Today I want to take a look at something that is puzzling me, and that dear Reader is the current somewhat bizarre “Small Biz Confessions” campaign that the British Business Bank is running.

Mindless tweet after tweet have been forthcoming from that organisation for quite some time now relating to that campaign, so I have decided to do some sniffing around to see if it is utter bollocks or in fact real.

Keep I mind throughout the following, the British Business Bank is the organisation tasked with overseeing and being the rule maker for the Bounce Back Loan scheme.

What a mighty fine mess they are making of that, if you are bored pop over here to their Accredited Bounce Back Loan Lenders List then click on the lenders links to get to their websites and see how many of them are accepting new customers who can then once the account is opened go on to apply for a BBL. (To save you wasting an hour or so the answer is one bank with a waiting list and a list of business types they wont touch with a barge pole too.).

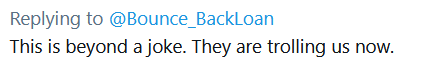

Their tweets have not only been somewhat puzzling me but have been doing the heads in of other people too:

Let us look at what I have discovered……

Looking at their dedicated page of that campaign we find the following image:

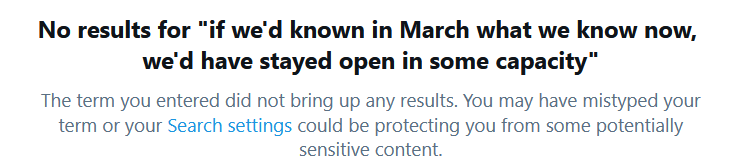

A quick Twitter search reveals the following:

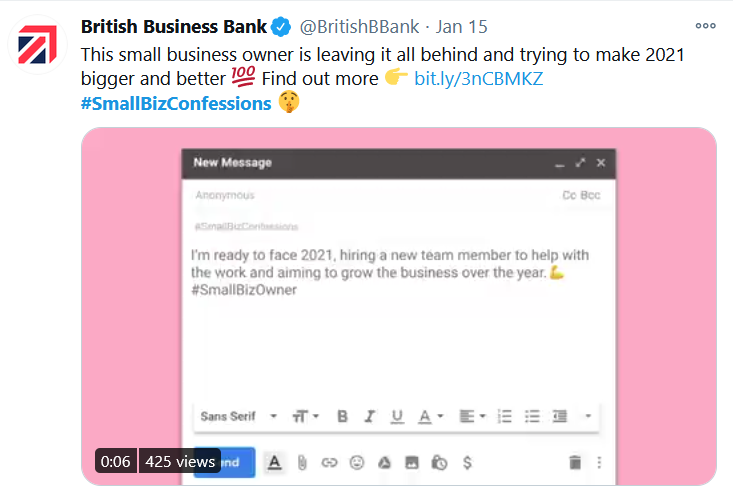

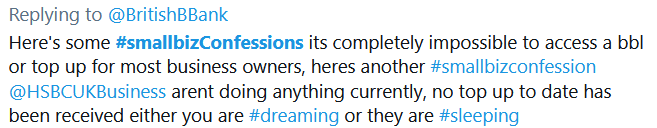

I did search for the hashtag they use and found the following tweet:

I did tweet the British Business Bank and those mentioned in that tweet to see if they would offer clarification:

To date I have not received any type of reply. I did try and find a Twitter account associated with @smallbusinessowner but could not find one nor could I find any trace of the tweet used in the above image.

I have in fact been asking the BBL for quite some time about this, and did notice that they have now changed their pretty little gifs to ones that do not give the impression they are from Twitter:

How are they getting these new “confessions”, I cannot find any way of submitting them on their website?

Either way, remember they spent a fair bit of cash on outsourcing their Social Media output, and it is us the taxpayer that is paying for it.

I did ask the British Business Bank how much they wasted, I mean spent on their Social Media presence and was told the following:

“We can confirm for this financial year we have spent £61,557 on our social media presence with external agencies to support our inhouse social media team.”

I did a search for anyone that did use that hashtag, alas two I did find have not yet been used:

Oh and this one:

It is now time to put the Bounce Back Loan scheme to bed, and for Rishi to get his head around his supposed replacement loan scheme(s), but with the British Business Bank involved I fear any he does announce will be an accident waiting to happen.

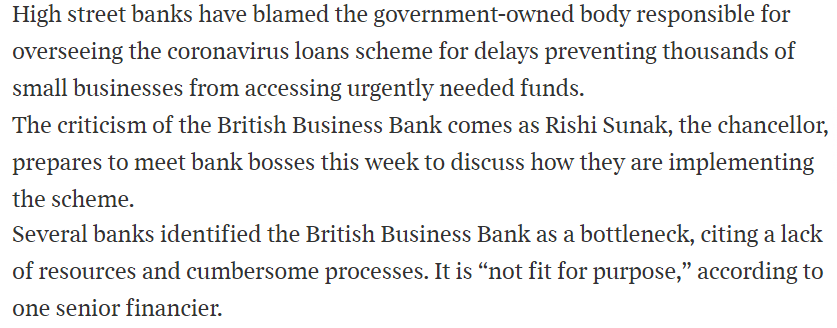

I do have to say that even the banks agree with what I have been saying about the way the British Business Bank operates:

C/O The Times

Oh, and one other thing, the above was in relation to the other schemes, one being the Cbils scheme which the British Business Bank wanted the Bounce Back Loan scheme to be based around, and urged the Government to amend to make it more like that wretched scheme they were already having problems with, you can see that in their Reservation Letter.

Sheesh………….. It could be said the lunatics have taken over the asylum.