You may remember Rishi Sunak doing the rounds recently on TV news channels and on radio too, reminding everybody with a Bounce Back Loan his “brilliant” Pay As You Grow options were available.

He seemed gleeful and excited to announce those forbearance measures were available, however what he failed to mention was just how much more interest those with one of those loans was going to be forced to pay when taking any of them.

He giddily did say though, that by taking them borrowers would be able to reduce their repayments, a prime example of smoke and mirrors, he doesn’t miss a trick does he?

With that in mind I have drilled down the extra interest payments collectively that SMEs are going to be forced to have to pay in added interest, and the results are truly shocking, unless of course you are a bank who will have welcome those PAYG options with open arms, safe in the knowledge you will be getting a bigger return.

Having said that though, let us not forget one lender, that being Tide have told their BBL customers and the Government to as good as get stuffed, as they are not going to be offering those PAYG options Rishi excitedly announced.

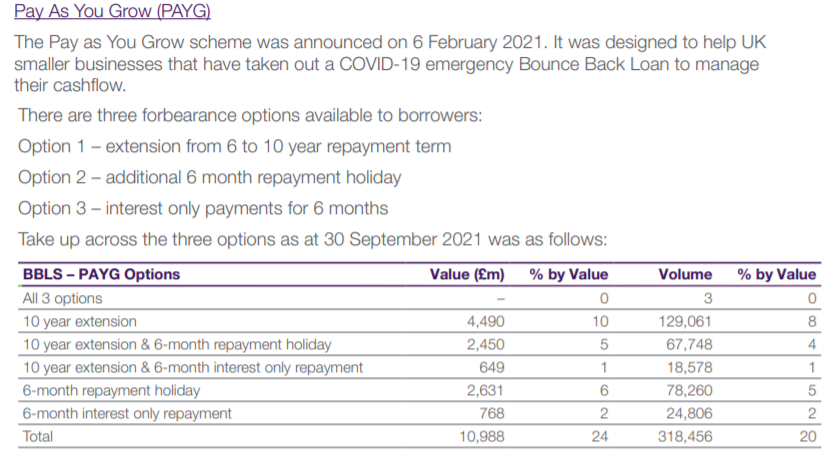

I am basing the following figures on the latest data released on PAYG options, which for reference were those in the BEIS Annual Report and Accounts.

*Be aware those figures are not yet conclusive, as many people were not at the stage when repayments were due and therefore could not access the PAYG options when the figures were announced and the date when the figures were based up until (30th September 2021), so they will no doubt grow in value moving forward, and some people may take them in any order moving forward too, however my figures will give you an idea of the amounts of cash involved.

Also, be aware when taking for example the interest only option but only on a 6 year term BBL, there is an option to extend the term of the loan by another 6 months. Those who may have taken that option is not mentioned in the BEIS data, so I have not included it in the figures below.

I have used a standard PAYG calculator on one of the BBL lenders websites to arrive at these figures, so any small discrepancies (if any) are down to that banks calculator and being as the maximum BBL value is £50,000 you will see below how I have done all of the “workings out” on the much larger collective figures.

If you spot any errors do let me know…..

Base Numbers/Figures

Let me present to you some base numbers, so that you can verify these figures for yourself:

A £50,000 Bounce Back Loan taken out over the standard 6 years, taking into account Government paying the interest on that loan for the first year, will see the borrow paying some £3,142.50 in interest.

Extending to 10 Years

Some £4,490,000,000 worth of Bounce Back Loans have been extended to 10 years in length:

£4,490,000,000 divided by £50,000 = 89,800

Interest on a 6 year BBL = £53,142.50

Interest on a 10 year BBL = £55,614.35

Increase in Interest £55,614.35 – £53,142.50 = £2,471.85

£2,471.85 x 89,800 = £221,972,130

Total Collective Increase in Interest Payable = £221,972,130

Extending to 10 Years AND 6 Month Repayment Holiday

Some £2,450,000,000 worth of Bounce Back Loans have been extended to 10 years in length and a 6 month repayment holiday has been requested:

£2,450,000,000 divided by £50,000 = 49,000

Interest on a 6 year BBL = £53,142.50

Interest on a 10 year BBL with a 6 month repayment holiday = £55,992.60

Increase in Interest £55,992.60 – £53,142.50 = £2,850.10

£2,850.10 x 49,000 = £221,972,130

Total Collective Increase in Interest Payable = £139,654,900

Extending to 10 Years AND 6 Month Interest Only Option

Some £649,000,000 worth of Bounce Back Loans have been extended to 10 years in length and a 6 month interest only option has been requested:

£649,000,000 divided by £50,000 = 12,980

Interest on a 6 year BBL = £53,142.50

Interest on a 10 year BBL with a 6 month interest only period = £55,992.60

Increase in Interest £55,923.33 – £53,142.50 = £2,780.83

£2,780.83 x 12,980 = £221,972,130

Total Collective Increase in Interest Payable = £36,095,173.40

6 Year Loan With 6 Month Repayment Holiday Option

Some £2,631,000,000 worth of Bounce Back Loans have a 6 repayment holiday option having been taken upon them.

£2,631,000,000 divided by £50,000 = 52,620

Interest on a 6 year BBL = £53,142.50

Interest with a 6 month repayment holiday period = £53,489.95

Increase in Interest £53,489.95 – £53,142.50 = £347.45

£347.45 x 52,620 = £18,282,819

Total Collective Increase in Interest Payable = £18,282,819

6 Year Loan With 6 Month Interest Only Option

Some £768,000,000 worth of Bounce Back Loans have a 6 month interest only option having been taken upon them.

£768,000,000 divided by £50,000 = 15,360

Interest on a 6 year BBL = £53,142.50

Interest with a 6 month interest only period = £53,451.47

Increase in Interest £53,451.47 – £53,142.50 = £308.97

£308.97 x 15,360 = £4,745,779.20

Total Collective Increase in Interest Payable = £4,745,779.20

Grand Total of Collective Increase in Interest Payments: £420,750,801.20

As mentioned the figures are set to rise as and when more SME’s are eligible for the PAYG options and are offered them by their lender, and as too if and when SME’s opt to take the additional interest only periods, as they can take up to three x6 month interest only breaks.