with cash to look the other way, I would never say such a thing of course.

Look at their faces, and ask yourself, would you buy a used car off any of them.