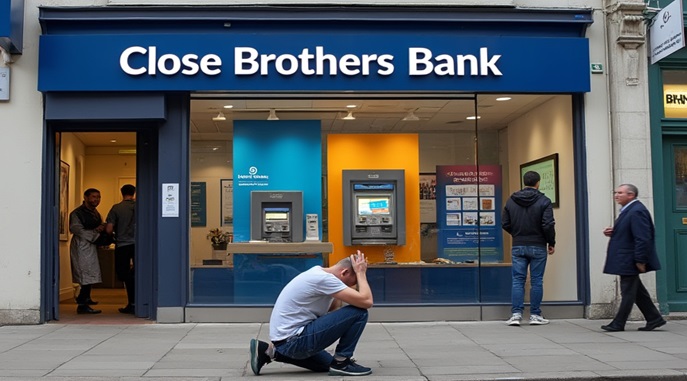

Close Brothers the Bank Lord Agnew Has Shares In Treats a Customer Appallingly and Stops Him Getting a Bounce Back Loan and One of Their Agents Send Him a “The Police Are Desperate to Arrest You” Message The Ombudsman Steps in and Gives Them a Good Slapping

Nothing shocks me anymore, and here is a tale and a half, regarding the utterly shocking way Close Brothers the bank that Lord Agnew has shares in treated one of their customers, it includes threatening messages and all manner of other wrong doing. […]