I have always known deep down, as I am confident that you have, that there would come a time when a legal firm took a close look at the Bounce Back Loan scheme, and the somewhat unusual laws and rules surrounding that scheme and would work out if there was any legal route to take to challenge them in the hope of getting them written off or reduced in value.

“Ambulance Chasers” is the term often referred to some such companies, and you only have to look at the way some firms hounded people regarding PPI claims to know there are plenty of them about.

However, whilst several legal firms are lining up to offer some form of service to challenge Bounce Back Loans, it was always going to be the first one to put themselves out there and prove to those with such a loan they do have a solid legal argument and are not just out there to make money that would get a lot of attention.

But let’s face it with over one and a half million businesses out there with Bounce Back Loans there is a lot of money to be made by any legal eagle who can give business owners a glimmer of hope that their BBL could be written off.

Pain, Suffering and Sleepless Nights

Now, on a personal note I know that many of you out there took out a BBL and whilst it did help you at the time, the clock is now ticking down to the start of repayments of those loans, and that is causing you pain, suffering and sleepless nights.

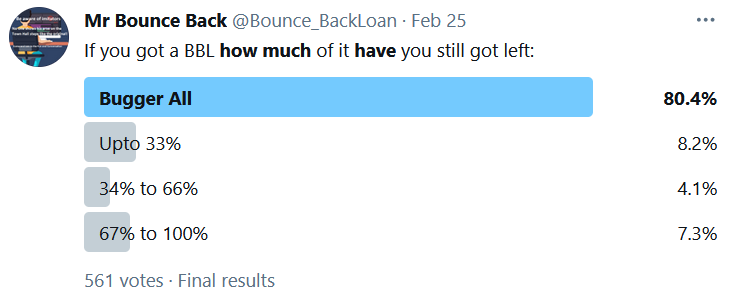

The following poll I ran should have woken Rishi and Co up to the stark reality of the situation that a lot of SMEs face:

However, his answer was to saddle those with a BBL with even more debt by offering the Pay As You Grow Options, for no matter which ones you selected and/or in which order, you would end up paying more in interest.

Tonight, We Will Look into the Options for Challenging Your BBL

As you may be aware back in August, I met up with the team running the EUA Campaign and had an insightful day out in Liverpool at their event which highlighted the plight of those excluded from any type of help or support during lockdowns and the effects of the pandemic.

I liked their style and the fact that they know that the only way to get attention to those problems was to get out there and do something, and that is what they did at that event and the previous one held in London.

For reference they are not in any way shape or form linked to any other group, just letting you know that for I have sadly seen some other groups fall by the wayside over the last year or so.

Anyway, enough of my ramblings, the EUA Campaign team have been in talks with one legal firm that are now offering a legal route for those of you with a BBL to take if you want to challenge your Bounce Back Loan.

I too have chatted to that legal firm alongside the EUA Campaign team and being somewhat well versed in the problems surrounding the BBL scheme I have of course asked them all manner of questions relating to the service they are offering. Including the obvious “what took you so long”.

To be frank I wanted to know whether they are simply ambulance chasers out to make a few bob or committed to offering a service that is needed and could get results.

To cut a long story short they told me in no uncertain terms what they were going to offer, how they are going to go about it, the legal argument, the chances of success, the cost of challenging a BBL, the fact they have committed a small fortune to offering their service, and all other manner of answers to questions that I know you want to discover.

Therefore, as it stands, I am impressed, it takes a lot to impress me having seen the way the Government, Banks and others have treated those with a BBL.

Cost of Challenging You Bounce Back Loan

Now, let me move onto the one question you will have about challenging your BBL, that being the cost of doing so. Well, if you sign up and retain the legal firm we will be chatting to later tonight via zoom, (which you are cordially invited to take part in) then their one off fee will be discussed.

The EUA being as they are, have haggled a discount for their members, so be aware of that, you will find details on their website:

However, I know many of you will find that fee out of reach, and I will be looking at that subject and plenty of others regarding challenging your BBL moving forward, so keep your eyes on my updates.

Be aware that I am not in any way, shape or form being paid by the legal firm or the EUA Campaign for my updates, news stories, articles, or anything else. If that ever changes, I will make you more than aware of the fact.

I am not offering legal advice or financial advice I am simply reporting things as I find/see them, in much the same way as I have been doing since the BBL scheme launched back on May the 4th 2020.

Tune Into the Zoom Chat Tonight

Tonight, all being well at 8pm you can watch and listen to members of the EUA team, one of the high up team members of the legal firm and myself discussing the service being offered.

Me being me, I have already discussed with the legal team things that I know will be in the back of the minds of some of you out there regarding certain aspects of you taking out your BBL, such as confusion over turnover figures, snatch back letters, not being given access to PAYG options, etc etc, and will have a chat with you about those things later in the zoom call.

Please do tune in and see what you make of it all, good, bad, or ugly. I know for a fact there will be plenty of other firms lining up to offer a similar service at some point in time moving forward, but being as this one is the first, they deserve to be listened to and of course grilled.

Here is the link to register for the zoom call, apparently once you register you will then be sent out the link for the meeting at 5pm ish tonight, the meeting itself starts at 8pm.

The Link >>EVENT REGISTRATION NOW CLOSED THANKS FOR ATTENDING IF YOU DID

I am looking forward to seeing you there.