It does look like the UK Government are prepared to call things done and dusted and draw a line under the matter, when you admit your wrongdoing and agree to settle up any money owed, when it comes to Bounce Back Loan skulduggery, as the following news update on Starling Bank seems to prove.

Let’s hope that moving forward, that thinking extends to BBL borrowers who may have made a simple BBL related mistake and not just the bank bosses who clearly did similar if not worse… More on that later….

Starling Bank, a leading UK digital lender, has come under scrutiny after distributing a £24.6 million bonus pool to its staff, including a reported £600,000 bonus for Chief Executive Officer Raman Bhatia, despite a £29 million fine from the Financial Conduct Authority (FCA) for “shockingly lax” financial crime controls and significant losses tied to the government’s Bounce Back Loan Scheme (BBLS).

The controversy has been further fuelled by Bhatia’s high-profile engagements, including an invitation to a Number 10 Downing Street garden party and participation in a promotional UK Labour Government video, while the former CEO’s MBE remains intact.

The FCA fine, announced in late 2024, was levied due to Starling’s inadequate anti-money laundering measures, which the regulator stated left the financial system vulnerable to criminals and those under sanctions.

Additionally, the bank reported a £28.2 million loss on BBLS loans after identifying a tranche issued without proper eligibility checks, prompting Starling to voluntarily waive government guarantees on those loans.

These issues contributed to a 25% drop in annual profits, falling from £301 million to £223 million for the year ending March 2025.

Despite these setbacks, Starling’s remuneration committee approved a nearly fivefold increase in its staff bonus pool, rising from £5.2 million to £24.6 million, with Bhatia himself believed to be in line for a £600,000 bonus, bringing his total compensation to £1.7 million.

An additional £5.4 million in bonuses was distributed to board members, paid in both cash and shares.

The bank justified the payouts, noting that a larger number of employees participated in its bonus schemes, including a long-term incentive plan involving Starling shares.

The decision to award substantial bonuses has sparked criticism, particularly in light of Starling’s recent challenges.

The BBLS, designed to support small businesses during the COVID-19 pandemic with low-interest loans of up to £50,000 backed by government guarantees, saw Starling issue £1.6 billion in loans by March 2021.

However, the bank admitted to weak internal controls, leading to improper loan approvals. CEO Raman Bhatia, who assumed the role in March 2024 following the departure of founder Anne Boden, acknowledged these shortcomings during a conference call, stating that the bank “may not have met all the procedures” required by the scheme.

He also indicated that executive pay cuts or clawbacks could be considered but provided no firm commitments.

Adding to the controversy, Bhatia’s public appearances have drawn attention.

He was invited to a Number 10 garden party, an event recognizing business leaders, and featured in a promotional video for Downing Street, highlighting Starling’s role in the UK’s fintech sector.

These engagements have raised eyebrows, given the bank’s regulatory troubles. Meanwhile, Anne Boden, who stepped down as CEO in 2023 citing a conflict of interest as a major shareholder, has retained her MBE, awarded for services to financial technology.

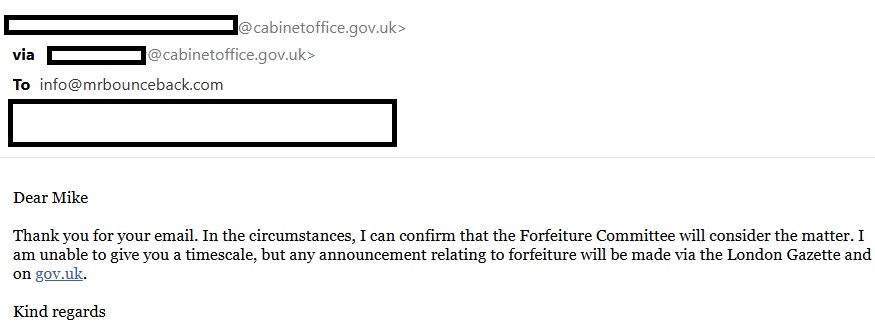

No moves have been made to revoke the honour despite the bank’s recent regulatory and operational lapses under her tenure, and the Cabinet Office Forfeiture Committee telling me they would look into the removal of her MBE.

Starling has defended its actions, emphasizing its commitment to addressing legacy issues and investing in growth.

The bank highlighted the performance of its Software-as-a-Service subsidiary, Engine, which contributed £8.7 million to group income, a 284% increase year-on-year. Bhatia has ambitious plans to expand Engine into the US market, targeting £100 million in revenue in the medium term.

“We are moving forward from a position of strength,” Bhatia said, pointing to Starling’s fourth consecutive year of profitability and a record 4.6 million open accounts.

However, the bank faces ongoing challenges, including staff unrest following Bhatia’s mandate for hybrid workers to return to the office for at least 10 days a month, despite insufficient office space.

This policy has reportedly led to resignations and accusations of fostering a “bland grey corporate hellscape,” as described by one disgruntled employee.

As Starling navigates these turbulent waters, its ability to balance growth ambitions with regulatory compliance and employee satisfaction remains under close scrutiny.

The substantial bonuses, high-profile engagements, and lack of repercussions for past leadership have intensified debates about accountability in the fintech sector.