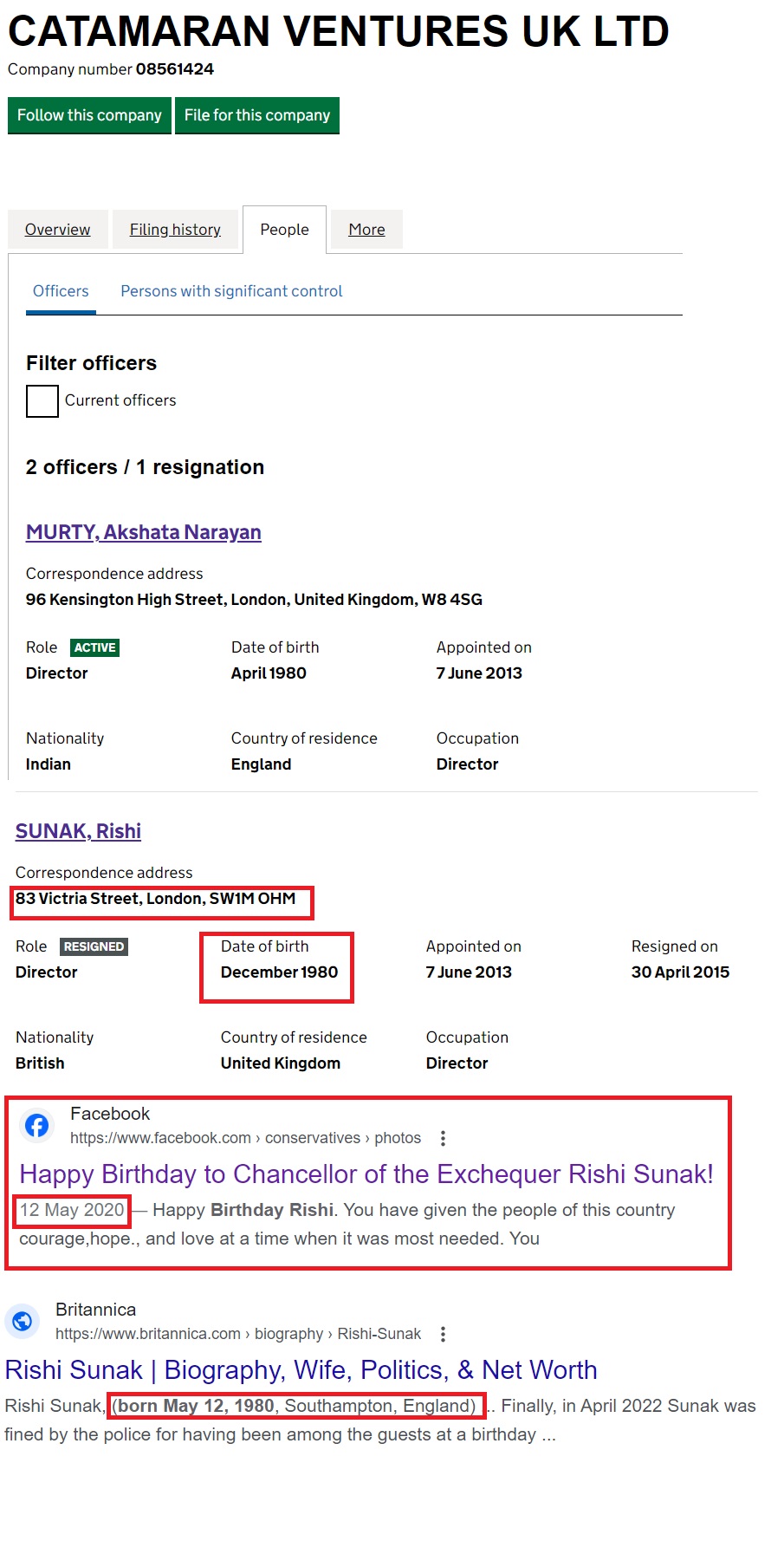

As you will no doubt be aware, Rishi Sunak was at one time a Director of a Company with his wife that went on to bag many Government backed Loans, many of which turned sour and were never paid back, but you may not be aware false information was registered when he gave his details to Companies House on his Directorship, such as the Registered Address and low and behold his date of birth.

If you know where Victria St in London is or why he claims to be born in December 1980 when his Birthday is on the 12th of May 1980 do let me know.

>>https://find-and-update.company-information.service.gov.uk/company/08561424/officers

However, to stop such nonsense in the future, robust laws to fight fraud, counter corruption and bolster legitimate business received Royal Assent today.

The Economic Crime and Corporate Transparency Act introduces world-leading powers which will allow UK authorities to proactively target organised criminals and others seeking to abuse the UK’s open economy.

Companies House will receive enhanced abilities to verify company directors, remove fraudulent organisations from the company register and share information with criminal investigation agencies.

Law enforcement agencies will benefit from greater powers to seize, freeze, and recover crypto assets, while groundbreaking legal reforms will allow the courts to dismiss spurious lawsuits which seek to stifle freedom of speech. Prosecutors will be better able to hold large corporations accountable for malpractice.

These changes will level the playing field for all businesses, ensuring the UK’s open economy remains a world class centre for businesses to grow and prosper.

Home Secretary Suella Braverman said:

I am committed to ensuring criminals do not profit from their offending and this landmark act will help law enforcement clampdown on the tactics they use.

