Just when you thought the Bounce Back Loan scheme couldn’t get any more ridiculous, it has. For the record, I have alerted Peter Kyle the Secretary of State for Business and Trade of this situation as such cases are brought before the courts on his behalf, sadly the last time I checked he was too busy tweeting on X about the pop group Abba.

It has come to my attention that the Insolvency Service, who are tasked with taking people to court for alleged wrongdoing associated with for example Lloyds Bank Bounce Back Loans are using a law firm to help them seek Director Bans and Compensation Orders that any sane and logical person would deem that law firm to have a perceived bias and a very obvious conflict of interest.

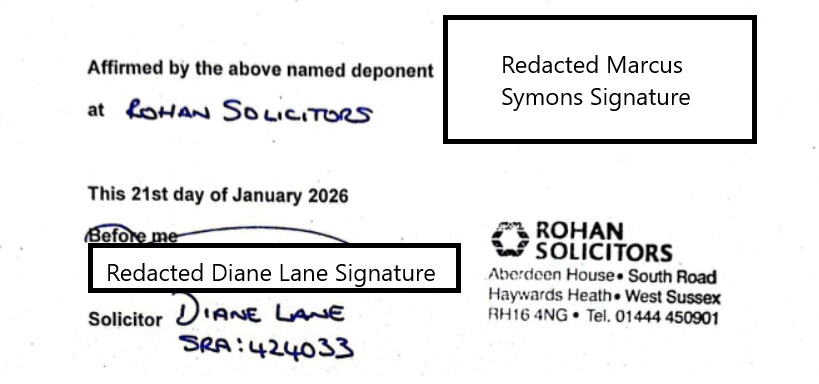

Take for the following document which is an affirmation of a statement of Marcus Symons from the Insolvency Service which is to be presented to a Judge, it has been affirmed by Diane Lane a solicitor at Rohan Solicitors.

A quick glance at Companies House reveals the following:

So, according to Companies House, Rohan Solicitors has an outstanding charge against them from Lloyds Bank and are working for the Insolvency Service in cases associated with alleged Bounce Back Loan wrongdoing with BBLs from Lloyds Bank.

Why is that is big deal I hear you cry, well if there is a perceived bias or any possible conflict of interest a legal firm should recuse themselves from such cases.

In fact below is a case of a similar nature in which a Judge was told to recuse himself from any and all cases related to HSBC as that Judge is associated with a firm that has an HSBC Bounce Back Loan!

Hugh Sims KC, acting as a Deputy High Court judge, determined that an impartial and well-informed observer would raise apprehensions about the judge’s impartiality. This viewpoint stems from the similarities between the issues faced by the company owned by the claimants and those of His Honour Judge Gerald’s business, Hot Yoga Brixton (HYB).

Mr. and Mrs. Ryan, the claimants, sought to have the judge recused from overseeing a derivative claim against HSBC, brought under section 261 of the Companies Act 2006. The request was made after the judge had already dismissed the permission application. Subsequently, the Ryans discovered the judge’s “business association” with the bank.

The Ryans argued that a “logical connection” existed between their complaints against HSBC’s alleged misconduct in providing rescue finance to their business and HSBC’s recent provision of rescue finance to HYB.

During a hearing, HHJ Gerald disclosed that he and his spouse each held 50% of the shares in HYB, a small yoga studio situated in Brixton, managed full-time, and serving the local community. The judge clarified that the relationship with HSBC was essentially transactional, devoid of a personal connection or an assigned account manager. Furthermore, neither the judge nor his spouse had offered personal guarantees or collateral.

However, HHJ Gerald determined that another judge should handle the recusal application. Mr. Sims, in his assessment, concluded that the well-informed observer “would conclude that there was a real possibility that the tribunal was biased” for three primary reasons.

Firstly, the observer would harbour doubts regarding the business association between the judge, through HYB, and HSBC. Given HYB’s financially troubled state and its proximity to the judge, coupled with potential subject matter overlap with the current case, the observer might perceive a genuine potential for bias.

Secondly, the judge’s handling of the apparent bias issue, once raised and clarified, would not alleviate concerns; rather, it could exacerbate them. Considering these factors, the observer might believe that there was a genuine likelihood of the judge being biased in favour of HSBC and against the Ryans.

The observer’s impression of potential bias would be reinforced by the judge’s approach during the substantive hearing. Certain misdescriptions of aspects of the Ryans’ case, interpreted unfavourably towards them, would contribute to this perception.

Mr. Sims emphasized that several indicators suggested that the judge did not fulfil his judicial duties in a fair manner during the hearing, as evident in the judgment. These indicators were significant enough that the well-informed observer might conclude that there was a real possibility of bias, regardless of the validity of grounds 1 and 2.

Mr. Sims ultimately determined that HHJ Gerald should not continue overseeing the permission application or issue any final orders pertaining to it. He recommended that the judge’s judgment be set aside. Importantly, Mr. Sims clarified in a postscript that the judgment did not assert any findings of actual bias.

Mr. Sims added a postscript, stressing that the judgment shouldn’t be interpreted as an invitation for individuals unhappy with a judgment to raise points of apparent bias after the fact and before considering an appeal. He emphasized the unique circumstances of this case.

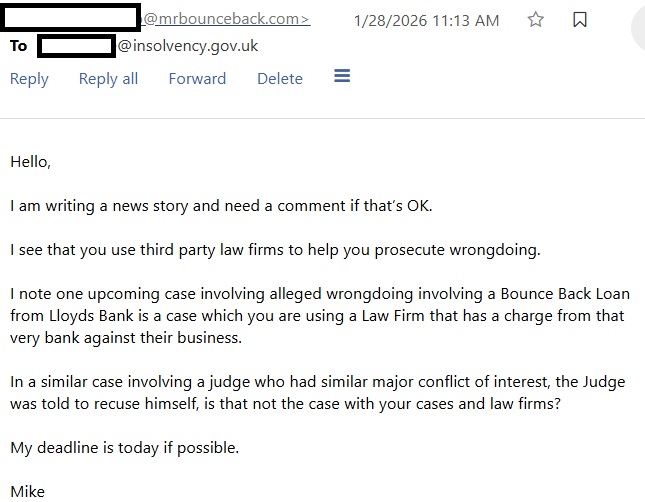

I Have Asked the Insolvency Service and Rohan Solicitors for a Comment

In the interests of openness, I have of course afforded both Rohan Solicitors and the Insolvency Service the opportunity to comment, alas some time has passed since I did so and neither party have responded:

In light of such the Judge in the case above will be informed. One must also worry whether any previous cases have gone before a Judge with this perceived bias and no one has noticed…..