It will have a big impact on our ability to fight organised crime, including terrorist funding, fraud and money laundering, and that will ultimately help keep us all safe.

Business Minister Kevin Hollinrake said:

We’re providing Companies House with the tools to take a much harder line on criminals who take advantage of the UK’s open economy, ensuring the reputation of our businesses is not tarnished by the UK playing host to the world’s scammers.

These reforms will remove the smoke and mirrors around companies hiding behind false identities, provide further protection to the public from companies fraudulently using their addresses, and deliver better data to support business and lending decisions across the economy, enhancing the UK’s reputation as a great and safe place to do business.

Lord Chancellor Alex Chalk said:

We will not stand by while wealthy individuals abuse our courts with malicious lawsuits designed to gag reporters exposing their misconduct.

This act reinforces our unwavering commitment to protect freedom of speech, and end the brazen exploitation of our legal system by corrupt elites.

The powers given to Companies House form the biggest shakeup to the service in its 180-year history.

Once the powers come into force, the agency will take immediate steps to improve the quality of information on the company register.

Invalid registered office addresses, such as those used fraudulently to set up companies, will be removed.

Verification checks will assess the identities of people setting up and managing companies, stopping criminals hiding behind false names or registering companies with fictional characters. This will help prevent fraudulent appointments and avoid people involved in money laundering hiding behind false names.

Changes to public beneficial ownership registers will also close loopholes that allow corrupt actors to use opaque companies to move and hide money.

It will additionally provide businesses with greater clarity on who they are working with, while allowing civil society organisations to expose corrupt actors, and for the public to increase their trust in governments.

Tackling illicit finance is a global issue with 30 other countries, including Nigeria and France, having public registers of beneficial ownership. Canada, Australia, and New Zealand are also implementing their own commitments.

Lord (Tariq) Ahmad of Wimbledon, Minister of State for Middle East, North Africa, South Asia, United Nations and the Commonwealth said:

Tackling illicit finance requires global cooperation and the UK will continue to work with our international partners to strengthen their registers of beneficial ownership, to reduce money laundering, create a level playing field for businesses and bolster national security.

Companies House Chief Executive Louise Smyth said:

These new powers are without doubt the most significant change for Companies House in our long history.

We have known for some time that UK companies have been misused by criminals to commit fraud, money laundering, and other forms of economic crime and our thoughts have always been with those affected.

We will now play a much greater role in preventing further abuse of the register. We will be taking unprecedented steps to crack down on fraudulent activities, help victims quicker and clean up the register by removing information we know to be incorrect.

This will underpin our efforts to improve the quality and reliability of our data, which will in turn hugely increase the value of the register for businesses across the UK and beyond.

The act will additionally give judges new powers to deal with strategic lawsuits against public protection, known as SLAPPS, involving economic crime.

These are court cases used by the powerful individuals to intimidate opponents. Russian oligarchs seeking to prevent public interest journalism are prominent users of such suits.

Major reforms to corporate criminal liability will also provide prosecutors with game changing powers to hold companies criminally liable for malpractice.

The creation of a criminal offence, called ‘failure to prevent fraud’, will hold a large organisation criminally liable if it benefits from a fraud that is committed by a member of staff.

An update to a legal principle known as the ‘identification doctrine’ will also ensure businesses can be held criminally liable for the actions of their senior managers who commit an economic crime.

Both changes remove the ability for a large company to hide behind complex management structures to evade scrutiny. This ensures a level playing field for all businesses and will help remove criminal money from the economy.

Chief Crown Prosecutor for the Crown Prosecution Service, Andrew Penhale, said:

Economic crime can have a devastating impact on individuals, businesses, and our economy.

The CPS is supportive of all reforms which helps to improve transparency and drive better corporate behaviours.

The introduction of a failure to prevent fraud offence and reform of the identification doctrine will better enable prosecutors to hold large companies to account for offences committed under their watch. It should result in greater care to prevent fraud before it happens.

Nick Ephgrave, Director of the Serious Fraud Office, said:

This is the most significant boost to the Serious Fraud Office’s ability to investigate and prosecute serious economic crime in over 10 years.

This new law will help prevent crime, as big businesses can no longer turn a blind eye to fraud.

We welcome the expansion of our search powers, which will help speed up our investigations.

The National Crime Agency (NCA) will additionally gain greater powers which compel businesses to hand over information which is suspected to be used for money laundering or terrorist financing.

Unnecessary reporting by businesses will also be reduced, enabling the private sector and law enforcement to focus their existing resources on tackling high value and priority activity.

New powers will additionally allow law enforcement to target illicit crypto assets. The NCA’s National Assessment Centre estimates that over £1 billion of illicit cash was transferred overseas using crypto assets in 2021.

The act has introduced provisions for police and the NCA to seize crypto assets more easily and convert them into money before a forfeiture hearing has taken place. In exceptional circumstances, there will also be a power to destroy seized cryptocurrency.

Graeme Biggar, Director General of the National Crime Agency said:

This act is long awaited and welcome. For too long criminals and corrupt elites have abused UK company structures to launder their illicit wealth; the new powers given to Companies House will help us tackle those who abuse our economy.

This act also gives the NCA and police greater powers to seize and recover cryptocurrencies, and we welcome the creation of a criminal offence which holds organisations criminally liable if they fail to prevent fraud by their employees.